In a week that saw two-thirds of its members falling 20% or more, the FinTech IPO Index fell to an all-time low, diving 27% for the week and extending its year-to-date loss to roughly 50%.

Source: PYMNTS

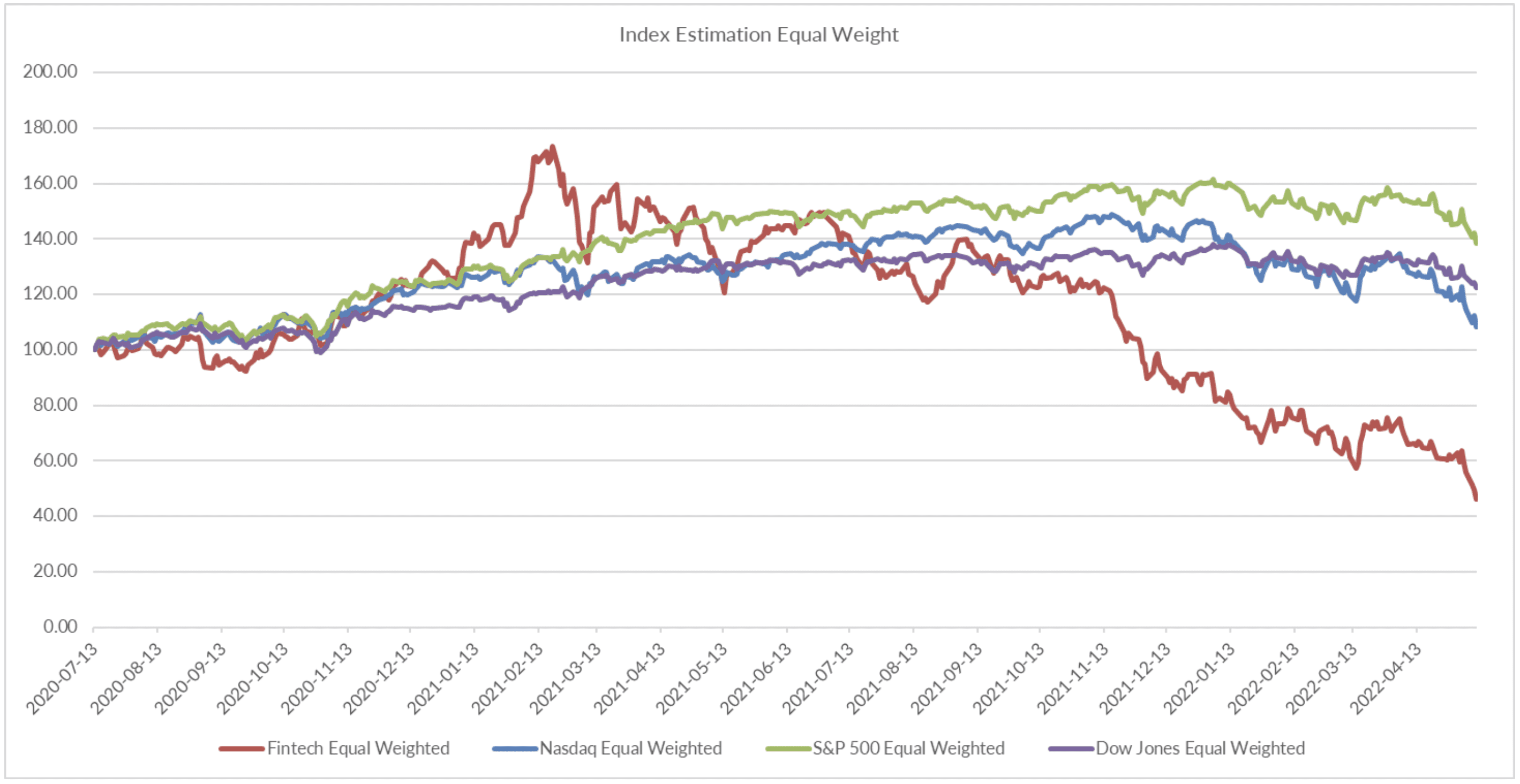

As the above chart shows, after peaking last March, the newly formed benchmark of recently listed FinTech companies has fallen nearly 75% in the past 14 months, dramatically underperforming the broad market benchmarks over both the long and short term.

Over that time, both sentiment and deal flow for new listings within the category have dried up. An early bullish bias for the group turned neutral last fall and then outright bearish in the new year.

Weekly Standouts

Leading the index’s outsized retreat last week was the 70% drop in shares of Upstart, the San Mateo, California-based lending platform that uses artificial intelligence (AI) to enable “effortless credit based on true risk.”

After going public in December 2020, Upstart soared to $400 per share as recently as 7 months ago, but it has since fallen into the low $30 range.

Despite the fact that Upstart co-founder and CEO Dave Girouard told analysts Monday (May 9) that the company had just delivered its seventh consecutive profitable quarter and fourth straight quarter of triple-digit year-on-year revenue growth, the company’s reduced guidance for the current quarter and full year sent investors running for the exits.

See also: Upstart Signals Turbulence for AI-Driven Lending Models, and Lower FICO Score Borrowers

“It’s become apparent that 2022 is shaping up to be a challenging one for the economy and for the financial services industry in particular,” Girouard said, adding how clear it has become that the Federal Reserve will have to aggressively act to bring inflation under control.

It’s a reality that has not only seen Upstart’s average loan cost rise by three percentage points since October, but also one that is also impacting the entire lending sector.

In addition to increasing rates for approved borrowers, he said this trend also leads to lower approval rates for applicants, and will reduce transaction volume in turn.

“Lending is a cyclical industry and always will be,” Girouard said, “so, we expect volume and pricing in our platform to vary accordingly.”

Bill Paying Gets the Blues

Alongside Upstarts’ unravel, a pair of billers in the FinTech IPO Index also suffered a very hard week, as shares of Bill.com and Billtrust fell 44% and 54% respectively for the five trading sessions from May 4 through May 11.

Related: Billtrust, Flywire Results Show B2B Payments Modernization Continues, Cards Gain Acceptance

In the case of Bill.com, the San Jose, California-based provider of back-office automation software for 380,000 small- to medium-sized businesses (SMBs) posted better than expected trailing results that were overshadowed by a cautious forecast.

Despite total revenue gains of 179% for the first three months of 2022 and 74% organic growth, Bill.com said its customer addition growth and revenue rates would slow in coming months.

Bill.com went public in late 2019 and has fallen 70% from a peak set in November, lowering its market value to about $11.5 billion.

On the plus side, not a lot to talk about this week, as the index of newly listees saw new advancers, leaving the relatively modest 6% decline by the U.S.-traded shares of Shenzen-based OneConnect Financial Technology Co. as the weekly leader.