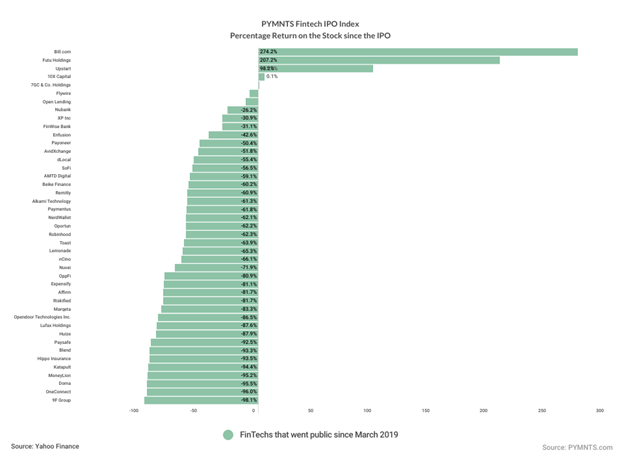

Toast shares got scorched in a week that saw the FinTech IPO Index give up 0.3%.

And earnings season has yet to begin in earnest — at least for the FinTechs.

Beyond the banks, beyond the details on deposit flight and whether consumers are spending more on their credit cards (they are) or losses are inching up on lending portfolios (they are), the FinTech landscape this week was dominated by company-specific headlines that revolved around stock market sentiment and around various partnerships. Through the next few weeks, the names in our four-dozen-strong pantheon will weigh in on their own challenges and opportunities, top-line momentum (or lack thereof) and margin profiles.

Toast Backs Off of Online Order Fees

In news relayed by PYMNTS, less than a month after sharing that it would add a $0.99 fee for consumers on online orders of $10 or more, Toast has ended that practice. Toast CEO Chris Comparato said that the decision followed “extensive discussions” with the platform’s restaurant customers.

“While we had the best of intentions — to keep costs low for our customers — that is not how the change was perceived by some of you,” Comparato said. “We made the wrong decision and following a careful review, including the additional feedback we received, the fee will be removed from our Toast digital ordering channels.”

Shares of Opendoor were down 16.5% on the week.

Barron’s reported that the stock slid on an analyst’s sentiment, with an “underperform” rating on the company, that the rally in the name has been overdone. The stock’s valuation is higher than peers and despite relatively worse performance on margins, as analyst Gordon Haskett noted.

Elsewhere, OneConnect shares slid 7.3%. As reported here

Banking credit information provider CRIF and regtech Know Your Customer have partnered in an initiative that will, according to the companies, help Ping An OneConnect Bank Limited streamline the digital onboarding process for its SME customers. The partnerships use real-time registry connections to automatically retrieve documents and map shareholders, per the reports.

These plummets swamped

Paysafe’s shares, which eked out a 0.7% gain.

The company said this past week that it had struck a new partnership with Betr, a micro-betting app from American professional boxer and social media influencer Jake Paul. The companies announced that Paysafe enables Betr’s customers in Ohio and Massachusetts to fund micro-bets and traditional wagers using their debit cards.

The partnership, per the announcement, broadens Paysafe’s presence in iGaming in Ohio and Massachusetts. Betr’s connectivity, for its part, enables alternative payment methods.

Robinhood’s stock gained 2.8%.

As reported here, the company’s retirement accounts are diversifying its revenues and widening its customer base. The company is also offering a 1% match to any deposit into the account to incentivize customers. In terms of mechanics, the retirement accounts offer trading in exchange-traded funds and stocks and have no percentage fee for retirement assets. This means Robinhood can continue offering free services, as we noted.