We’re at the very tail end of 2021, and depending on where — and when — you look, the SPAC sector is either dead or rising, phoenix-like, from ashes.

But in general, the last few weeks have shown increased activity for public listings, both traditional and through tie ups with blank check firms.

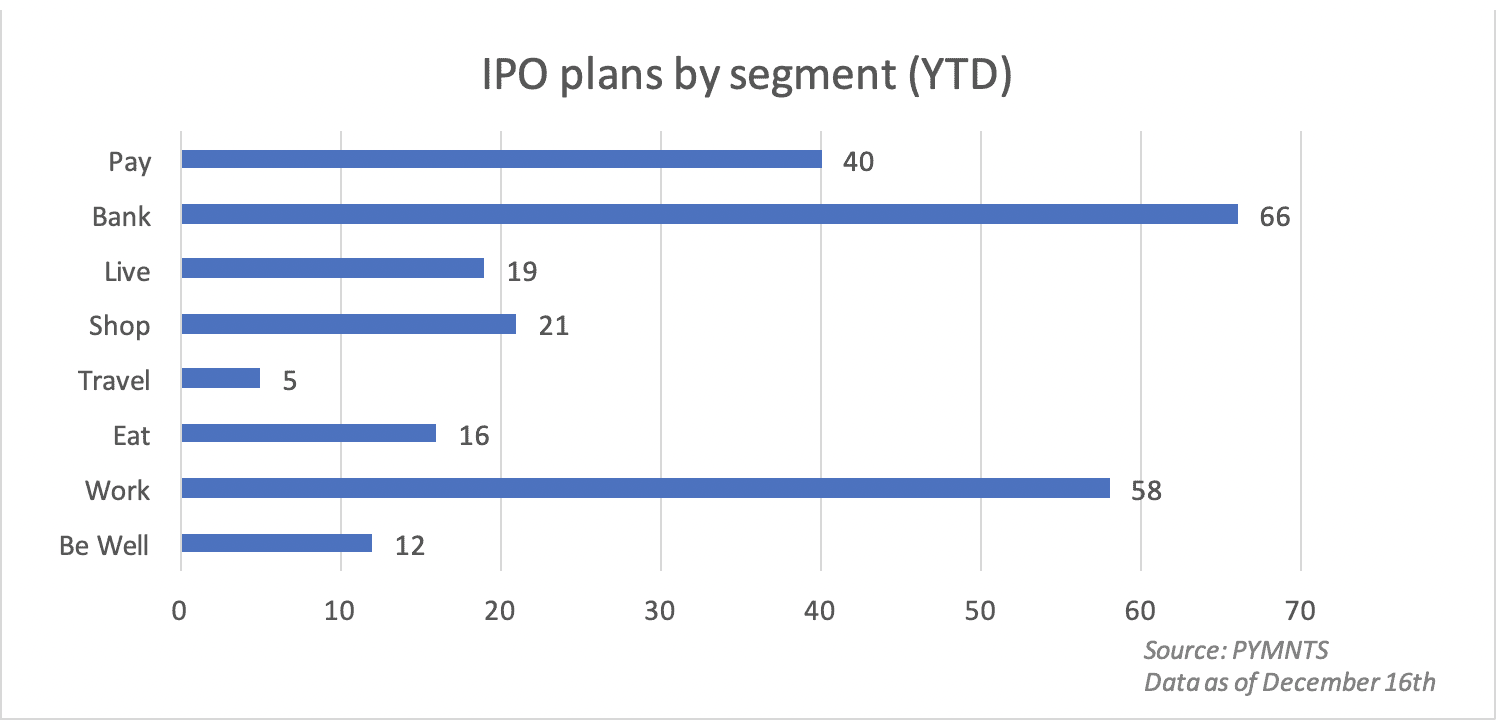

To that end, banking-related plans for listings, as tracked by PYMNTS, stand at 66, outpacing listings for firms that aim to change the way enterprises “work” (i.e., their back end operations), at 58, and payment-related companies, at 40 year to date.

We contend that listings may well accelerate into the new year, in part due to the fact that interest rates are set to rise. In that rising rate environment, it stands to reason that investors will look for returns that can outpace both inflation and rising rates. Against that backdrop, executives of companies that are mulling listings, and the (financial) companies that take them public, may sense opportunity over the near term — particularly in payments and with platforms.

Among the headlines that have dominated the past week, Rezolve stands out, where the mobile commerce platform said this week that it is merging with SPAC Armada Acquisition Corp.

As reported by The Wall Street Journal, the platform helps businesses cement direct-to-consumer relationships, who in turn leverage mobile devices to enable interactive commerce experiences. Reuters noted that the deal will give Rezolve as much as $190 million in gross proceeds.

Separately, and as noted in this space, and in further evidence of platforms’ (public listings) appeal, social media platform Reddit is planning to go public and recently submitted a draft registration statement as part of its S-1 filing with the Securities and Exchange Commission (SEC). The specifics — financial details, and how many shares are being listed — have yet to be disclosed.

Read also: Reddit Confidentially Files Draft Registration with SEC for IPO

Platforms Come to Market

Smaller deals abounded this past week, too. Pregnancy care platform developer Nuvo Group, based in Israel, said Monday (Dec. 13) that it would raise $10 million, with a market value of more than $415 million.

The company said in its S-1 with the SEC that its “INVU platform was designed to allow expectant mothers to access prenatal care both at home and in the clinic according to their obstetrician’s protocol, through a self-administered and easy to use wireless sensory band that connects to our cloud-based platform and provides personalized clinical-quality care in a virtual environment,” in real time.

Elsewhere, SPAC JJ Opportunity has filed for a $50 million IPO, and has said in its own filing that it will focus its “search for a target business on companies within technology-enabled financial sectors, including but not limited to FinTech, software services and technology.”

But in a sign of the turbulence that might await new listings, Brazilian digital banking FinTech Nu Holdings (parent company of Nubank) went public earlier in the month and priced its IPO at $9 in the U.S., surging above $11 in its initial intraday trading. As of this writing, the shares are trading hands at $9.58, amid a general market downdraft.

But as spotlighted before the offering, the company scaled back its offering, through a deal downsize that shaved 20% as the company came to market. We noted then that the “downsized offering is also being examined on a sector level, as perhaps an indication that the enthusiasm for global neobanks may be diminishing.” A rough week’s of trading does not a trend make, of course, but sentiment bears watching.

Read here: Nubank’s Downsized IPO Sparks Questions About Neobanks, IPOs, Warren Buffett and More