Fintechs got big by unbundling old-school banking and financial services — money transfers, for example — and building entire businesses around discrete functions. It’s what brought forth Zelle, Venmo and other popular finance apps that are now household names.

In digital shift phase two, disintermediation is, in some cases, reintegrating, leaning into curated and interoperable ecosystems accessed and powered by the rapid ascent of super-apps.

A prime example of the trend is Toronto-based Nuula, a newly formed FinTech that’s disrupting the disruptors with its super-app focus on the data and processing needs of small businesses while simultaneously creating opportunities for third parties to service those small and midsize businesses (SMB) needs.

In a recent interview, Nuula CEO Mark Ruddock told PYMNTS’ Karen Webster that the rising generation of entrepreneurs — increasingly of millennial age — approach value creation from a digital-native set of expectations not well represented in current offerings of many big players.

“[Millennial entrepreneurs’] expectations are defined by the rest of their digital lives, not by their relationship with traditional financial institutions,” Ruddock said. That, plus the fact that digital transformation enabled by technology like machine learning is “finally allowing us to crack the nut of digital underwriting within the small business space and to create much more of a mobile, modern user experience around that,” is powering a new type of FinTech.

To that end, Nuula announced a $120 million fundraise in early September to further develop its super-app ecosystem. Ruddock said Nuula is “not trying to be … a traditional alt-fi. We re-imagined the entire end-to-end experience, from acquisition through monetization.”

Advertisement: Scroll to Continue

Read more: Small Business FinTech Nuula Lands $120M in Funding

Saying that “we are kind of bundling the unbundled bank,” Ruddock told Webster that Nuula has no ambition “to become an end-to-end financial provider ourselves. We are looking at the innovation happening within the Fintech space around small business, and…curating best-in-class components of the small business financial services space into one super-app.”

The Super-App As SMB Neobank

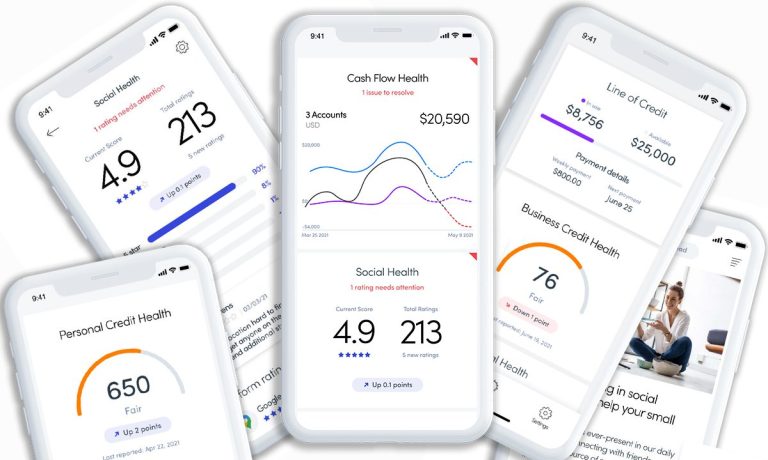

Joining a constellation of brands including Shopify, Square and Stripe that are revolutionizing retail, Nuula aims to give SMBs “access to a blend of insightful content, critical business metrics and innovative financial products that can help power their businesses, anytime and anywhere,” according to a statement outlining plans for the new capital infusion.

Ruddock told Webster that “We want to create an app that small business owners in particular are going to [use] every day” to access “the metrics that matter … in the palm of their hands.”

The vision is a super-app with “free tools like cashflow forecasting and monitoring business and personal credit files, because that’s how you adjudicate credit for small businesses.” This mélange will also include customer sentiments, social commerce “and even Shopify data” he said: “All of their eCommerce data in one place at a glance on their phone. That is one really important piece that drives both engagement and retention on [our] platform.”

Nuula’s ecosystem is being designed to attract third parties in verticals from restaurants to insurance, whose most relevant offers will be surfaced in a timely fashion for small business owners based on an ever-deepening understanding of business needs based on data signals.

In this way, Ruddock said Nuula uncovers a sweet spot obscured by world-shaking events.

“Unfortunately, the pandemic has made a lot of really great businesses look like really bad businesses, and it’s unfair to them,” he told Webster. “What we’re saying is that we’re going to look at all of [an SMB’s] historical data … we’re going to continuously watch you as you move forward, as you recover, as you grow, as you scale.”

As the platform detects financial improvement, “we’re going to unlock capital and other financial products for [that business] earlier in the cycle. In order to do that, we’re looking both at that data for underwriting purposes and for signals of intent.”

By aligning intent and timing through data, he said third parties in the Nuula ecosystem — insurers, for example — can put forth offers at ideal moments in the life of a small business.

If an SMB is using the super-app to perform cash flow forecasting, for example, Nuula sees the data and machine learning algorithms and can “know” if it’s a time to unlock a line of credit or not.

“Insurance is much more subtle,” he said. “Let’s say that in your transactional data we have detected that you’ve started to acquire significant assets, whether it be equipment for your restaurant kitchen or whatever. It’s an interesting time to think about re-evaluating your insurance. Are you properly insured for these investments that you’re making?”

He added that “Rather than creating a bazaar … with billboard ads rolling over the application in front of the customer every day, clocking everything under the sun, we want to find those moments when that conversation is the most interesting, compelling, and engaging.”

Insights Bearing on Lending, Collections and More

What’s in it for third-party services offered up in the Nuula super-app is a seat at the table when SMBs are ready to make relevant buying decisions.

“Our partners can get access to those ongoing signals so that they can fine tune their response within their own app,” Ruddock told Webster.

“Lenders that are working on our platform [will get] signals about cash flow issues before they would normally ever see them. We’re hoping that this cross-section of really amazing data, proper qualification, continuous scoring and continuous movements and analysis of data will make it that much more compelling as an ecosystem.”

Saying that Nuula’s client acquisition focus is “the smaller end of the small business spectrum,” Ruddock told Webster that managing risk in SMB lending is a key feature of the super-app.

“If the [revenue] curves are going up, we can gradually advance more credit in the form of this dynamic line of credit to the customer,” he told Webster. “But if we see the trajectory change, we can slow down or restrict the growth of that credit, or maybe even start to pair it back a little bit. What we’re trying to build is a self-healing line of credit in a way which grows with the customer and protects downside risk.”

It’s not just about divining data for lending and the offering of other services. Collections is another greenfield for the Nuula super-app, Ruddock said.

“We believe there’s huge opportunity also in algorithmic collections. If we know two days in advance that you’re not going to make your regular loan payment, it makes no sense for us to ACH that transaction and have it bounced, and have you pay a fee and us pay a fee. However, if we can dynamically adapt our collections to fit the availability or affordability of that customer at that moment, if it lies within an acceptable range for us, it becomes a self-healing loan.”