My plan on Friday evening was to write a hard-hitting piece on a services segment with incredible marketplace friction. Then I went to Whole Foods on the North Shore of Boston Saturday morning to do some grocery shopping.

There, right inside the front door, was a nice, young Whole Foods team member, who let me know that the store would soon be offering special discounts to Amazon Prime members who shopped there. He then asked if I would like information about how to become an Amazon Prime member so that I could take advantage of those deals.

When I told him I was already a Prime member, he said, “awesome,” and handed me two pieces of paper.

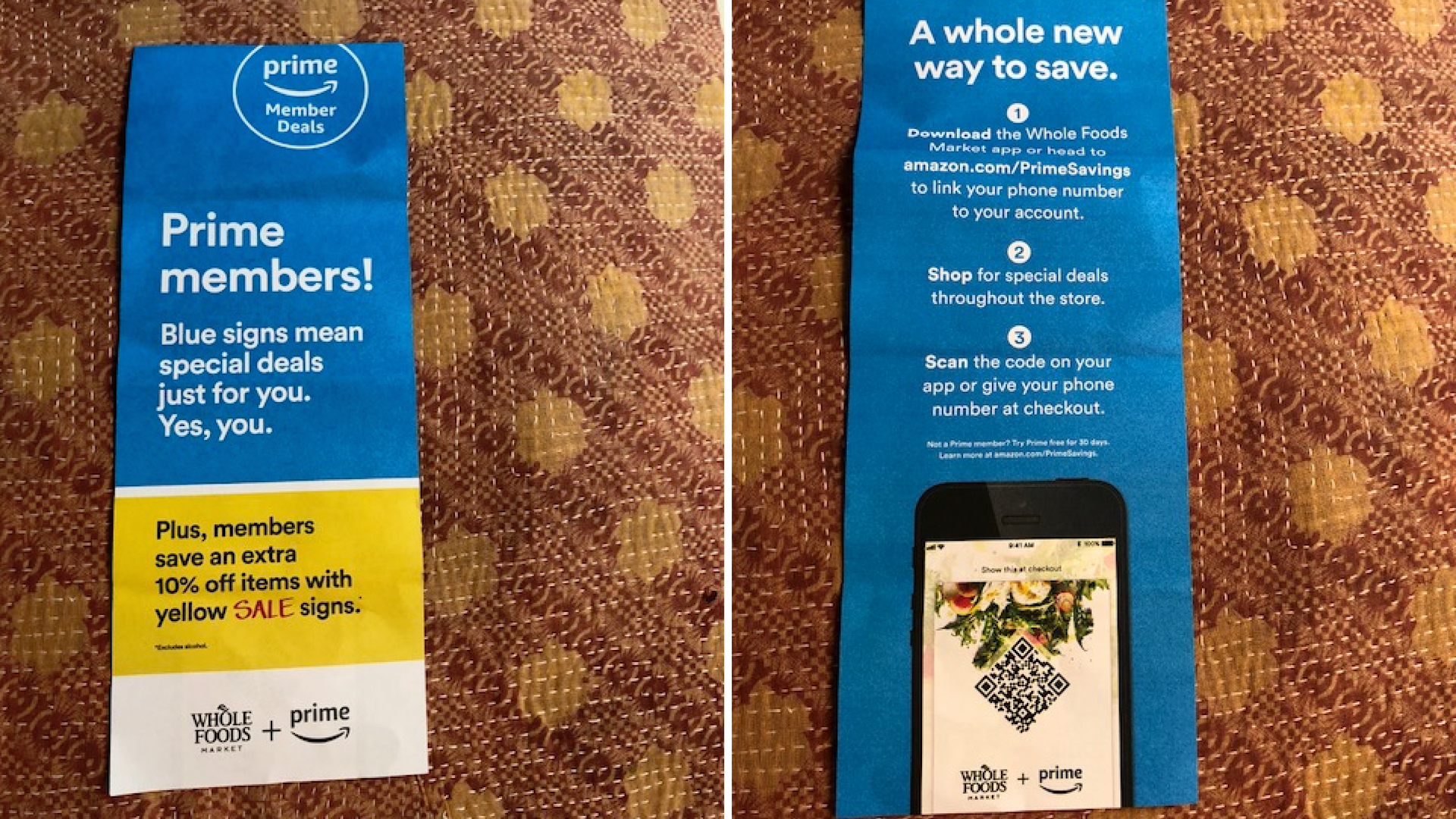

One had instructions for how to identify savings in the store, which he said would vary from week to week, and then how to link my existing Amazon Prime account to get those savings applied at checkout (which is automatic and done via QR code à la Walmart Pay).

