As many cash flow fixes as have flowed into the marketplace since the pandemic’s onset, large gaps persist — even among treasury banks — in transparency needed to forecast accurately.

“Most organizations today struggle with siloed payment channels, creating disparate data sets that prevent the free flow of information. This leads to back-office fragmentation, which gets in the way of obtaining holistic views of cash flows,” according to PYMNTS January 2021 Mastering Multichannel Commerce Playbook: Bringing Multichannel Optimization To The Back Office, a Citi collaboration.

“Centralized cash flow management systems can help, but several barriers impede such offerings’ adoption. Forty-three percent of treasurers in a survey noted that treasury departments are challenged with standardization of processes and controls, 33 percent struggle with bank relationships, 21 percent struggle with account structures and 28 percent are challenged by multiple technology platforms,” the Playbook states.

To gain a deeper, more dimensional understanding of impediments to optimization, this latest edition of PYMNTS Mastering Multichannel Commerce Playbook series takes an exacting measure of how treasurers are using digital tools to break down siloes for greater visibility.

Modernize To Optimize

Businesses are implementing digital solutions at a dizzying rate these days, and that momentum will continue as more firms “diversify income sources and optimize AR operations to maintain cash flows and keep operations afloat,” per the Playbook. “It has thus become more crucial for businesses to modernize their back-office operations for optimizing multichannel payment flows, improving their cash flow forecasting capabilities and overall visibility. Advanced learning tools such as AI and machine learning can help.”

Fortunately, tech is catching up (and now bypassing) traditional and often paper-based processes for automated treasury solutions that unify back offices into a holistic view.

“Technologies have emerged to digitize the invoice presentment process, providing instant invoice delivery, transparent interaction through customer facing portals and real-time status reporting,” Anupam Sinha, global head, domestic payments and receivables, Citi Treasury and Trade Solutions told PYMNTS. “Additionally, integrating electronic payment methods such as direct debit can help ensure payments are received on time and reduce delinquency.”

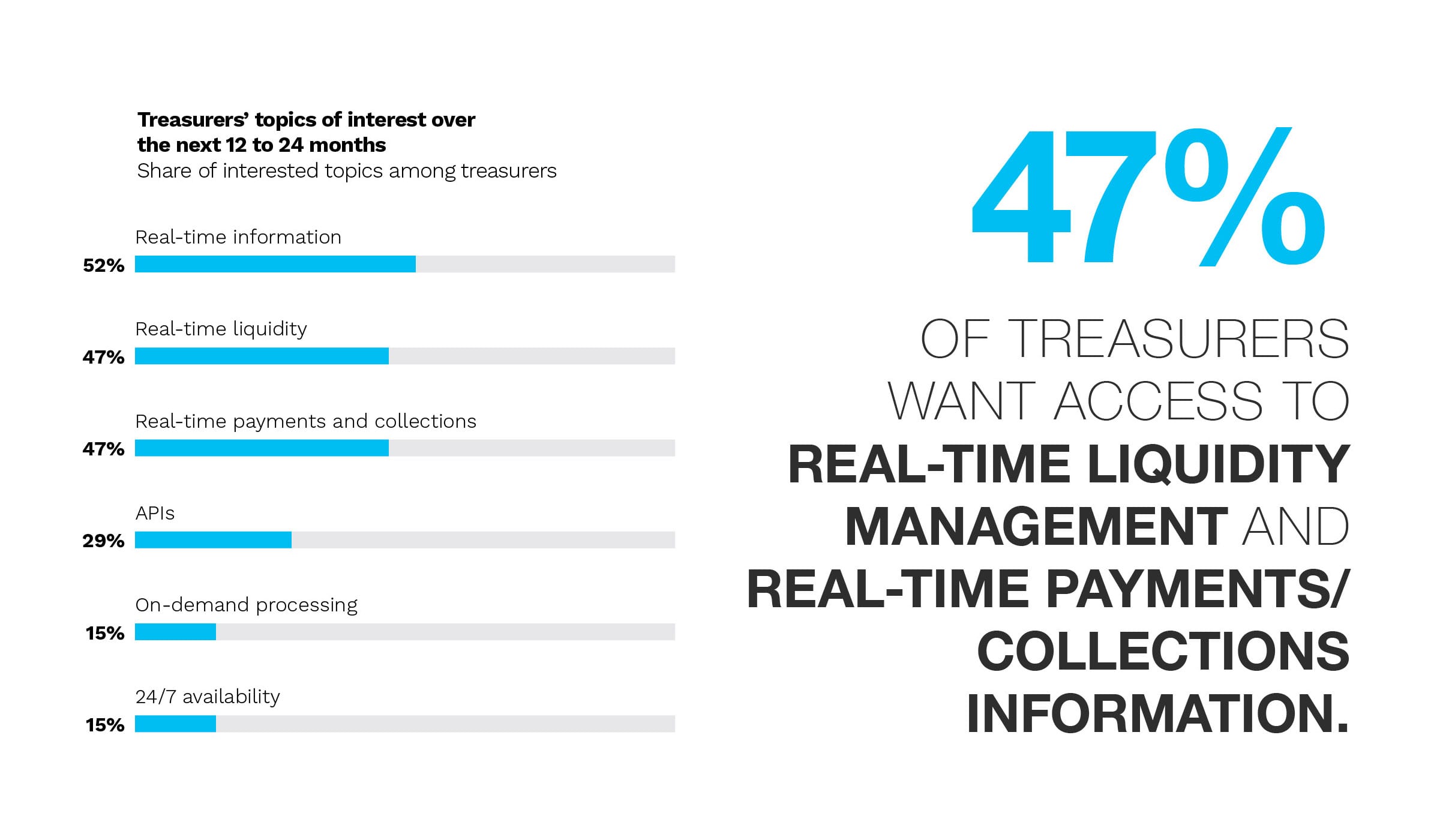

Treasurers continue to identify forecasting, liquidity planning/cash visibility and optimization as areas that will be most impacted by these efforts.

