Commerce should be rewarding. In fact, it had better be.

PYMNTS November 2020 Cardholder Loyalty Engagement Report, a Novae collaboration, is a special “How Rewards Programs Give FIs A Top-Of-Wallet Advantage” edition, delving into the many ways that loyalty and rewards programs can attract and keep new digital-first consumers.

Surveying a census-balanced panel of over 2,100 U.S. consumers, PYMNTS researchers went looking for ways that financial institutions (FIs) can “tailor their loyalty and rewards programs to retain customers and attract new ones.” Easily done as said these days, as solutions abound.

Moreover, it’s turning out to be a possibly fatal error to downplay or ignore loyalty.

“Failing to provide the right loyalty and rewards programs can hurt FIs’ bottom lines. Digital wallet users value rewards so highly that many would be willing to leave their FIs and register for and link other banks’ card products to their wallets to access them,” per the report. “Research reveals that 44.5 percent of Amazon Pay users, 39.5 percent of Google Pay users and 38.5 percent of Apple Pay users say they would be ‘very’ or ‘extremely’ likely to leave their current FIs for competitors if those competitors can offer their preferred types of rewards.”

That’s unsettling, but not inevitable, as we learn in the Cardholder Loyalty Engagement Report.

Advertisement: Scroll to Continue

Voted Most Likely (To Switch FIs)

You have to keep a good eye on bridge millennials, that high-earning, high-spending group that has rerouted metaphorical rivers with their like-minded commercial proclivities.

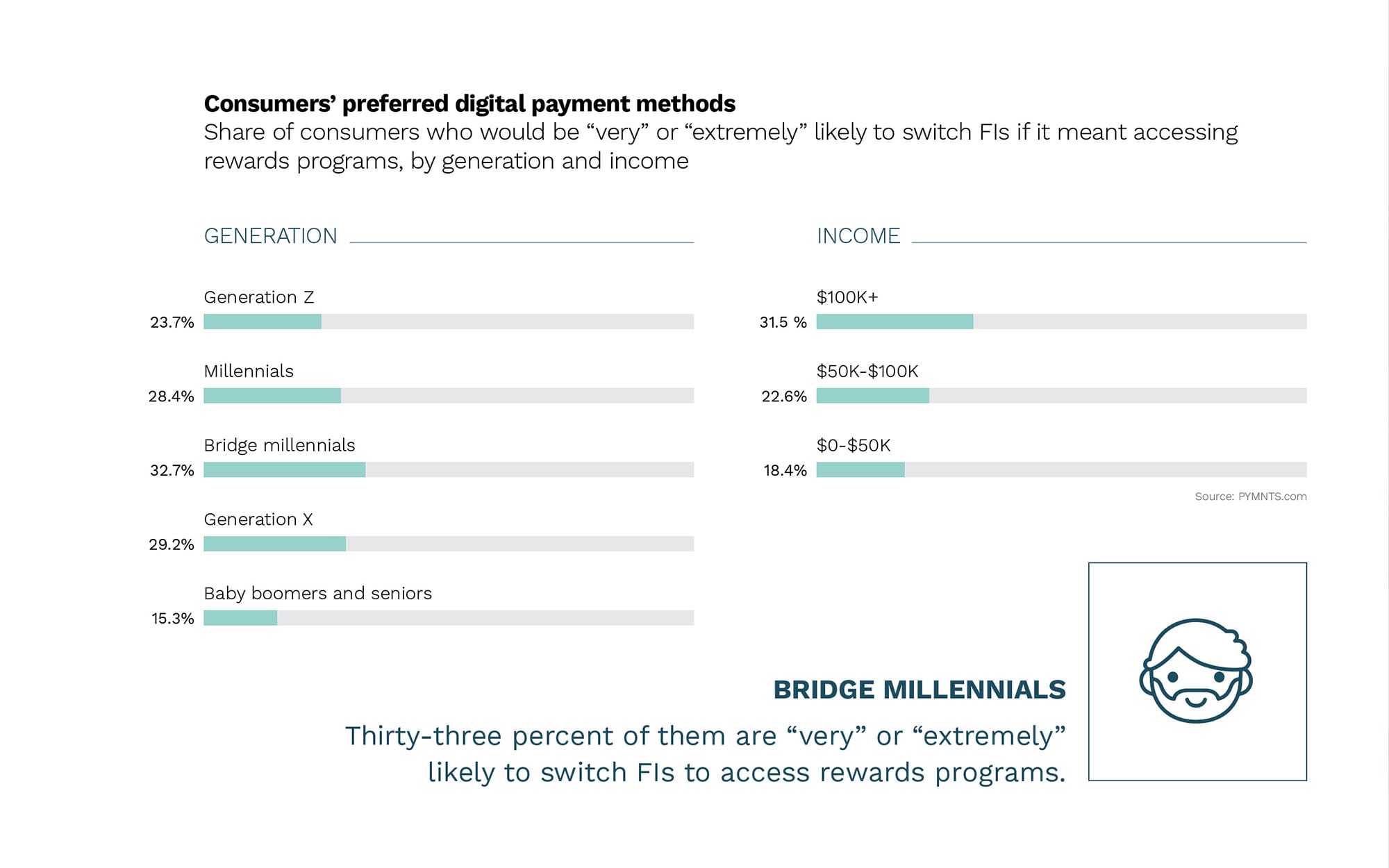

“Bridge millennials are the most likely to say they are willing to switch FIs over loyalty and rewards programs,” the report states, “while baby boomers and seniors are the least likely to do so. Our research suggests that 32.7 per-cent of bridge millennials would be ‘very’ or extremely’ likely to leave their current FIs for competitors if it meant gaining access to loyalty and rewards programs, compared to just 15.3 percent of baby boomers and seniors.”

