Online bank transfers, also known as pay-by-bank transfers, can be used to pay recurring bills and are the third most frequently used for this purpose after debit and credit cards.

Adoption is steadily growing for online purchases, with 35% of consumers using online bank transfers for online retail payments in January, up from 33% in May 2022. To promote broader use, rewards programs such as cash back rewards, special discounts or gift cards can play a role.

“The New Payment Options: Building Stronger Customer Ties With Pay by Bank Transfer” a PYMNTS Intelligence and Nuvei collaboration, examined consumers’ willingness to use online bank transfers for recurring bill payments and online purchases.

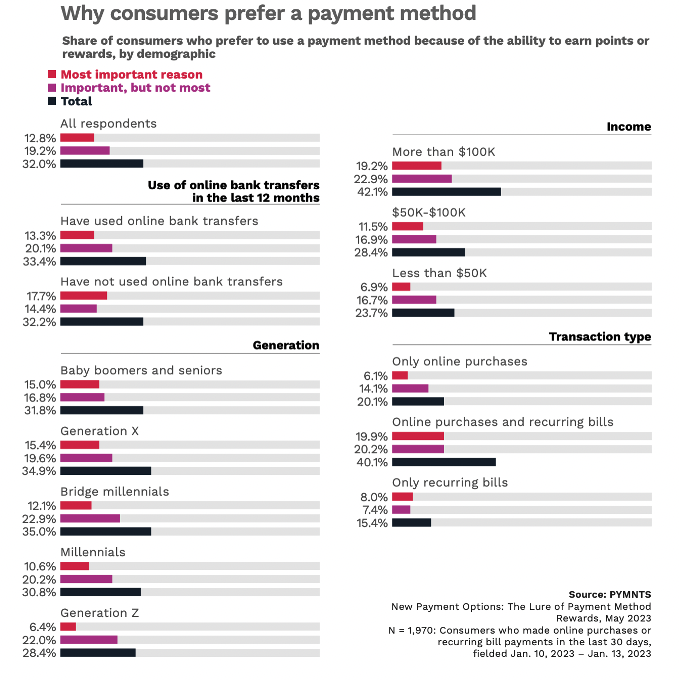

According to the survey, a minority of consumers tried online bank transfers for the first time in the past year. Among those who did, 1 in 4 were motivated by the opportunity to earn rewards points. Additionally, 32% of consumers said they would be very likely to use online transfers for retail purchases if a rewards program was available.

The findings indicated that rewards play an important role in encouraging the adoption of online bank transfers. Millennials, bridge millennials and high-income consumers showed a greater interest in rewards programs for this payment method compared to other segments.

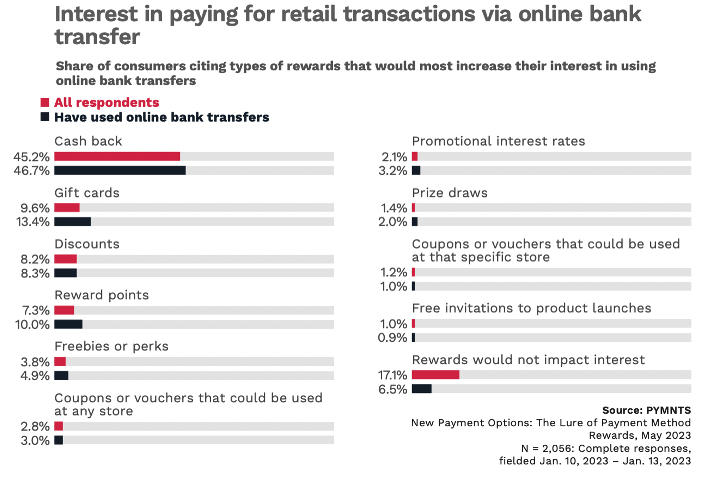

Another study by PYMNTS Intelligence and Nuvei, “The Lure of Payment Method Rewards,” found that of all possible benefits associated with rewards programs, cash back rewards emerged as particularly appealing to consumers, with 47% of consumers preferring a program that gives them cash for using online bank transfers. Other rewards that garnered interest among customers were gift cards (13%), reward points (10%) and discounts (8%).

Rewards were not only a motivation to attract new customers, but also to foster loyalty. The survey found that rewards could drive consumers away from certain payment methods. Specifically, 21% of consumers reduced their use of online bank transfers because another method offered better rewards.

Rewards were not only a motivation to attract new customers, but also to foster loyalty. The survey found that rewards could drive consumers away from certain payment methods. Specifically, 21% of consumers reduced their use of online bank transfers because another method offered better rewards.

The findings highlighted the importance of offering competitive rewards programs to retain customers and prevent them from switching to alternative payment methods.

Rewards programs have the potential to drive the adoption and use of pay-by-bank transfers for both recurring bill payments and online purchases. Financial institutions and FinTechs that offer them should consider implementing rewards programs to incentivize consumers and promote broader use of this payment method. By tapping into the power of rewards, they can attract and retain customers, especially those demographics that see the appeal in the benefits of these programs.