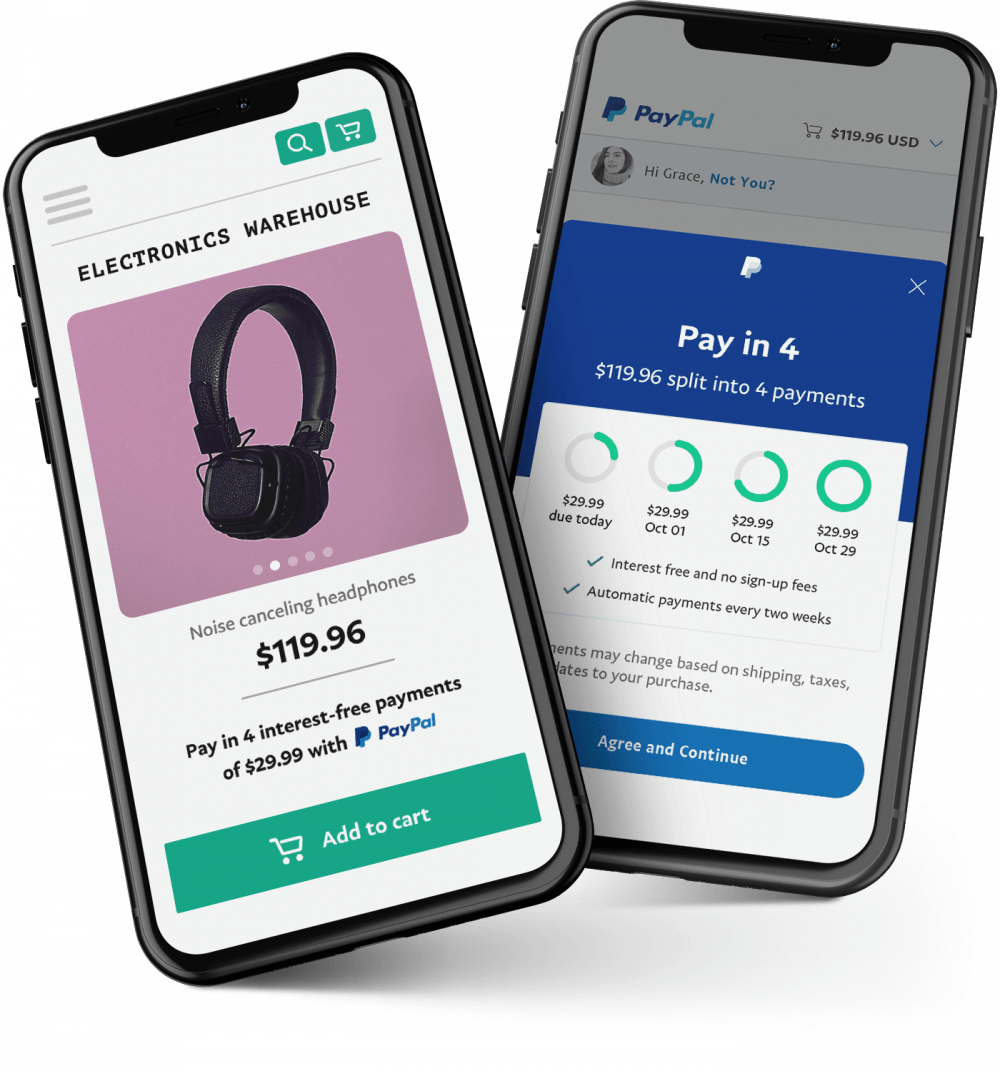

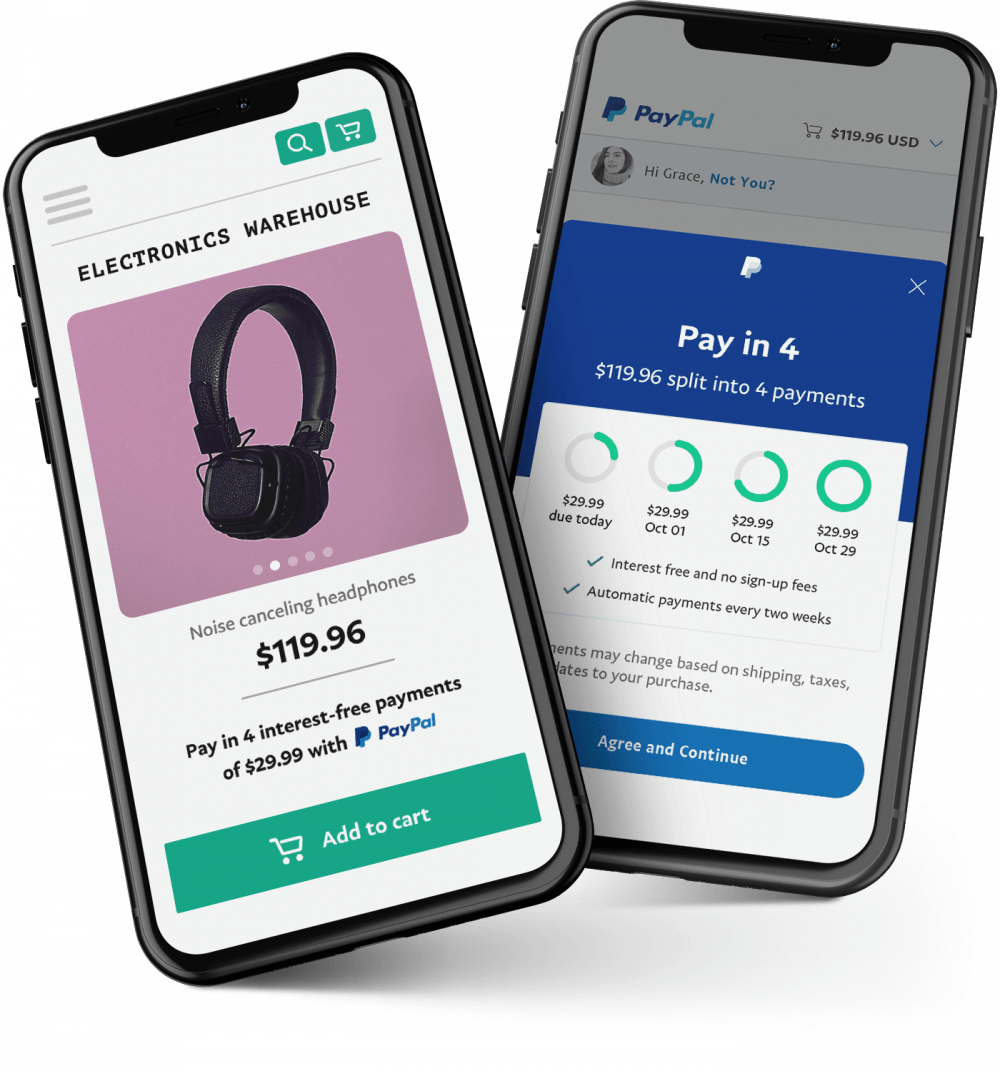

With Pay in 4, PayPal customers have an option to pay 25 percent of an item’s price upfront, then pay the rest over six weeks through three equal payments. This program is for purchases between $30 and $600 and there are no interest charges or other fees (except for late fees if someone doesn’t pay on time). For consumers, Bland said, Pay in 4 offers a near-ubiquitous online installment payment experience given PayPal’s penetration of online merchants (79 percent of the top internet 100).

With Pay in 4, PayPal customers have an option to pay 25 percent of an item’s price upfront, then pay the rest over six weeks through three equal payments. This program is for purchases between $30 and $600 and there are no interest charges or other fees (except for late fees if someone doesn’t pay on time). For consumers, Bland said, Pay in 4 offers a near-ubiquitous online installment payment experience given PayPal’s penetration of online merchants (79 percent of the top internet 100).

“What we continuously hear from businesses of all sizes is that they are looking for trusted ways to help drive sales [and] attract customers without taking on additional costs,” Bland said. “At the same time, what we hear from our consumers is they are looking for flexible and responsible ways to pay when they shop. This has all accelerated during the pandemic, and this economic uncertainty has created additional stress for the retailers and for consumers.”

