Go figure: One of the most digitally connected demographics also prefers in-store retail purchases.

Per PYMNTS’ “ConnectedEconomy™ Report: Meet the Zillennials,” this bridge generation is, on average, over twice as digitally connected as baby boomers and 36% more than Gen X.

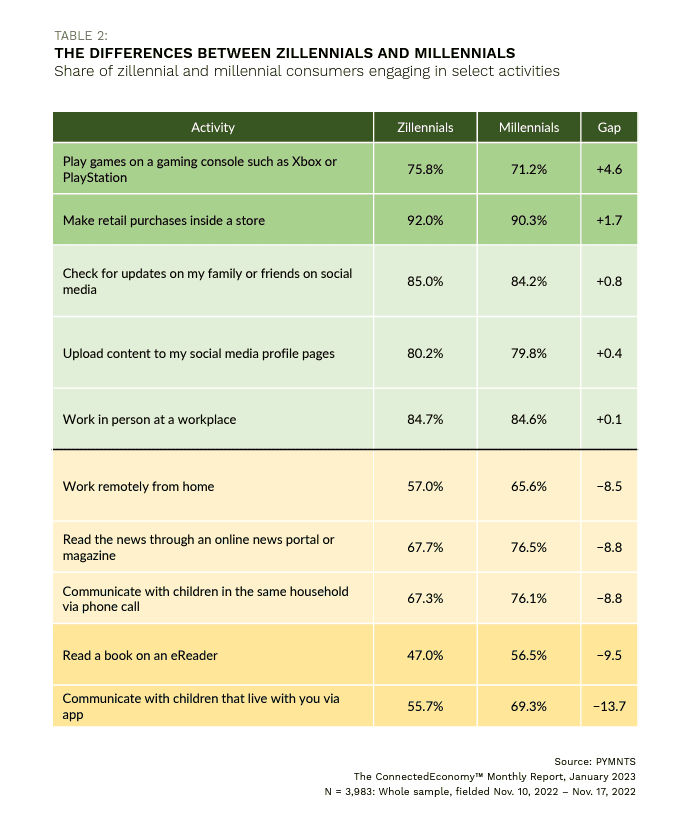

Which is why it may be surprising that when it comes to overall retail, zillennials prefer in-store purchases more than their millennial counterparts.

This behavioral crossroads between online and in-person shopping presents a particular opportunity for retailers trying to win zillennials’ loyalty. One approach may be offering more eCommerce-like payment options at the in-store point of sale (POS), appealing to both aspects of their habits.

Many retailers may already be clued into this consumer demand, as 65% of U.S. merchants surveyed say they believe customers would be very or extremely likely to switch merchants if alternative in-store payment options were not offered. And although digital wallets are quickly gaining mainstream adoption, other purchasing options may also appeal to zillennials.

One alternative payment option that is increasingly popular with the younger generations and shoppers overall is buy now, pay later (BNPL). PYMNTS research has found that although younger customers are the most likely demographic to utilize BNPL, 46% of surveyed department store shoppers overall are highly interested, and 52% of non-BNPL users are curious about using the plan for luxury purchases. And, per this month’s “Buy Now, Pay Later” tracker, 8% of shoppers this past Black Friday utilized BNPL for in-store purchases.

Janessa LaCombe, senior program manager for Sezzle, recently explained to PYMNTS the importance of bringing BNPL in-store. “Making sure that buy now, pay later is reflected in your omnichannel strategy as a merchant makes sure that your ecosystem is more meaningful, where the whole becomes greater than the sum of its parts. Adding [the BNPL] option increases engagement across all channels and gives a true omnichannel shopping experience.”

Real-time payments is another method gaining popularity with both consumers and merchants, as 32.5% of U.S. retailers plan to introduce the payment option in-store over the next three years. The near-instantaneous payment method is intended to make both the purchasing and return processes quicker for consumers while also increasing merchant liquidity. Real-time payments are designed to resemble the eCommerce experience more closely than traditional in-store POS transactions.

Online bank transfers for in-store use are lagging behind the other available payment options merchants may offer to zillennials and other consumers. While the method is most popular for recurring online bill pay, 9.3% of consumers used it for online shopping in the 30 days prior to PYMNTS’ November 2022 study. Given that the above digital payment options are being adopted at varying rates for in-store use, online bank transfers may also become more popular for use in physical stores in the future.

Catering to zillennials’ retail habits with expanded payment options can be a win-win for shoppers and merchants alike, as both groups seek convenience and cost savings in their transactions.