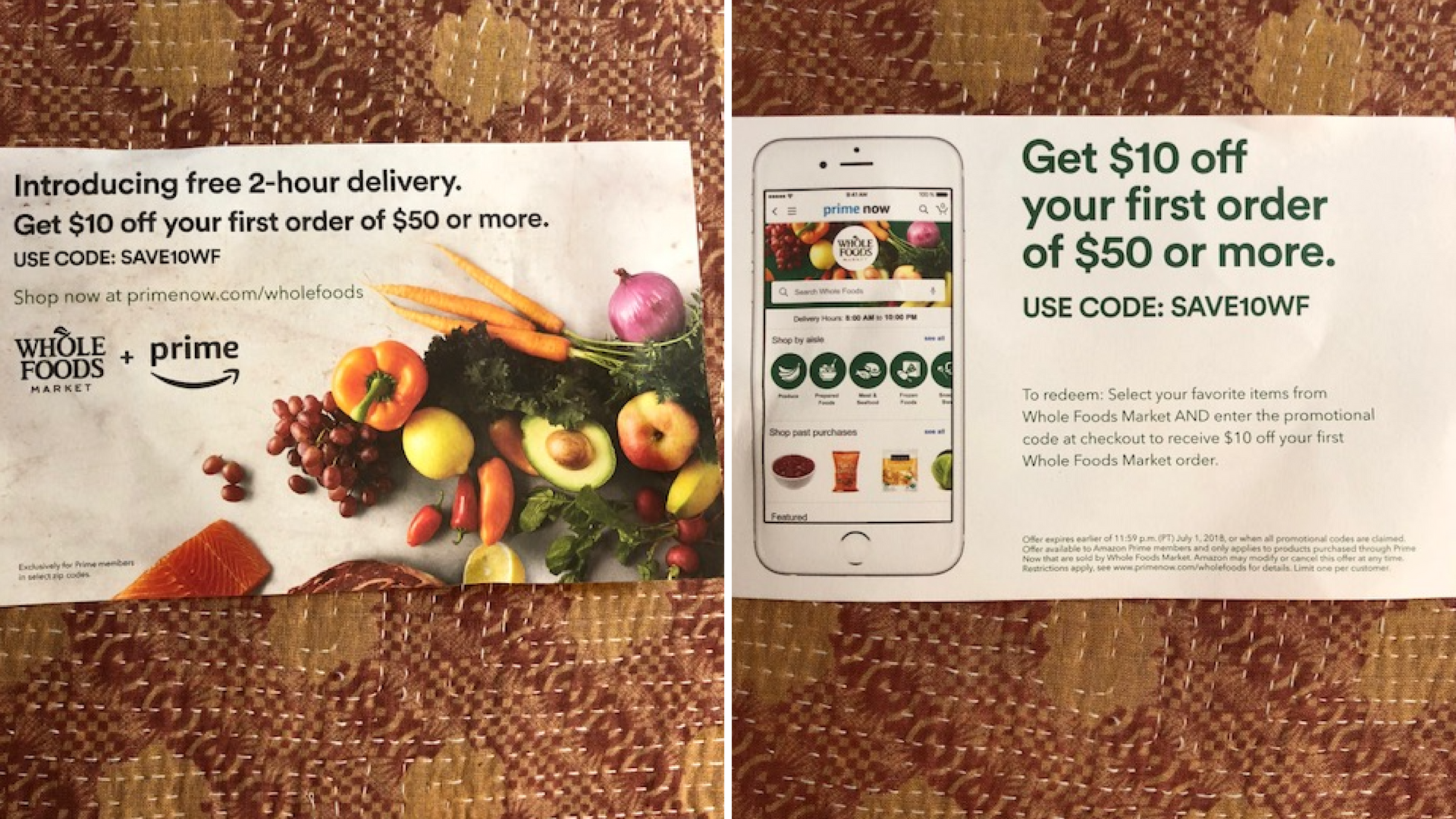

Another had an offer with a promo code to get $10 off my first online order, which would be delivered free to my front door in two hours or less once I linked my Prime account to Whole Foods.

PYMNTS has been tracking the impact of the Amazon/Whole Foods acquisition on the grocery store sector since the day it happened, including this latest Whole Foods plus Prime Member Deals program strategy.

I’ve been writing about the impact Amazon would have on the consumer’s grocery shopping journey and disruption to the grocery segment since Amazon introduced Dash buttons in March of 2015.

But there’s nothing like experiencing the onboarding experience live, firsthand — and just like any other consumer filing into the store on a Saturday morning to buy stuff for the weekend — to understand the impact.

