From robotic delivery to voice-based ordering and payment, the food sector continues to ride a wave of digital innovation that touches many aspects of grocery and restaurant experience.

For The How We Eat Playbook, a PYMNTS and Carat from Fiserv collaboration, we surveyed nearly 5,270 U.S. consumers about their preferences in dining and food shopping, learning that the surge in online food and grocery purchases “presents a massive opportunity for grocers and restaurants to win over new customers, but that largely depends on whether they can deliver the pickup and delivery experiences that meet online shoppers’ rapidly shifting expectations.

This is evident in both the restaurant and grocery sectors, and consumer demand for more digital engagement and greater convenience is driving a sea change in how we eat.

For example, PYMNTS found, “In total, 67 percent of restaurant customers opt to order their food for either pickup or delivery, compared to 51 percent who report dining on-site.”

On the grocery side, 95% of consumers still shop and pay inside physical stores, however, “72 percent order them online for either curbside pickup or home delivery. Ordering groceries online for home delivery is more popular than ordering online for curbside pickup: 67 percent of grocery shoppers now opt for delivery compared to 51 percent for curbside pickup.”

Get the study: How We Eat Playbook

Advertisement: Scroll to Continue

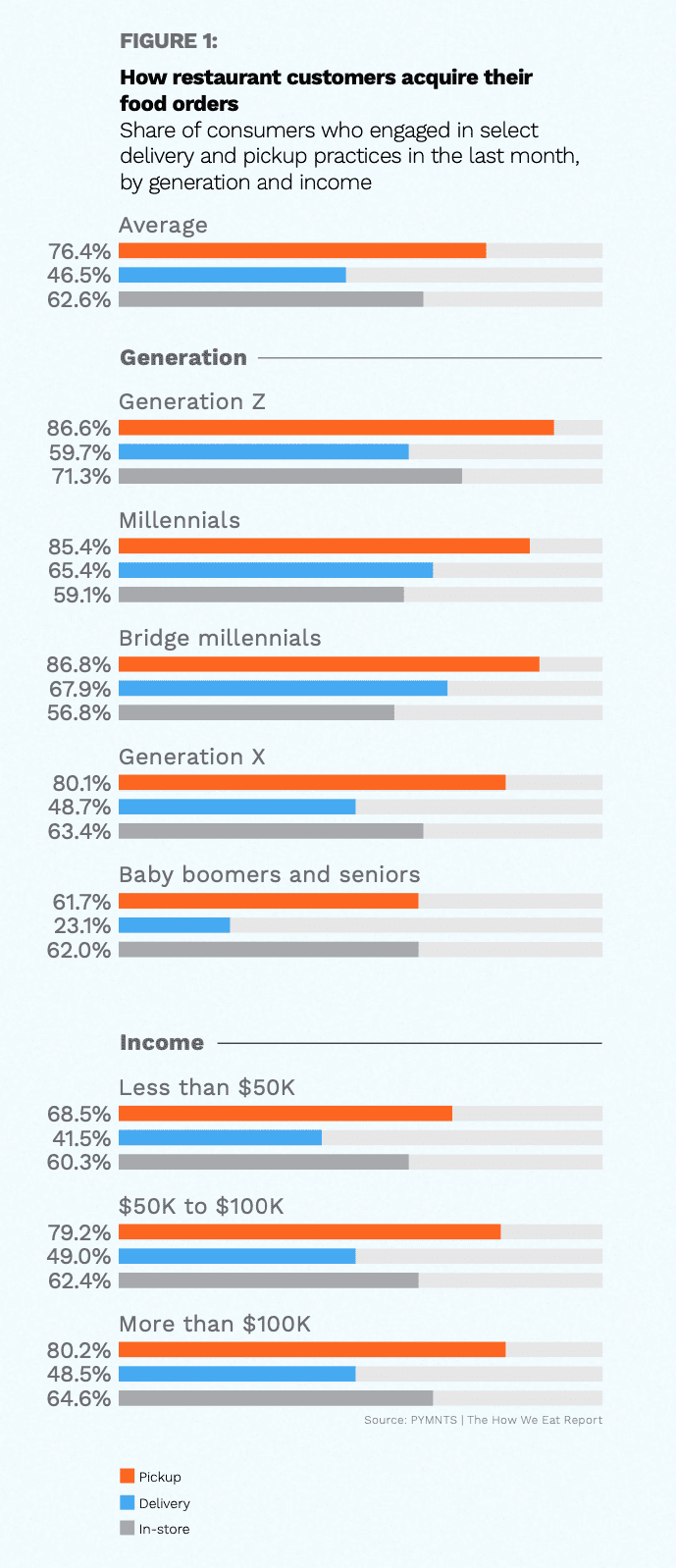

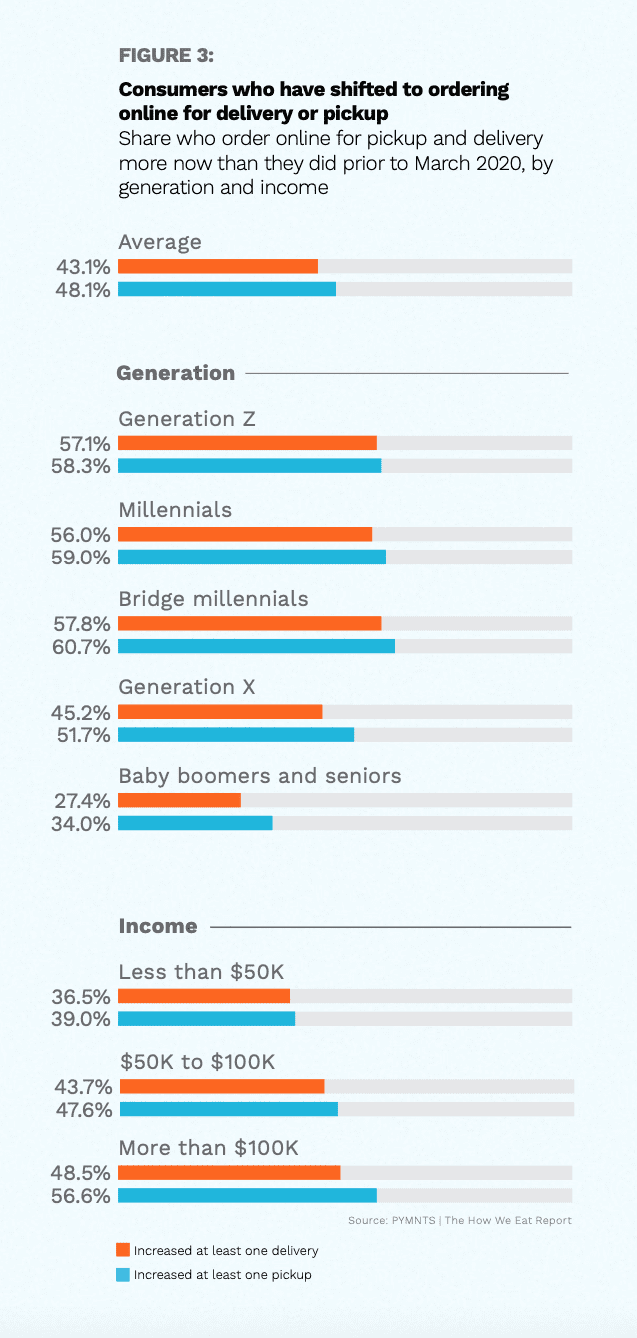

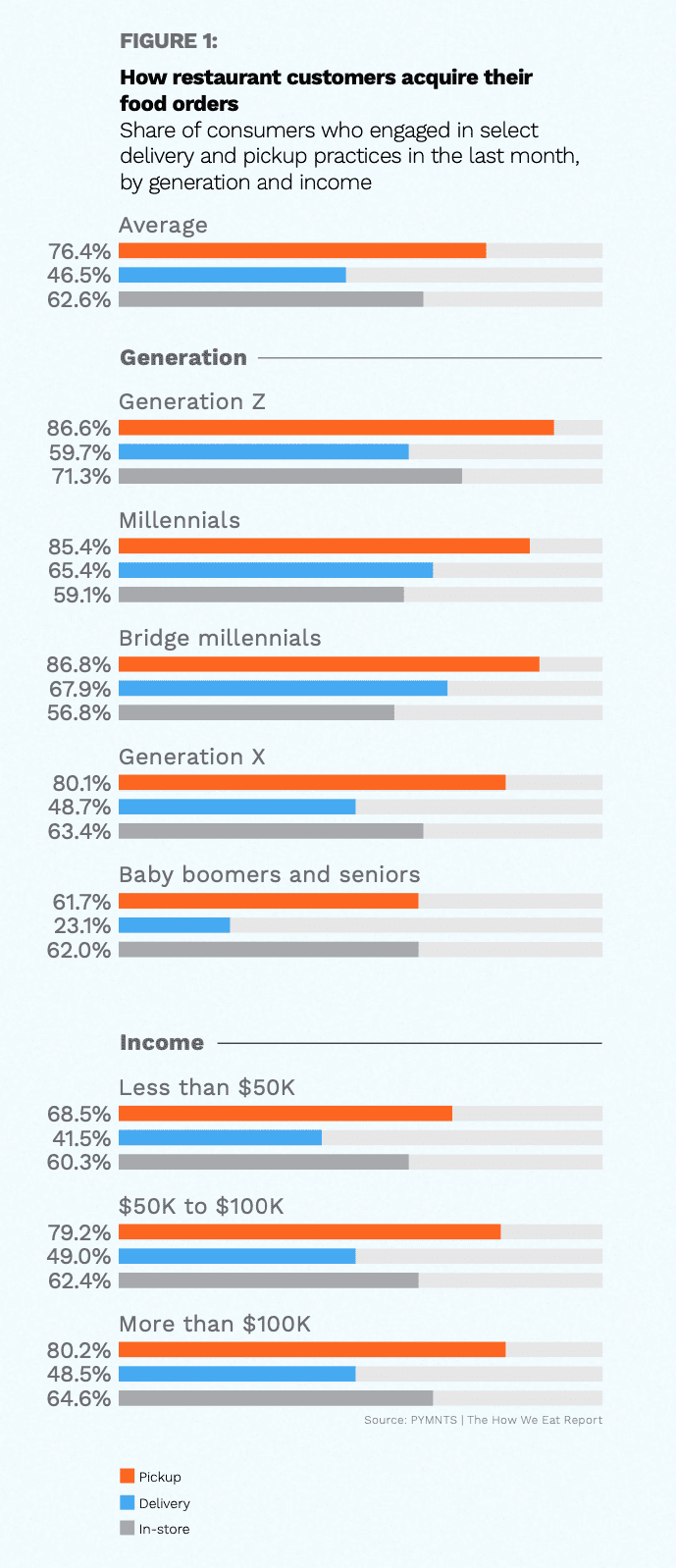

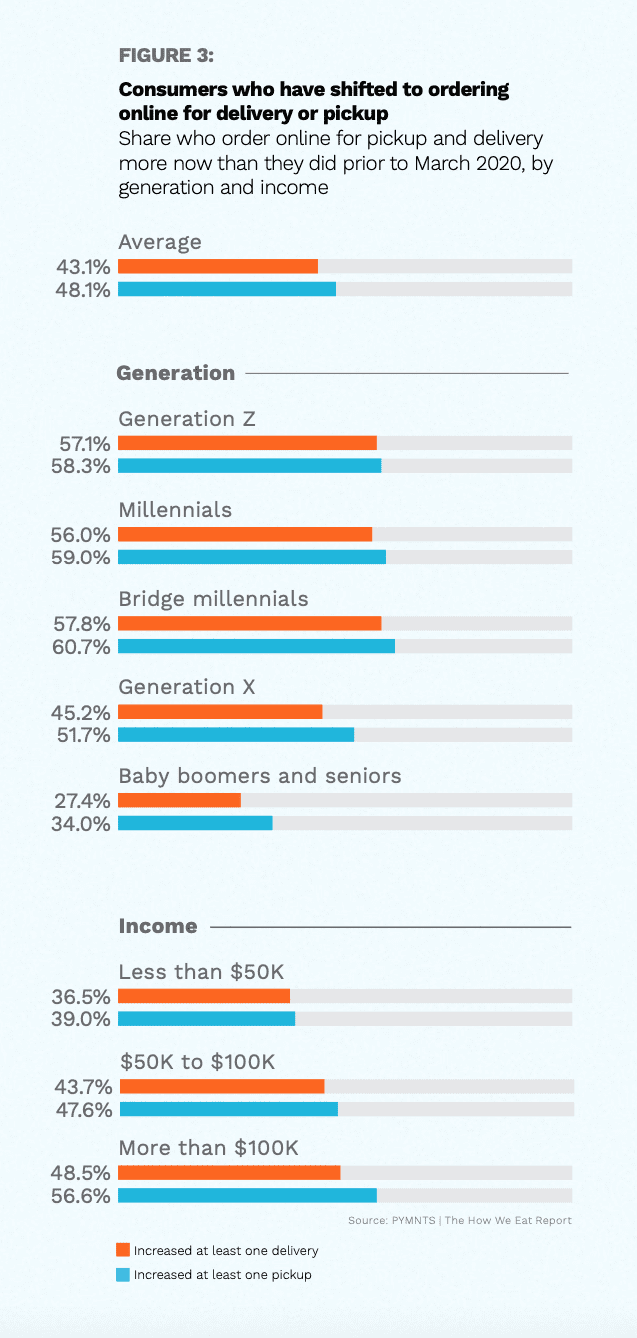

Demographic Differences are Clear

Delving into demographic trends behind shifts in food ordering and payments, The How We Eat Playbook states, “Millennials and bridge millennials are more likely to both order online for home delivery or on-site pickup than they are to dine on-site,” with 85 percent of millennials and 87 percent of bridge millennials place restaurant orders online for pickup, respectively.