Bland said there would be some credit evaluation before PayPal approves a customer. Still, because of the modest loan sizes, he said that PayPal expects to approve the vast majority of applicants.

“Given the challenging and uncertain times we’re living in, we felt it was more important than ever to provide this solution to help retailers help consumers,” Bland said. “And we’re going to make it available [in] time for the upcoming holiday shopping season.”

Pay in 4 Aims To Meet Consumers’ Growing Interest In BNPL

Advertisement: Scroll to Continue

Pay in 4 isn’t PayPal’s first foray into the world of installment payments. PayPal with PayPal Credit, Bland said, was an early alt point of sale (POS) credit pioneer a decade ago, well before the alternative online credit option was given the “buy now pay later” moniker and offers consumers an interest-free line of credit option with payments spread over a six-month window. Pay in 4 is PayPal’s newest addition to its Pay Later portfolio of credit options for PayPal users.

But Bland said that consumers looking to control their spending are increasingly attracted to BNPL options that allow them to defer payments while providing transparency in how those payments are structured and how much it costs to opt-in to that way to pay.

“We can imagine that this will resonate with the younger demographics already favoring installment payments, but also all demographics who want to avoid paying credit card interest and who maybe also looking to stretch out their funds over a six-week period,” he said.

Pay in 4 – Helping Merchants Boost Sales

Bland said the benefit for merchants is that Pay in 4 provides another payment choice for PayPal customers who already like and use PayPal to make online purchases. Bland said that PayPal data shows that PayPal checkout conversions are 82 percent higher than checkout without PayPal. When businesses promote PayPal Credit, they see a 21 percent increase in sales and a 56 percent increase in order values.

“That’s really important because if you think about the scale of PayPal, we have over 300 million consumers around the world, [and] certainly a big chunk of that is in the U.S. market,” Bland said.

Bland also said that making Pay in 4 available to consumers is free to merchants: free of added integration hassle and costs since it is simply another feature inside of the PayPal wallet for consumers, and it is free to offer. Pay in 4, he said, costs merchants nothing above and beyond their existing PayPal pricing when a sale is made. Pay in 4 sales proceeds are paid in total when a sale is made.

Merchants To Help Drive Pay in 4 Awareness

When asked how PayPal plans to promote Pay in 4, Bland said PayPal believes merchants will take the lead as they have a rather powerful incentive to boost sales, particularly given the current economic environment and during the traditional make-or-break holiday season.

That makes merchants, Bland noted, the best promotional channel they have for igniting the new service, as they should. Merchants have the best grasp on their customers’ needs and wants and thus the most logical path to align their needs with the value proposition of the Pay in 4 installment option.

The Pay in 4 Path Forward

Bland added that Pay in 4 is just the latest move toward the democratization of financial services that has motivated PayPal’s expansions more broadly into the credit market. Those efforts include Working Capital for businesses and PayPal Credit for consumers.

He said the goal is to keep deploying tools to make commerce more engaging, easier to use and ultimately more rewarding for consumers and the merchants they like to shop. Based on early beta tests of the product, Bland said that he’s excited to see it launch and scale in the U.S. — and soon other markets, as well- and in time for holiday 2020.

“The demand [so far] we’ve seen is remarkable — and across all categories of merchants — from the largest enterprise merchants to the smallest mom and pop shops. “

With Pay in 4, PayPal customers have an option to pay 25 percent of an item’s price upfront, then pay the rest over six weeks through three equal payments. This program is for purchases between $30 and $600 and there are no interest charges or other fees (except for late fees if someone doesn’t pay on time). For consumers, Bland said, Pay in 4 offers a near-ubiquitous online installment payment experience given PayPal’s penetration of online merchants (79 percent of the top internet 100).

With Pay in 4, PayPal customers have an option to pay 25 percent of an item’s price upfront, then pay the rest over six weeks through three equal payments. This program is for purchases between $30 and $600 and there are no interest charges or other fees (except for late fees if someone doesn’t pay on time). For consumers, Bland said, Pay in 4 offers a near-ubiquitous online installment payment experience given PayPal’s penetration of online merchants (79 percent of the top internet 100).