It’s why I am now convinced that Amazon and Whole Foods — and the launch of these Prime Member Deals at Whole Foods — isn’t only about converting Whole Foods shoppers into Amazon Prime customers.

It’s about creating the flywheel for the physical store version of the Amazon marketplace.

Prime Time at the Grocery Store

I’ve been a Whole Foods shopper since I moved to Boston 17 years ago for the same reasons that each of you may be too: organic meat, seafood, produce and foods, great bread and cheese and a fun vibe. Grocery shopping is a chore any way you cut it, but there’s nothing like contemplating which eggplants look the best with Motown tunes playing in the background as inspiration, not to mention free sample munchies all over the place.

But beautiful produce, nibbles and cool playlists aside, over the course of those 17 years I’ve shopped at Whole Foods, I never downloaded their app.

The app offered little value and isn’t rated very highly in the App Store. More than anything, I didn’t need yet another useless app taking up space on my home screen.

What a difference a day makes, as the song goes.

Priming the Pump for Convenience

Since Saturday, the Whole Foods app has found a new place on my home screen, even though to get the Prime discounts, I didn’t have to download it. The Amazon Prime program at Whole Foods also works by linking a mobile number presented at checkout.

As one of the 90 million U.S. consumers who is already an Amazon Prime member, I know the value of a Prime membership, the convenience of the Amazon Pay checkout experience and the ability to get what I order on the same day, the next day or within two days when I order from Amazon.

As a long-time Whole Foods customer, I know, like and trust the Whole Foods brand and the quality of the products they carry in-store.

Asking me to link my (known value) Prime membership account to a store that I also already shop a lot (known value) didn’t seem much of a stretch. Particularly when that ask gives me new deals at a store I already shop and free two-hour delivery when an order is placed online on top of what I already get.

Along with the promise of much more.

I expect that once the program swings into full gear, the products I buy regularly in the store — and order online — will be used to build my in-app shopping list, with specials and deals noted as a way to drive preference or even introduce me to new brands.

Those items may even be linked to new recipes that I might like to try with the ingredients needed to make them added to the list. Amazon has done deals with recipe aggregators Yummly and Allrecipes, so that’s not that much of a stretch.

On top of Prime Deals, brands will be able to offer me deals to select their brands over others with special coupons and offers too, just like they do today online at Amazon Pantry.

Maybe I will even get to learn more about some the local, third-party suppliers that have their food in the store to further establish my affinity and brand preference for a store that supports local producers.

I’m sure I’ll be able to ask Alexa to add things to my list, including having her place an order to Whole Foods and have it delivered, free, two hours later — so I don’t even have to go to Whole Foods to shop when it’s raining or snowing or when I don’t have time to make a trip. I’ll be OK doing that too, since I know enough about the quality of the products to trust that they will pick out good stuff and send it home.

That is, items from the list minus the ones that I buy often enough — olive oil, spices, condiments, paper towels — that Whole Foods will prompt me to set up on auto-refill – a product-by-product subscription service with products sent to me at the appropriate frequency. There will be no need to add those items to the list for me to remember to pick up at the store; Whole Foods and Amazon will do the remembering for me and make sure that when I purchase them, I am buying them from Whole Foods.

If Whole Foods could only send a cook home to prepare it all…

I am only half kidding.

Amazon Pro Services is a marketplace of local home services providers, so let’s see how long it takes to find chef services emerging to take the notion of meal kits and prepared foods to a new level.

All tied to Prime membership and Amazon Pay.

Until then, there’s Whole Foods and the massive amount of floor space it’s now giving to prepared foods and meal kits — and free two-hour delivery — to tide me and the rest of Whole Foods plus Prime shoppers over.

Priming the Pump for Whole Foods Shoppers

I’m one of the 60 percent of Whole Foods shoppers who are also Prime members, so that nice young man at the store entrance didn’t score a new Prime member for Amazon.

His initial approach though — asking me to sign up for a Prime membership — is proof that the Whole Foods plus Prime program is as much about turning the small percentage of existing Whole Foods shoppers into Prime customers as it is to shifting more grocery spend of the Amazon Prime/Whole Foods customer to their channels.

Prime member-only deals and free two-hour delivery, with $10 off the first order of $50 or more, is the opening salvo and an important appeal to a Whole Foods customer who may allocate only a small amount of grocery spend to that store.

Before the Amazon acquisition, Whole Foods as the “Whole Paycheck” grocery store option was a label it earned the old-fashioned way — because they deserved it.

