Whether the holidays are the most wonderful time of the year is often a matter of taste.

That the holidays are the busiest time of year for more merchants, on the other hand, is simply a matter of fact. And digital fluidity, thanks to mobile, is becoming a non-negotiable core competence during this busy season – and throughout the entire year.

And PayPal wants to make sure that its merchants — all 15 million (and growing) of them around the world — are able to run and grow their businesses at the speed of digital: to navigate them simply, seamlessly and on the go.

So yesterday, it launched the new PayPal Business app.

The journey has been long, and pretty comprehensive, PayPal’s VP of Merchant Product and Technology Arnold Goldberg told Karen Webster in a chat just before the news of the app went public. In fact, this offering for its merchant customers has been in the works for the last two years.

But, when building out an application that is eventually meant to serve millions upon millions of merchants around the globe — slow, steady and smart is the order of the day.

“We spent a lot of time listening — a full two years — and that time was spent interviewing merchants to really understand the use cases that our merchant partners wanted to see come alive in the app,” Goldberg told Webster. “What we launched is really the beginning of the journey to create an amazing app for our merchant base.”

So what will that journey look like?

It starts with a soft launch

As Elvis famously noted, fools rush in — and since PayPal would vastly prefer a world where merchants can’t help falling in love with the new app, slow and steady will continue to define the race. That’s why today’s launch is limited in scope to the U.S and is designed to solve the most direct, and popular, use cases.

The first of which, Goldberg noted, is to give merchants a single, unified hub where they can really visualize all of their payments-related information passing through.

“A merchant may be an eBay seller, and also operate a website, and may now be considering experimenting with some selling on Instagram. Merchants want – and need – to see and manage all of those transactions.”

Merchants also have to manage their customer lists, keep current on their invoices, manage shipping and other backend issues — in short, Goldberg noted, there are a lot of plates to keep spinning. So, what their merchant partners reported they also needed from the app was a central, mobile-native digital location where all off those related business inputs could be viewed at once.

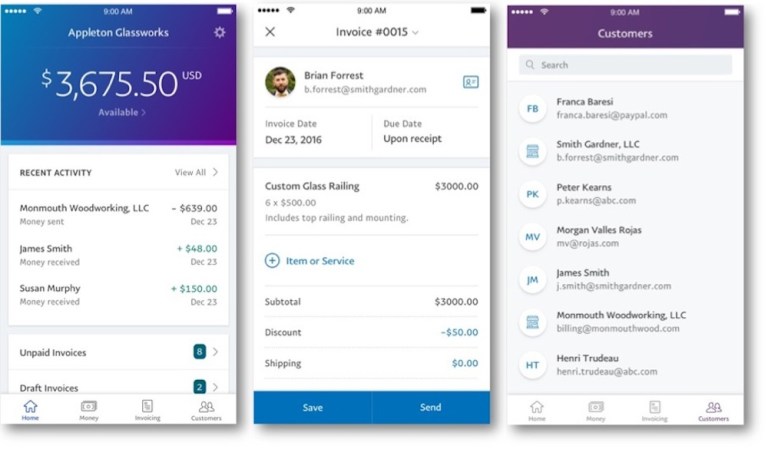

And so the app, as it stands today, comes ready to help — allowing customers to create, send and attach photos to invoices directly from their mobile phone; monitor sales activity; withdraw funds; issue refunds; send payment reminders; manage customer lists; import contacts and view customer histories.

“This is best suited for any firm that’s running a business or maybe even a few of them but probably doesn’t have dedicated resources to keep track of it all. This is really for the merchant and business owner who is really on the go — and wants to see their business from a data perspective anywhere they go.”

And while it is easy to stereotype these firms as tiny micro-firms, the size of the business varies from SMBs to genuine mid-sized business. The real unifying factor, says Goldberg, is for those merchants who wish to log in and see their business without having to develop their own custom interfaces to do that.

The goal …

Build something customers actually want.

The power of functionality, Goldberg said, is often the easiest thing to overlook when building apps for any of PayPal’s user groups — customers or merchants — especially when there is a strong temptation to just throw everything into the app but the kitchen sink and rush it into merchants’ hands.

“It was really important to us during this whole process not to throw a bunch of things at the wall and then see what works later,” Goldberg explained.

That meant, he said, at times making sacrifices. The ability to withdraw money, for example, was something they heard about from merchants but didn’t have in the original instantiation of the app. One might have been tempted to launch the business app earlier and add the withdrawal feature later — but that wouldn’t have been the right approach for this project, Goldberg noted.

“We realized that it was important enough to merchants that it had to be there from the word go.”

A similar issue was present with invoicing. PayPal already has a web-based invoicing interface — but instead of just porting that into the mobile app, the team instead tore it down and fully redesigned it for mobile. If the goal is to make it easier for merchants to be on the go, Goldberg noted, then the features have to be designed to actually be equally on the go.

“When we talk about what design means, it’s not the cool effects that we talk about. It’s how to create simplicity around the things that are actually very complicated and making it work easily,” Goldberg noted. “This gives us a chance to have a really, really simple user interface that lives up to the very high bar that our consumer app already lives up to.”

So what’s next?

This, as Goldberg noted at the beginning of a conversation, is just the beginning. The goal is to hand out more than tools, he noted, but also to give them the data tools they need to run better in the future.

In short, PayPal doesn’t want to just help their merchants manage their businesses — they want to use this app to help them grow.

Goldberg says that they are sitting on a treasure trove of data – and that part of his team’s remit is to give that data back to merchants in a way that helps them run their business better. Data without suggested actions and insights, Goldberg noted, is pretty useless.

Which means what’s next for PayPal is building that better data conduit so that merchants can get the data they really need to see, delivered in a timely enough fashion that they can act on it.

It’s a big project — but PayPal has proven that when it comes to this app, they are nothing if not patient.

Because the point, Goldberg said, is to create something that merchants don’t ever have to wonder about – but can instead turn their focus to just using.