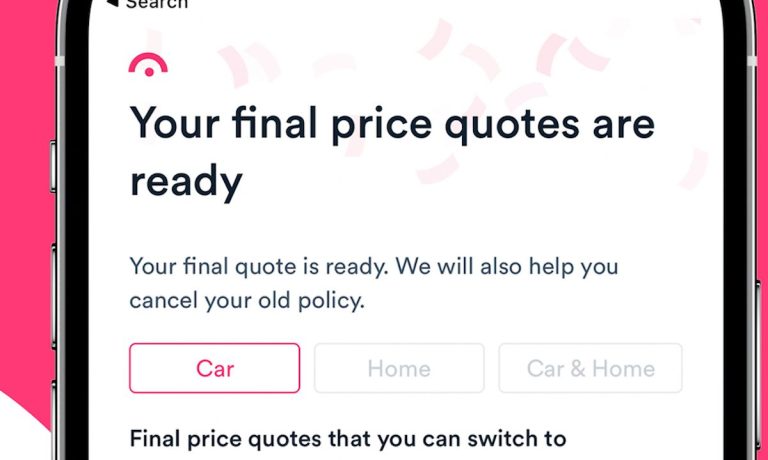

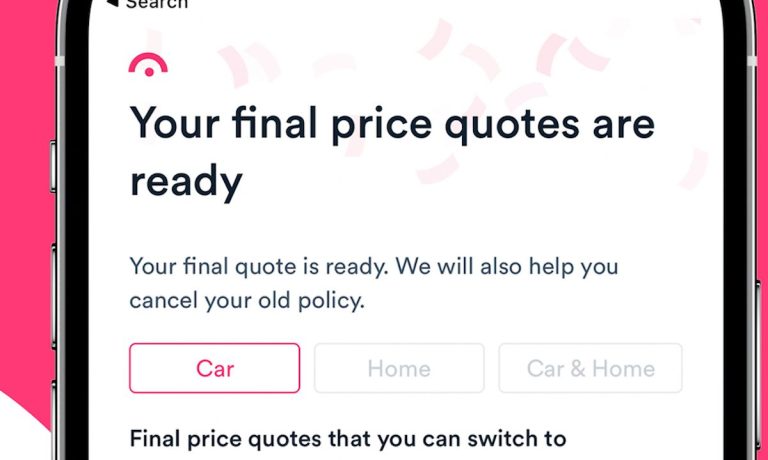

Insurance app Jerry on Tuesday (Aug. 10) announced that it has completed a $75 million Series C funding round, pushing the company’s value to $450 million.

The latest round of funding will help Jerry launch marketplaces in vehicle financing, repair, warranties, parking, maintenance and other services.

Jerry raised $28 million in a Series B fundraising round earlier this year and has brought in $132 million in total fundraising since 2019.

The company, which also serves the home insurance industry, boasts more than one million customers and is licensed in all 50 U.S. states. It claims to save its customers an average of $800 per year on automobile insurance, and expects that number could go up as its artificial intelligence (AI) and machine learning technologies improve.

Meanwhile, competitor Hippo Enterprises Inc. recently launched a homeowners association policy — available in Arizona and coming to Nevada and Oregon — and will also roll out insurance for condominium associations and single-family rentals.

Related news: Hippo To Expand Insurance To Include Homeowners Association Policies

Advertisement: Scroll to Continue

Hippo provides home insurance policies in 37 U.S. states, with plans to soon expand into more. The company uses digital onboarding via integration with third-party data providers to modernize the way insurance policies are written. That means electronics, appliances and smart home upgrades are likely to be covered, while ceramic bowls might not be.

Hippo Home Care is a free service for insurance customers that connects homeowners with home professionals who can answer questions, troubleshoot problems and offer repairs. Customers can receive support by phone, video or email.

Additionally, insurance firm Ethos recently raised $100 million after a $200 million Series D round in the spring, bringing the total amount raised to $400 million and pushing its valuation to $2.7 billion.

Also read: Insurtech Company Ethos Raises $100M In Latest Funding Round

The San Francisco-based life insurance provider, which focused on life insurance for women and low- and middle-income families, is available in 49 states. The company expects to hand out $20 billion in life insurance coverage this year.