Applying Received Payments Faster

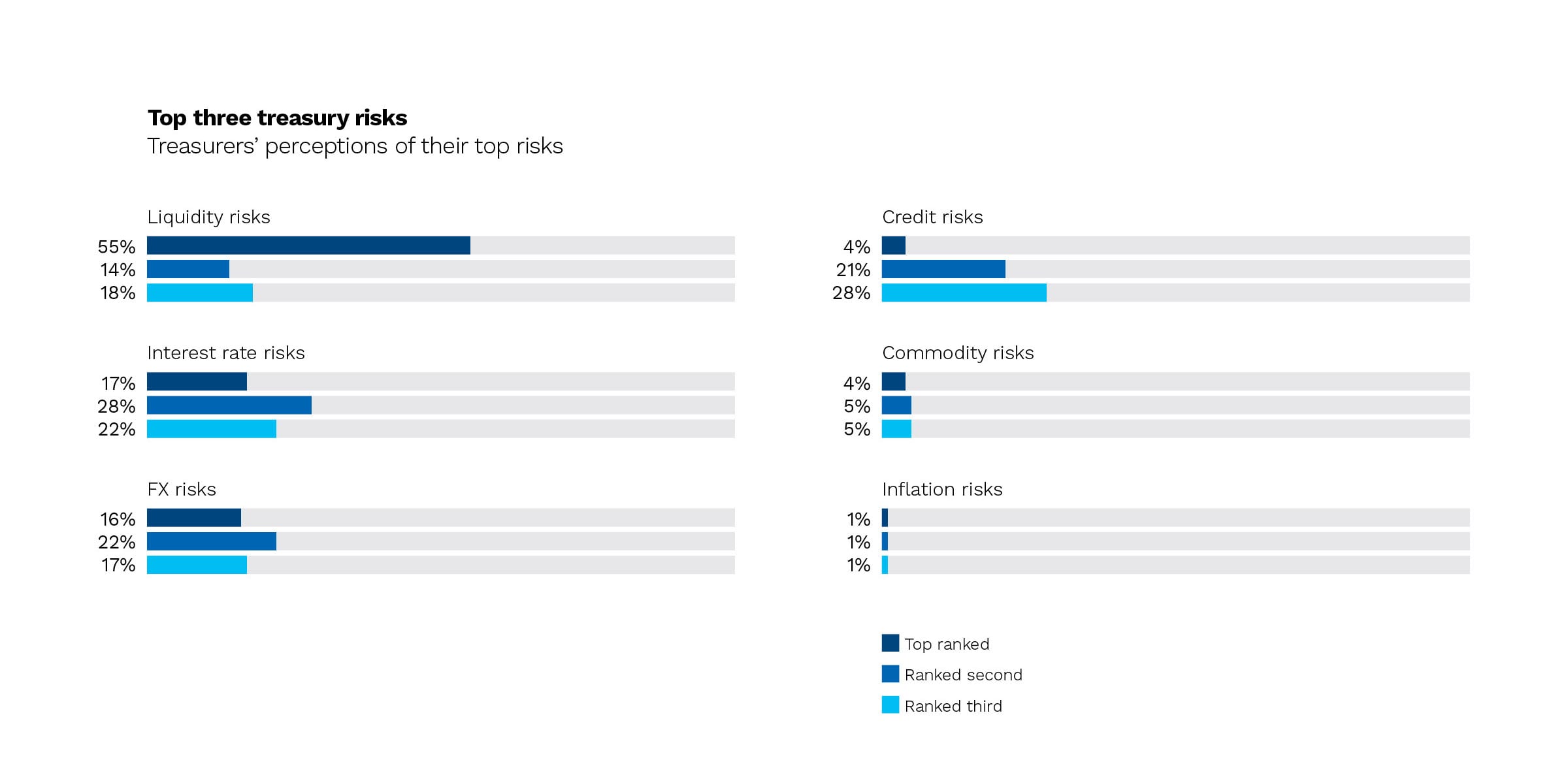

The January 2021 Mastering Multichannel Commerce Playbook notes, “Liquidity rates have become a key challenge for treasurers since the pandemic’s onset … as have interest rate risks, FX risks, external funding, cybercrime and digital treasury transition. Multichannel payment integrations in the back office can help deliver comprehensive, real-time transaction reporting, which can in turn improve treasurers’ abilities to respond to cash flow and liquidity management challenges.”

To meet these challenges, banks and financial institutions (FIs) are leaning on tokenization, electronic invoicing and platform payments to cross borders and ford commercial rivers.

“Collectively, [back-office automation] can help [chief financial officers] significantly reduce delinquent payments. Cash flows can also be optimized by digitizing invoices for immediate presentment, migrating to digital payment acceptance to increase the adoption of direct debit while reducing acceptance of checks and automating cash application processes to apply received payments faster,” Citi’s Sinha told PYMNTS.