Since the dawn of social media, the notion of inserting commerce into social networks has seemed like the natural extension of having groups of friends share every detail of their day-to-day lives on those virtual networks. But what may have made sense in theory didn’t deliver in reality. People were much more interested in being social – looking at and commenting on what people were eating, wearing and doing – than they were in shopping while there.

Venmo started out with a very different proposition: sending money between friends is an inherently social activity. It often accompanies paying back that friend for an experience they shared – eating lunch or dinner, going to a sporting event or a concert, or buying flowers for Mom’s birthday. On both sides of that commerce transaction is another set of inherently social activities: making the plans, booking the event and then collecting (or paying) the money.

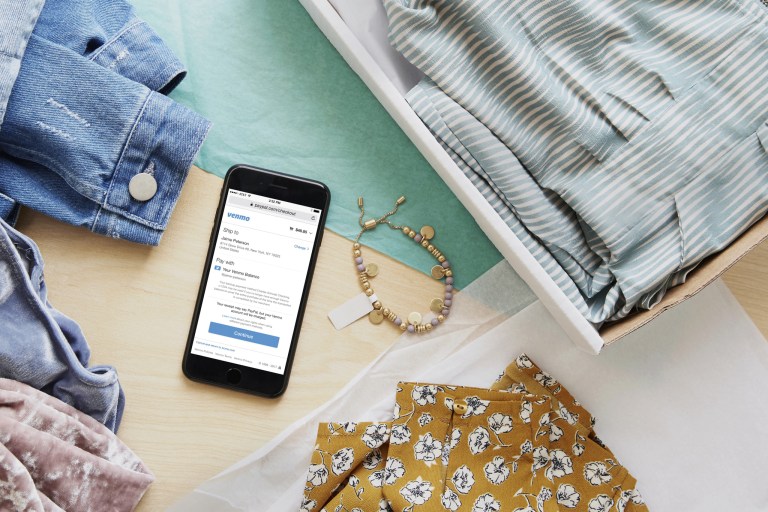

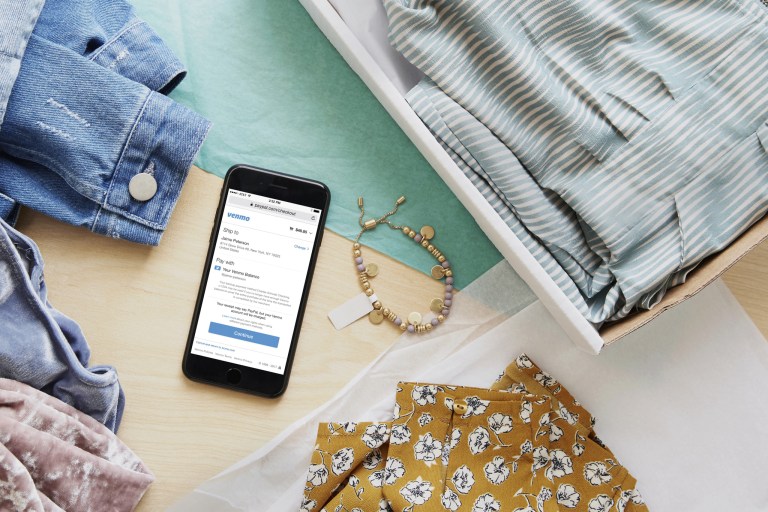

Today, Venmo is making commerce a whole lot more social with Pay With Venmo.

Starting this week, and rolling out over the next two, Venmo users can use their Venmo accounts to shop at 2 million-plus U.S. retailers that accept PayPal.

“This is something we have had in mind for many years,” PayPal COO Bill Ready told Karen Webster in a conversation shortly before the news was publicly announced.

Advertisement: Scroll to Continue

Ready told Webster that not only is this available for Venmo users, but it also happens for PayPal merchants with absolutely no work on their part. Much like the One Touch enhancements, a merchant’s existing PayPal button will automatically accept Pay with Venmo customers.

The goal, he noted, is to give Venmo customers more ways to use their accounts. With the simultaneous rollout of Instant Cash, Venmo users, Ready said, will have access to their money more quickly than ever before. With Instant Cash, Venmo customers can instantly transfer money from Venmo to their bank accounts via eligible debit cards for $0.25 a transfer. Funds will typically be available in a customer’s bank account in a matter of seconds.

“It’s not just an evolution in what Venmo can do,” Ready said, “but a way that social commerce can be meaningful for consumers.”

How Pay With Venmo + PayPal Works

For both Venmo users and merchants, Pay With Venmo doesn’t come with a learning curve. As part of the rollout, when Venmo users log onto the app, they will be told that they can now use their Venmo accounts anywhere they see the PayPal button in-app or on the mobile web. Retailers will have the option to add a dynamic Venmo tag, Ready said, but it’s not required for the payments solution to work.

Here’s what makes it social.

Once a Venmo user clicks the PayPal checkout button, they will be redirected to a Venmo-branded page to complete the transaction, where they will retain all the powers they’ve come to know and love with Venmo, including splitting the check.

Ready said that Pay With Venmo has been in testing mode for a while, with a focus on refining the functionality to ensure it is right.

“We have used the distribution capability – the PayPal rails – to make Pay with Venmo a very frictionless way for retailers and consumers to do business,” Ready said, adding that Pay with Venmo offers those retailers instant access to the highly coveted millennial demographic.

The Bigger Opportunity

Venmo, because it started with the commerce and then developed a social element, has become something of a unique digital destination, Ready noted.

“You have a tremendous number of Venmo users who think of Venmo as the product they want to use to pay for everything,” Ready said. “But I think this also creates a forum where it’s actually okay to talk with friends about purchases they have made – that’s a reputation we have been building for the last several years.”

Venmo, he said, has evolved quickly from being only about collecting money from friends to the conversations their users were having about what they were buying and why, what experiences the app helped them share or “just talking about some cool stuff you found.” And because it is such an authentic and natural place to talk with friends about things they have or might like to buy, it creates a more authentic and natural place for merchants to better engage with those potential customers.

“We aren’t an ad platform, but we think what we do have is a very powerful access point to an organic conversation, particularly with millennials,” Ready explained. He added that Venmo’s goals are to make it easy for users and merchants to be able to buy – and start a dialogue about the things they buy – turbocharged by the fact that recommendations from friends carry a lot of weight and have the potential to drive viral marketing around items or experiences that they see their friends purchasing.

As for any overlap between Pay With Venmo and PayPal users, Ready explained that there are, indeed, overlapping “Venn diagrams” on Venmo. As millennials have pulled their boomer parents (and their family networks) into Venmo to send them money, the lines for who might use Pay With Venmo and who might use PayPal might not be as clear-cut as Pay With Venmo for Millennials and PayPal for the Xers and Baby Boomers.

“What we do see, however, is that people who are really into social media [tend to] like Pay With Venmo,” Ready said. “If they tend to favor more traditionally solitary commerce experiences, they lean toward PayPal.”

So instead of having to choose, Ready said that PayPal wants to give both sets of users the opportunity to buy whichever way they want – and give merchants a chance to catch the sale either way.