Online merchants have long used PayPal and Venmo to drive checkouts.

But in the current macro environment, for smaller online sellers to move beyond the “small to mid-sized” designation — in other words, boost top lines — they need to give customers more payment choices.

And, amid the day-to-day challenges of grappling with inflation and volatile consumer spending, they need to manage cash flow more adroitly.

Beginning Tuesday, Nitin Prabhu, PayPal’s vice president of Merchant Experiences and Payments Solutions, told Karen Webster, “We’re going to help these merchants do more — and give them the tools they need to compete with the larger players.”

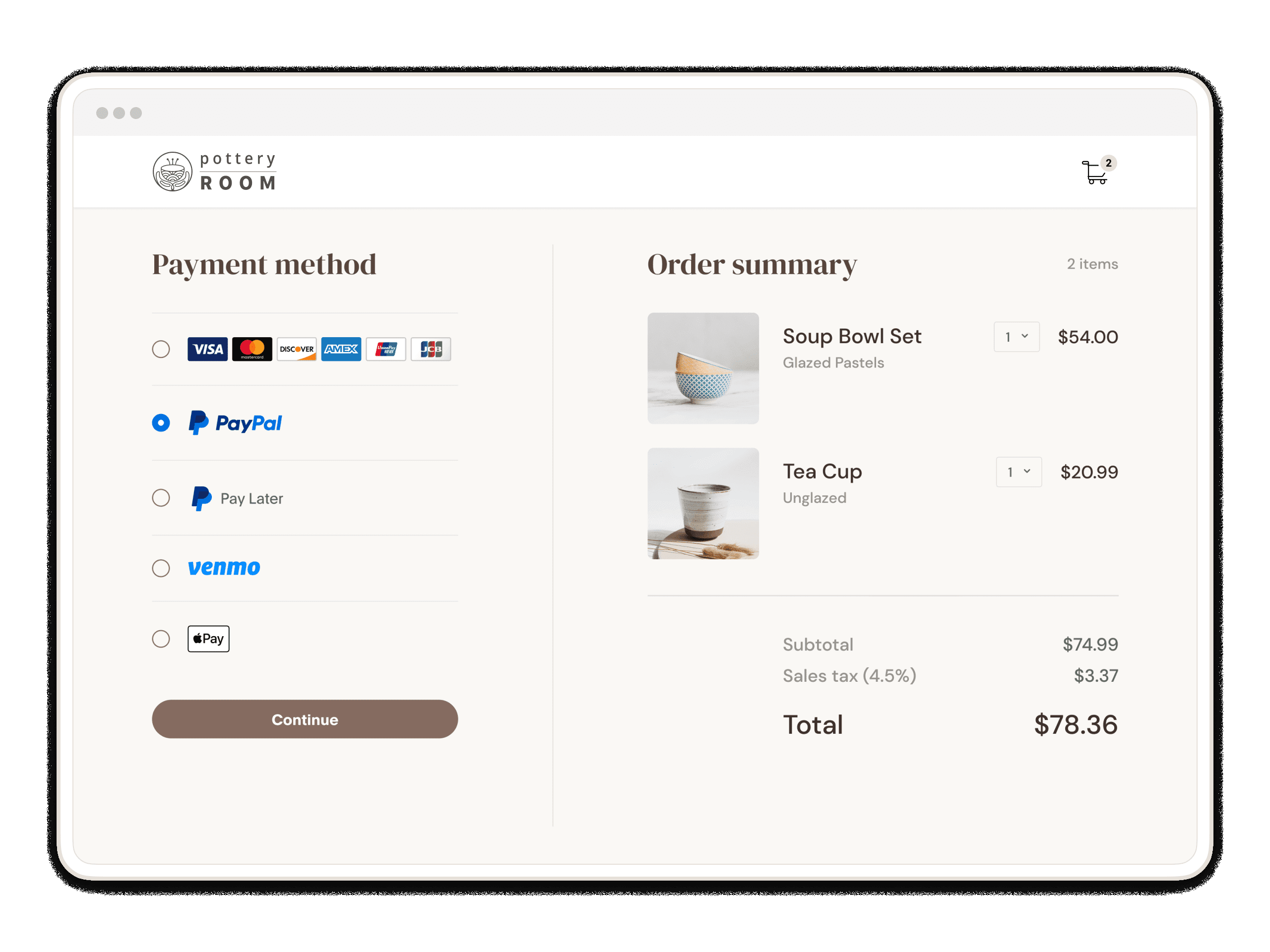

As announced on Tuesday (April 4), the company said it is expanding its small business payments solution with several key, new features that — taken as a whole, offer SMBs an enterprise-level suite of core payments capabilities. The solution already lets SMBs accept PayPal, Venmo and PayPal Pay Later.

Now Apple Pay’s in the mix too.

The added features touch on everything from security and fraud protections to account updates and broadened payments acceptance to smaller players using PayPal’s all-in-one checkout integrations.

According to Prabhu, among the most pressing issues right now: “What we’ve seen with smaller merchants is that they have cash flow problems.”

The balancing act can be tough, as sales garnered on a given day might be used to buy inventory for the next week’s sales (restaurants and coffee shops are prime examples here).

As part of the Tuesday announcement, Prabhu explained that SMBs would continue to have access to automatic transfer, which sends payments from a seller’s PayPal account to their bank account.

But now, they can choose between flat rate pricing on card transactions or Interchange ++ (IC++), which has previously only been available to PayPal’s enterprise-level clients.

In that pricing model, SMBs receive the full amount from an eligible card payment at the transaction time without the card processing and interchange fees subtracted.

PayPal invoices those cumulative fees monthly and auto-debits them from the SMB’s bank account.

According to Prabhu, the net impact is that merchants have better cash flow visibility on hand without having to tap into working capital and better insight into their processing costs.

As Prabhu told Webster, “merchants now get the total amount of the sale, available right away … so they can pay their rent, their bills and their suppliers, and then they ‘settle up’ at the end of the month what they owe in interchange.”

