Credit cards have been a lifeline in the current inflation-fueled economy.

But for the consumers who have been using their credit cards to cover a broad and significant portion of everyday expenses — the high spenders — the pressure looms to find new, alternative ways to pay for the goods and services they need.

As detailed in the report, “Credit Card Use During Economic Turbulence,” a PYMNTS and Elan Credit Card collaboration, and in evidence of just how much individuals and households have been relying on their cards, one-third of cardholders increased their share of credit card spending in the last six months.

Only 15% reduced spending.

Higher costs, not surprisingly, have been a prime mover in spurring that pivot toward using cards more often.

Advertisement: Scroll to Continue

High Spenders, Defined

We’ve defined high spenders as consumers who use credit cards to pay at least 40% of their monthly expenses. A full 38% of consumers fit into that category — 12% of consumers always or usually carry a revolving balance between statements. Another 26% of consumers rarely or never carry a revolving balance between statements.

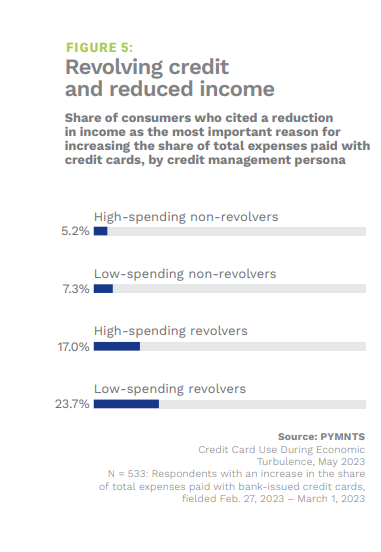

High-spending revolvers were the most likely to shift more spending to their cards, as nearly half did so. Beyond the fact that inflation’s been an influence, we note another pressure in the mix: Wages. A significant percentage of our respondents noted that a reduction in income was the most important reason they increased the total share of expenses paid with credit cards. The chart shows that 22% of the high spenders pointed to that reason.

There’s evidence that these high spenders are being judicious in managing their credit card use: 47% of high-spending revolvers prioritize credit-limit monitoring features that alert them to approaching spending limits and 29% of high-spending non-revolvers do so.

Purchasing Power Declines

The aforementioned sentiment over a reduction in income comes even as wages rise. The actual reduction is the result of inflation outpacing that wage growth. In the latest government data, average hourly earnings climbed by 4.4% in the year through April. But as we noted in this space, consumer prices have risen by 4.9% through that same period. Thus, there’s a gap between what things cost and what can be comfortably covered by cash flow that comes in the form of one’s recurring paycheck.

Credit cards have been filling that gap. But it may be the case that as that credit card debt becomes ever more expensive — average credit card rates are now north of 20% — individuals will tap alternative ways and means of satisfying the demands of their monthly expenses. Our recent deeper dive into buy now, pay later earnings reports has shown that volumes among the various providers are swelling by double-digit percentage points.

Elsewhere, personal loans, facilitated by platforms such as SoFi and LendingClub, may draw a wider audience, as they offer conduits to pay expenses but also to consolidate credit card debt and pay it down at cheaper rates.