The new Cardholder Loyalty Engagement Report continues, noting that “Age is not the only factor that is related to consumers’ likelihood of switching FIs for lucrative loyalty and rewards programs.” PYMNTS finds that that nearly 32 percent of consumers earning over $100,000 annually also likely to switch. “This compares to just 22.6 percent of consumers earning between $50,000 and $100,000 per year (mid-income consumers) and just 18.4 percent of those earning less than $50,000 (low-income consumers) who say the same.”

Do Not Dis Debit

Banks and financial institutions (FIs) that feel they have a lock on their customers and clients may want to reacquaint themselves with words like “hubris” and “over-confidence.” Loyalty may have taken years to earn but it can be lost in the time it takes to download an app.

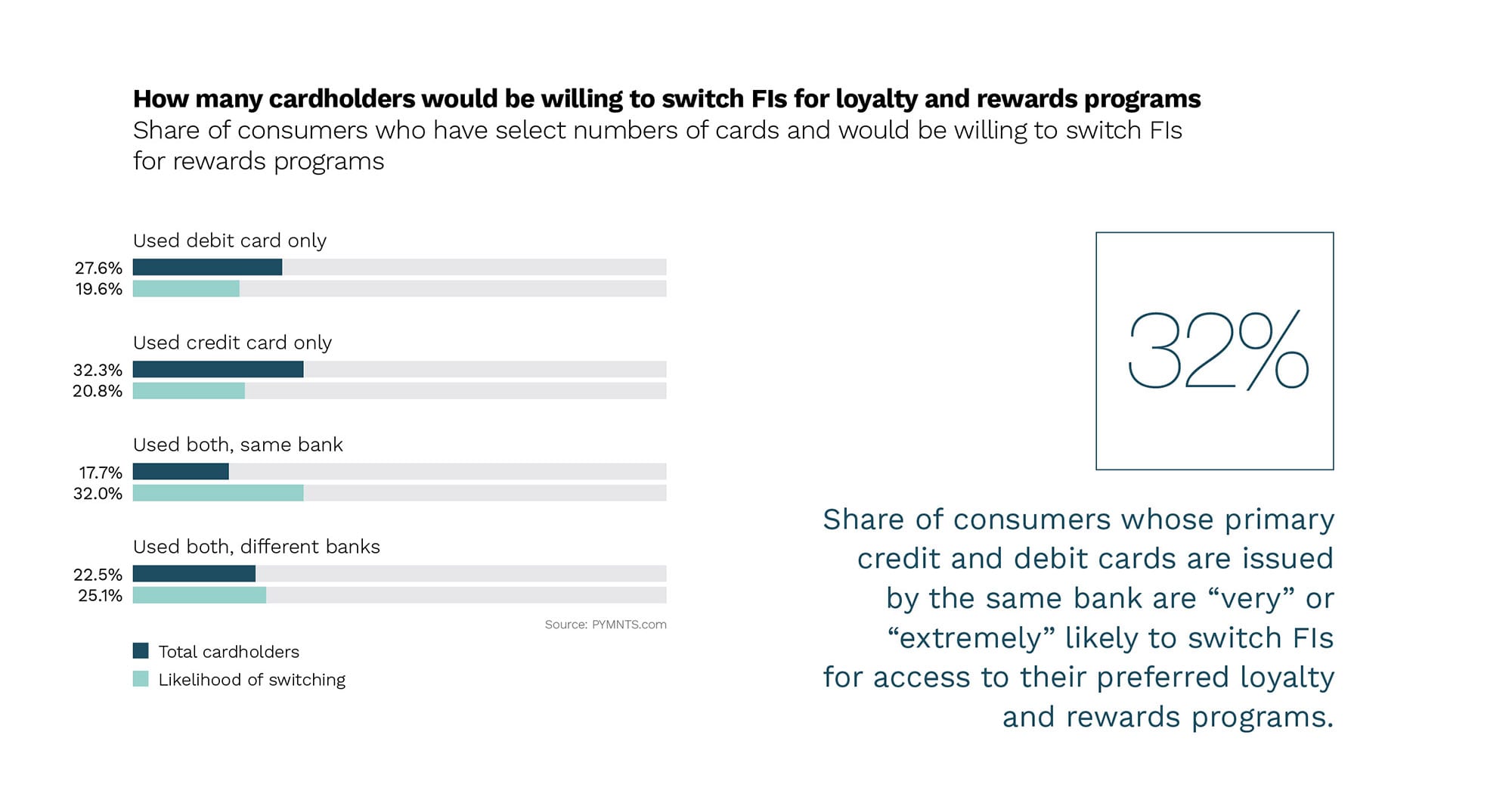

“Consumers who use both credit and debit cards issued by the same bank are the most likely of all to be willing to switch FIs for access to loyalty and rewards programs, with thirty-two percent of them being ‘very’ or ‘extremely’ likely to do so,” per the report. “This compares to 25.2 percent of consumers using both cards issued by different banks and 20.8 percent of consumers who use only credit cards. Consumers who use only debit cards are the least likely to leave their current FIs for rewards programs, with only 19.6 percent being ‘very’ or ‘extremely’ willing to do so.”

Debit cards, which are eclipsing credit at the moment, are the card type with the least loyalty rewards associated. That’s a disconnect that cardholders simply won’t tolerate.

“Even consumers who are given debit card rewards options are often not provided access to the types of rewards programs they seek. Only 8.3 percent are allowed to earn rewards or cash back when using their accumulated points,” according to the Cardholder Loyalty Engagement Report, “and only 4 percent are offered discounts for entertainment-related purchases.”

Cardholders who lack access to their preferred rewards perks are a risk in the portfolio of FIs coast-to-coast, and to truly secure loyalty they must offer the right rewards program options.