Also, 65% of millennials and 68% of bridge millennials order food online for delivery.

At this point in the pandemic, we found that 59% of millennials and 57% of bridge millennials dine on-site, respectively, therefore “restaurants must provide both pickup and delivery options if they hope to gain ground among these digital-first consumers.”

“Millennials and bridge millennials lead the way in online grocery shopping. They are just as enthusiastic about ordering their groceries for delivery or pickup as they are about doing so with their restaurant orders. Eighty-eight percent of millennials and 89 percent of bridge millennials buy groceries online for delivery or curbside pickup,” per the study.

Read now: How We Eat Playbook

Voice Gets a Seat at the Dinner Table

Voice commerce is growing in new directions, with food emerging as a prime use case.

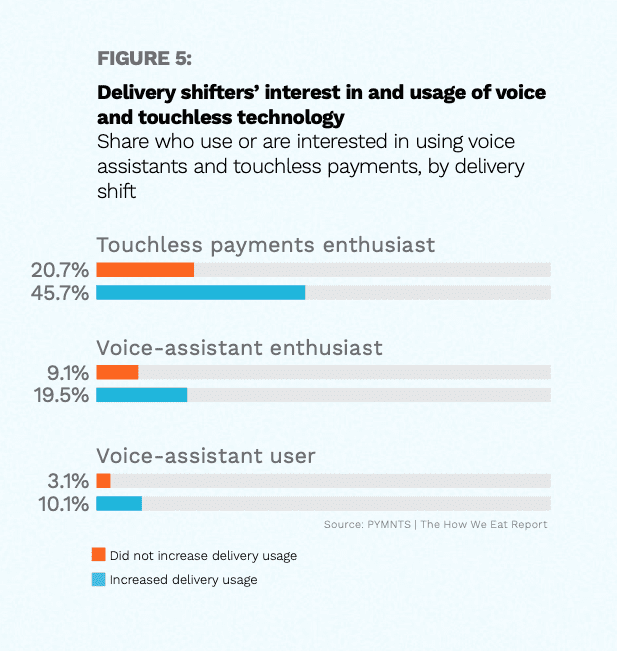

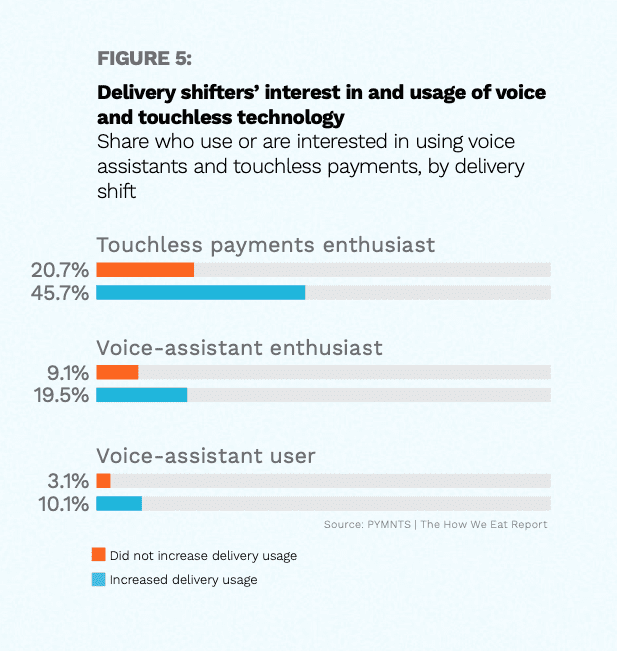

According to How We Eat, “Consumers who have shifted to ordering more food and groceries online also are more than twice as likely to express interest in using voice-enabled devices to shop and pay going forward.”

Breaking it down, 20% of consumers say they are “very” or “extremely” interested “in using their voices to buy food and groceries, compared to 9.1% of consumers who are ordering just as much or less pickup or delivery than they did prior to March 2020.

The study adds that “connected consumers’ interest in shopping and paying with their voices opens a new world of opportunities for voice-enabled connected commerce experiences, whether ordering food, buying groceries, paying for gas or even paying bills with voice-enabled devices.”

See the study: How We Eat Playbook