PayPal said Tuesday the processing fees stand at 2.59%+49 cents for card payments, alternative payments and digital wallets.

“What we started seeing is that smaller merchants that are now on the cusp of becoming medium sized merchants were requesting this,” said Prabhu. “And merchants want to see the cost transparency to promote one payment method over another.”

Cash flow gets a boost when merchants offer consumers’ preferred payment options at the checkout. Prabhu noted that nearly two-thirds of consumers abandon shopping carts when preferred payment methods are unavailable.

Beginning Tuesday, PayPal’s SMB will also be able to accept payments with Apple Pay — which Prabhu said had been in increasing demand from merchants and consumers alike.

Beginning Tuesday, PayPal’s SMB will also be able to accept payments with Apple Pay — which Prabhu said had been in increasing demand from merchants and consumers alike.

“We’re going to support other APMs as well, when demand comes up,” remarked Prabhu, who added that “we’re a [payments] agnostic platform.”

The newly expanded tools also let customers save their payment methods with the PayPal vault and keep their cards up to date and protected with real-time account updates (especially useful in subscriptions and recurring revenue models) and tokenization. Fraud protection is one of the most important levers an SMB can use to improve its profitability and improve the SMB’s overall business health. PayPal’s payments solution, the company said on Tuesday, will continue to offer fraud, chargeback and seller protection on transactions.

Prabhu stated that the vaulting function reduces friction in online transactions — as consumers will not have to re-enter their details. Vaulting, he said, cuts down on the latency that comes with adding new cards and checking out — shaving time off the process. PYMNTS’ own data shows that customers want to keep their payments credentials stored online, and nearly half of them trust PayPal as their vault provider.

“We want to make the commerce experience as seamless as possible, especially for returning customers,” he said.

Looking ahead, he said PayPal would be examining ways to expand its SMB cross-border offerings, where the company already enables smaller firms to buy and settle more than two dozen currencies. “We’ll want to expand that service outside of the U.S. to other markets as well,” he said.

In the near term, he told Webster that with the new SMBs tools easing and speeding customer checkout, “we will be expanding this very aggressively. We see a lot of demand ahead.”