Digital Features Drive Global SMBs’ Digital Shift

The pandemic has hit small- to mid-sized businesses (SMBs) much harder than large chains, as the latter tend to have more cash reserves and more capital to support necessary digital services such as mobile ordering or curbside pickup. These impacts will likely continue to affect SMBs even as vaccination efforts pick up, with PYMNTS’ research showing that the vast majority of consumers intend to maintain the digital shopping practices they have adopted since the pandemic began.

This means that SMBs will have to redouble their efforts to improve digital services if they want to stay relevant in a world where large shares of consumers have shifted to online and mobile shopping — and have grown to expect the ease and safety associated with it.

This means that SMBs will have to redouble their efforts to improve digital services if they want to stay relevant in a world where large shares of consumers have shifted to online and mobile shopping — and have grown to expect the ease and safety associated with it.

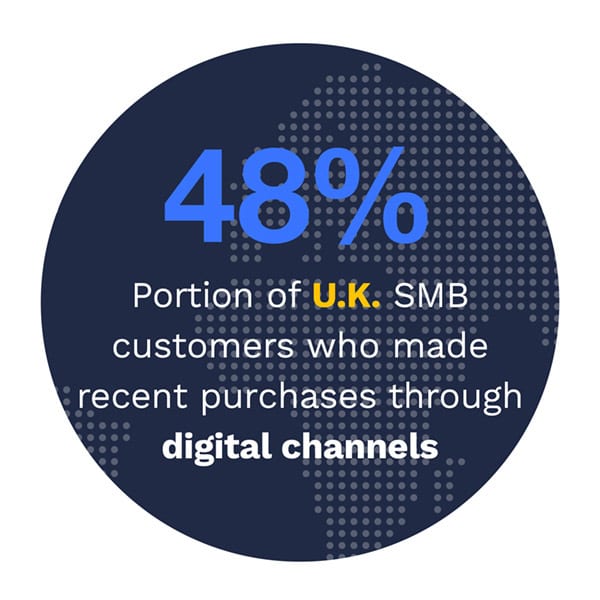

PYMNTS has tracked these monumental pandemic-driven changes in its Global Digital Shopping Index series, which features reports focusing on four key markets: the United States, the United Kingdom, Australia and Brazil. The SMB Edition is based on surveys of more than 8,000 consumers and 2,000 merchants across all four markets, and it examines how SMBs and large stores are adapting to these shifts alongside their customers.

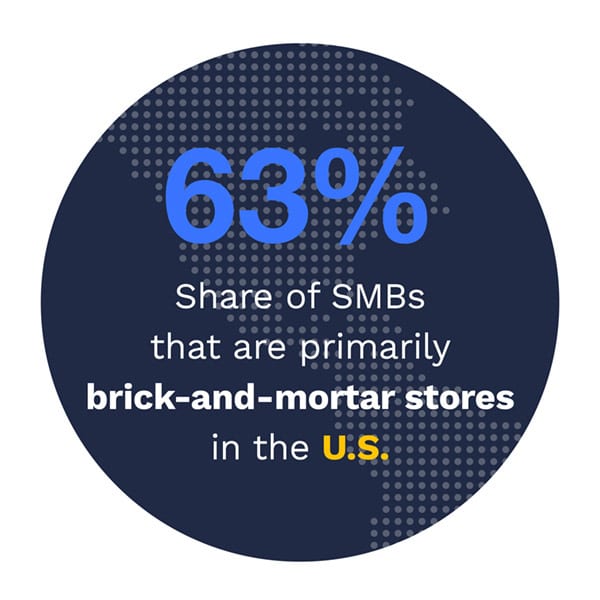

Our research confirms the conventional wisdom around large chains and smaller stores. SMBs as a whole are less likely to offer wide-ranging digital features, and they tend to score lower than large firms in our Index, which measures consumers’ satisfaction with various aspects of the shopping experience. However, 0ur research reveals much more complex dynamics that vary by market.

We found that store-oriented omnichannel SMBs — those that sell via online channels but make most of their sales in stores — perform as well as large stores in consumer satisfaction. Twenty-six percent of these SMBs are top performers, approximately the same share as large stores.

We found that store-oriented omnichannel SMBs — those that sell via online channels but make most of their sales in stores — perform as well as large stores in consumer satisfaction. Twenty-six percent of these SMBs are top performers, approximately the same share as large stores.

Our analysis also shows that consumers are looking for different types of features from SMBs versus large chains. One of the strongest distinct considerations is free shipping: Large-store shoppers are more likely to view this as the most important digital feature than are SMB ones. Just 4 percent of SMB customers in the U.S. consider free shipping to be the most important feature merchants can offer, while large-store customers are four times more likely to have this view.

This suggests that consumers may be drawn to SMBs for reasons that go beyond mere convenience. SMB shoppers appear to be more interested in using digital features to enhance their shopping trips rather than replace them, and this could confer an important advantage because visits to the store tend to result in additional unplanned purchases.

To learn more about these findings and the other key takeaways from our research, download the report.