Payday Raises $3 Million for ‘Future of Work’ in Africa

African neobank Payday is looking to new markets after raising $3 million.

The funding, announced Wednesday (March 29), will help the company secure operational licensing in the U.K. and Canada — the company has offices in Rwanda and Vancouver – while also expanding its operations in Great Britain, where Payday was recently incorporated.

“Funding will also be used to boost talent acquisition as the startup’s team complement expands from 35 to 50 employees, as Payday looks to further fuel the future of work through borderless payment alternatives in major currencies,” the company said in a news release.

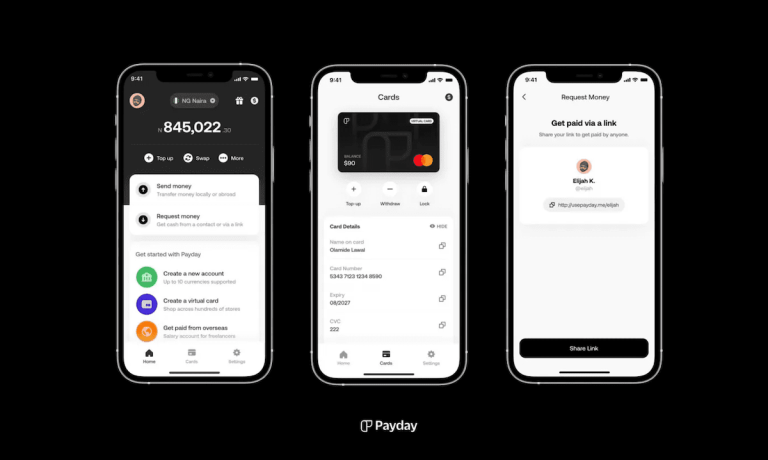

Since 2021, the company says it has processed millions of dollars in transactions for customers in Rwanda, Nigeria and the U.K. using its digital app.

In addition to the new funding, Payday says it has welcomed new members to its co-founding team, including Elijah Kingson, a veteran of U.K. neobank Revolut, and Sean Udeke, former board member at Goldman Sachs and product manager for Expedia.

The news comes as remittance senders and receivers are increasingly using digital apps, according to recent Visa research.

The company said last week that 53% of these consumers use digital apps to send and receive money around the world, while 34% go to a physical bank or branch, 12% send cash, checks or money orders by mail and 11% give money to another person traveling to their home country.

“This new research shows incredible acceleration of digital payments, but there is still more the industry can do to bring streamlined remittances within reach for more migrant workers and their families who rely on these lifeline payments to do everything from pay for food, education or even unforeseen medical costs,” said Ruben Salazar, global head of Visa Direct.

Some of the pain points faced by senders include fees that are too high, which was cited by 38% of senders in the United Arab Emirates (UAE), and issues with calculating the exchange rates, cited by 37% of those in Singapore, Visa said.

At the same time, many remittance users consider app-based digital payments the most secure method for sending money across borders. For example, 61% of those in Singapore said ease of use and security is the reason they use digital-only methods.

Additional research by PYMNTS has found that the need for affordability and convenience fuels the way consumers send and receive cross-border payments.

Payment services providers (PSPs) that provide alternatives to traditional remittance payments tools could see a wave of interest from consumers hoping to avoid high fees and lengthy processing times, according to “The Digital Currency Shift: The Cross-Border Remittances Report,” a collaboration between PYMNTS and Stellar Development Foundation.

For all PYMNTS EMEA coverage, subscribe to the daily EMEA Newsletter.