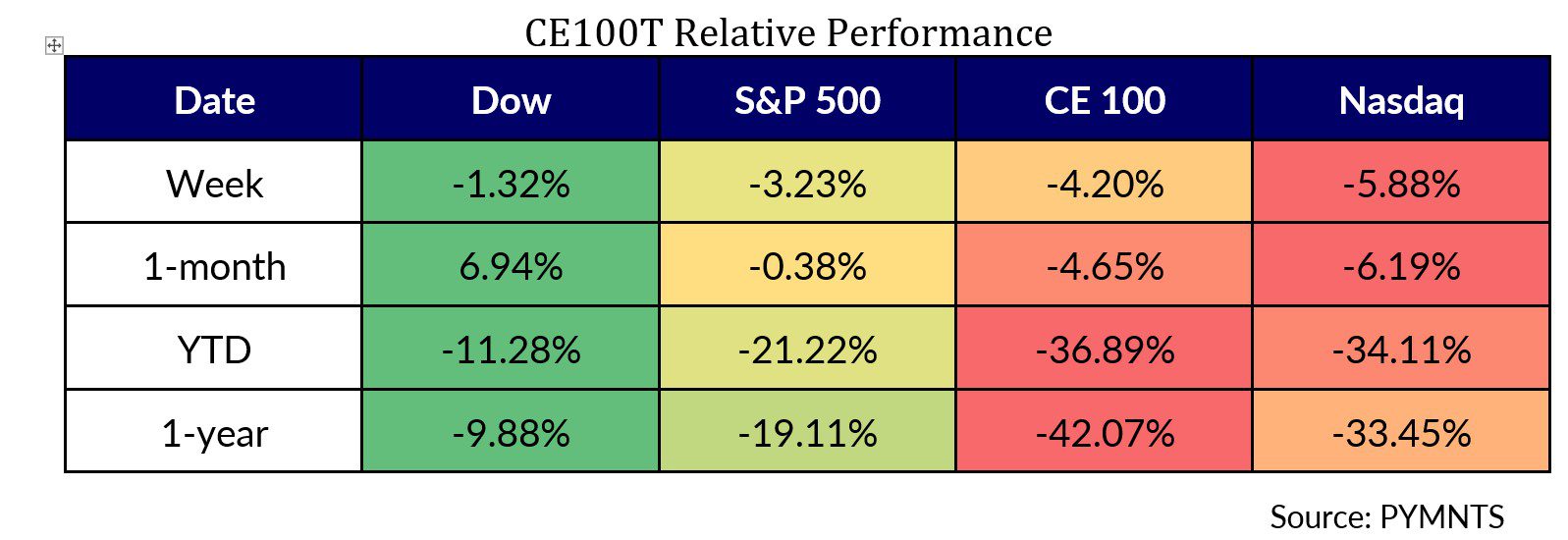

Friday’s rally, where the broader indices were up more than 1.1%, was not enough to salvage a rocky week, as earnings continue to dominate.

And within the Connected Economy’s pantheon, there was little investor cheer to be seen; almost all CE100 segments were lower — and to that end, the CE100 Index sank 4.2% overall.

Blame it all, perhaps, on the Fed, on worries that the cycle of “hot” economic data keeps spurring rate increases, and yet inflation remains stubbornly entrenched.

Fed Chairman Jerome Powell said last week that the Fed Funds rate — and thus interest rates across the board — may be ratcheted up still higher.

It almost didn’t matter what numbers our index stalwarts put up. The overall trend was … down. For many of the companies that have reported recent results and offered management commentary, a slowdown is in the cards, right into the all-important holiday shopping season.

Payments Names Slide

The challenges are most evident in the “Pay and Be Paid” sector, which slid 7.7%, and which offered a stark portrait of what’s to come as consumers are bedeviled by inflation. Most immediately, the pressures are being felt in the lower- and middle-income tiers and those consumers are pulling back a bit.

PayPal lost a bit more than 12% on the week. And as detailed in our own reporting on the quarter, PayPal’s users are still engaged, but spending is clearly slowing. Some of the key digital shifts and movements toward installment lending are still firmly being embraced: The company processed nearly $5 billion in BNPL volume, up 157% year-over-year, with over 25 million consumers using the option.

There are more than 280,000 merchants displaying the BNPL option on their checkout pages. Overall engagement, or transactions per active account, grew by a record 13% to 50.1, as detailed in the company’s investor materials.

But CEO Dan Schulman noted on the call that there is “a challenging macro environment” in place and noted “slowing eCommerce trends and an unpredictable holiday shopping season.”

FIS sank a staggering 29% amid its own earnings report, as within its merchant segment, with organic growth slowing to 5%, the company noted that U.S. consumers are shifting their spending behavior to more discretionary verticals, which is in turn pressuring yield in the segment.

Western Union lost 7.9% as its earnings showed that third quarter C2C transactions were down 12% year over year, tied to the suspension of operations in Russia and Belarus and adjusted revenues from that segment slipped 8%. Digital money transfer revenues declined 12% on a reported basis, or 9% constant currency, while transactions declined 20%, the company said.

The consumer, then, is becoming more cautious, where they had been freely spending. Elsewhere in the CE100 names, companies in the “Have Fun” segment were off markedly, as the group was down 8.5%. We’d hazard to guess that the slowdowns noted by the consumer firms may have a negative read-across for the “fun” names, which are reliant on discretionary spending.

DraftKings sank more than 25%, and we noted that investors are concerned about projected losses of more than $500 million continuing into next year. As a result, DraftKings sank as user growth was up, more slowly than analysts had expected.

There were some notable gainers in the week, however — and not necessarily related to earnings. Ocado soared 32% through the week. That performance helped drive the Shopping segment up 2.3%. Ocado shares soared after the company, which is focused on grocery logistics, announced that it reached a pact with Lotte Shopping, the supermarket arm of South Korea’s biggest retail group. The deal would enlist Ocado to build out a network of customer fulfillment centers, reported Bloomberg.