Earnings season is largely in the rearview mirror — but not entirely done.

And as a result, this past week saw the FinTech IPO Tracker turn in a relatively flat performance. As did the broader indices. As measured through the past week, for example, the broader S&P Index showed a 60 basis-point gain.

It might not be all that surprising that equities would take a bit of a breather in the wake of all the volatility that has become the norm amid surging inflation and the continuing war in Europe.

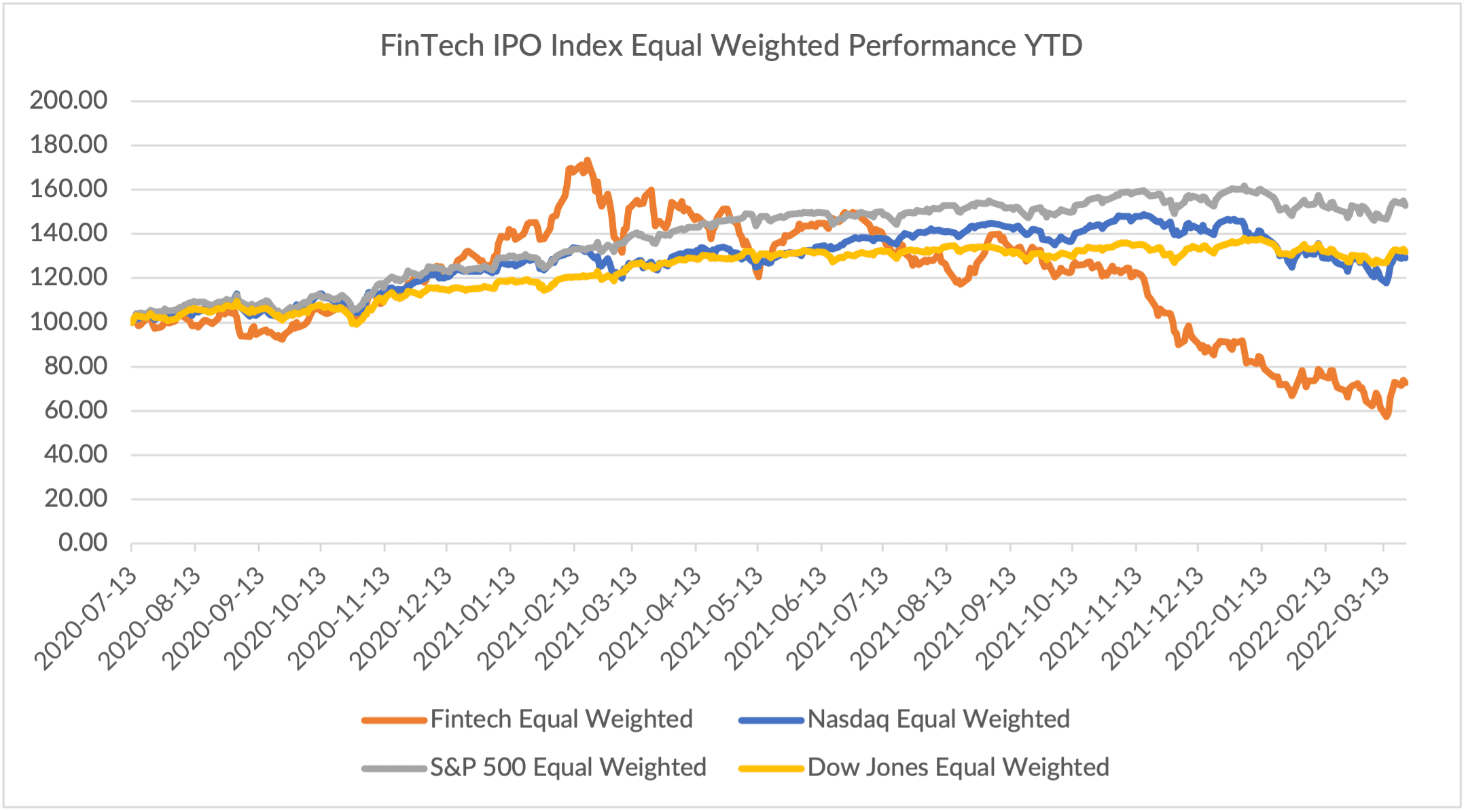

The FinTech Index, as we track the equal-weighted performance of more than 44 names changing the face of financial services, showed a relatively sedate gain of a few basis points. The reading remains at just under 78, which is a significant decline from its initial baseline reading of 100 upon creation of the Index (and its inaugural “class” of firms that went public just before the pandemic).

Drill down a bit, and none of the sedate stats above should suggest that there was no company specific news over the past few days. And: the last few gasps of earnings did indeed impact individual company performance.

Earnings Season Continues (Here and There)

Huize, for example, was up 67% on the week (driving its market cap to $75 million). The company posted its fourth-quarter results at the end of last week, and said that its digital insurance offerings and online platform helped gross written premiums surge by 90% to the USD equivalent of $312 million, and operating revenues gain 151% to about $153.2 million.

OneConnect Financial Technology shares gained 38% through the past week. The company said in a March 21 announcement that China Ping An Insurance Overseas (Holding) Limited, a wholly owned subsidiary of Ping An Insurance, purchased 5.3 million OneConnect American depositary shares on the open market.

KE Holdings was the worst performing name on the list, down 9% through the past week, giving up gains that had been seen in the previous week, where the name surged roughly 60%. Investors, of course, have been speculating about what regulators might or might not do in terms of examining, or putting guardrails around, FinTech and platform companies. Earlier in the month, government officials had stated, through state run media, that such examinations would be “transparent” and predictable.

But we note that the jury is still out, in terms of what all that means fort the regulatory landscape. And any real regulatory shifts or pronouncements might be centered on data collection, sharing, capital reserves and the like.

As has been reported in this space, Beijing regulators are considering a plan that would permit their U.S.-based counterparts to examine audits of some Chinese firms that do not collect sensitive data.

Earlier this month, the China Securities Regulatory Commission (CSRC), the People’s Republic of China’s central regulator of the securities industry, summoned leaders from the nation’s top internet companies, including popular search engine Baidu and eCommerce giants JD.com and Alibaba.

Read also: China Regulators Tell Alibaba, Other U.S.-Traded Firms to Prep for Audit