An account-to-account (A2A) payment, as the name suggests, allows a person or business to send money directly from one account to another in a quick, safe and affordable way.

A2A payments, also known as pay-by-bank, can be separated into two distinct types: push payments, which allow payees to send money when pushing a button through online banking; and pull payments, which occur when a company or organization automatically withdraws (or pulls) money from a consumer’s bank account. Push payments usually consist of one-off sums to another bank account, whereas pull payments often take the form of subscriptions or recurring automated payments for goods and services.

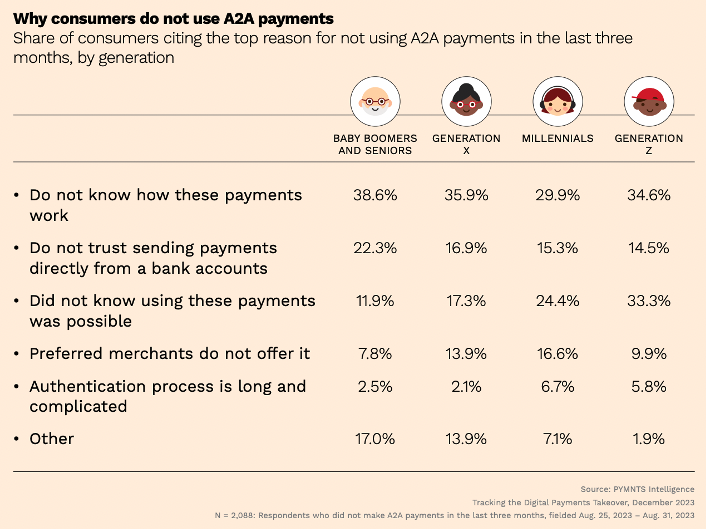

The use of this payment method is more widespread among older generations, like Generation X or baby boomers and seniors. The study “Tracking the Digital Payments Takeover: Consumer Familiarity Controls Account-to-Account Payment Growth,” a PYMNTS Intelligence and Amazon Web Services (AWS) collaboration, revealed that the primary barrier to wider adoption of A2A payments among younger consumers is not technology or availability, but rather a lack of knowledge and awareness.

This is one of the key conclusions drawn from the study, which examined the appeal of A2A payments and explored the incentives or discounts that could sway consumers to use A2A payments in specific scenarios, such as when making purchases, settling accounts or paying bills.

The study investigated why consumers do not use A2A payments, and nearly 35% of Generation Z consumers who do not use A2A payments said the top reason was that they don’t know how these payments work, and 33% said the primary reason was that they did not know using these payments was possible. Despite Gen Z’s reputation for being on the cutting edge of technologies, the percentage of Gen Z consumers who were specifically unaware of this method is nearly three times the corresponding share of baby boomers and seniors (12%) — and it is nearly double the share of Gen Xers (17%).

One potential reason for the limited knowledge of pay-by-bank as a payment method, particularly in eCommerce, could be that many consumers have not come across A2A as an option at checkout. For the method to take off in the way that buy now, pay later has, A2A payments may need to gain momentum in that way.

The lack of awareness highlights the necessity for more extensive campaigns run by merchants to educate customers, especially younger consumers. Once that is achieved, the next step may be addressing perceived security concerns. Approximately 15% of millennials and Gen Zers expressed security reservations as a reason for not using A2A payments, indicating another need for more thorough communication about the strong security measures that many A2A platforms currently use.