As all organic, all the time, Whole Foods was among the most expensive grocery stores to shop, with SKUs that didn’t include many of the brands that many grocery shoppers liked to buy. That forced shoppers to divide their spend and their time among several stores, adding to the friction of an otherwise friction-filled and time-consuming grocery shopping experience.

In response, grocery shoppers also began shifting spend online to buy things easily purchased that way too: bulky items like paper towels and cleaning supplies and other staples. And their spend to other stores that offered consumers all options — organic foods, name brands and their own private label brands — at cheaper prices.

The PYMNTS Omnicommerce study of 4,000 consumers quarterly on grocery shopping bore that out, reporting that 55 percent of all grocery store shoppers divide their grocery spend between physical and digital channels, and that product and price were the reasons people selected the stores they shopped.

Of the 41 percent of consumers who we reported still concentrate their grocery spend predominantly online, more than a third of those physical shoppers (37 percent of the 41 percent) visit multiple stores in search of “deals” and products not found at their main “go-to” store — and two-thirds of millennials do.

Whole Foods, therefore, needed more than great-looking eggplants, free samples and inspiring playlists to bring people into its stores and allocate a chunk of their grocery store spend shopping there.

It’s something the Amazon acquisition of Whole Foods has helped to deliver.

Since the acquisition, Whole Foods has adjusted its prices, while expanding its selection of prepared foods to get more feet into its stores and more shoppers buying. Installing Amazon Lockers at Whole Foods, it’s said, has helped to steer more feet in its direction too.

Analysts report that Whole Foods sales have risen 34 percent month over month since the acquisition, and the number of new customers has increased 27 percent over that same period.

Sales per customer in the physical store are down 1 percent — the result of discounting prices to get shoppers in the store.

At the same time, sales of Whole Foods’ private label 365 brand are growing online.

Studies report that Whole Foods’ private label 365 brand is now the No. 2 private label brand sold by Amazon, a business that analysts project to soon equal the entirety of Macy’s revenue, at $25 billion in annual private label sales by the end of 2022.

Whole Foods, Whole Paycheck, may take on an entirely new meaning now.

Priming the Amazon Prime Pump

I am also a shopper who didn’t take advantage of Whole Foods’ loyalty program when it had one, even though I shopped at Whole Foods and grocery store loyalty programs are mainstay customer acquisition and retention tools. It’s not clear how many other Whole Foods shoppers did either, and it wasn’t always clear as a shopper how meaningful the rewards were and whether signing up was worth the effort.

This ask, this time, is different.

The guy at the front door wasn’t asking me to opt into a Whole Foods loyalty app but a bundle of benefits offered by Amazon Prime — that also happened to include free two-hour delivery on groceries and deals on products sold at Whole Foods.

Those deals are part of something much bigger and much broader than Whole Foods, including access to a library of streaming content that now rivals Netflix for the quality of its original programming, as well as free delivery on items purchased on Amazon.

Putting pen to paper, it’s like getting the entire $119 Amazon Prime membership for free, if someone orders more than one grocery delivery a month and wants it delivered in two hours or less. The Whole Foods sign-up inducement of $10 off a grocery purchase of $50 or more brings the annual fee to $109, or $9.00 a month.

It’s why I think that Whole Foods plus Prime is just the first in a series of online/physical store mashups that will use Prime as a lever to get consumers to download a store app and/or link their Prime membership to that store to get special deals and two-hour delivery of products.

In a world where consumers now download zero apps, local stores plus Prime could help those merchants get more out of their branded apps and rewards and loyalty programs than other third parties and certainly their own efforts could deliver.

Even the positioning — Prime and Prime Member Deals — is a subtle signal that Amazon would like, at least in this case, for the positioning of the program to be wrapped around Prime, not Amazon. The only reference that the program logo has to Amazon is the Amazon arrow that, in this case, goes from the “P” in Prime to the e at the end.

Priming the Local Marketplace

I am also a shopper, like most, who doesn’t opt into store loyalty programs. There are notable exceptions, of course, but the value of most merchant-branded rewards programs are too small to be meaningful.

Consumers know that too: Accruing points with a merchant yields little redeemable value, which is why most don’t opt in and even fewer download the apps to get them. As part of our consumer Omnicommerce study, we asked 4,000 consumers each quarter who shopped merchants to tell us the value of merchant store loyalty and rewards points to them, and their choice of merchant.

Both placed near the bottom of the list.

For the Bridge Millennials — those aged 30 to 40 years old who are the first generation of connected consumer with spending power — they barely register.

Amazon, with Prime, could turn that around, just like it did when it launched Amazon Sellers online.

It’s plausible that Amazon could use Whole Foods, along with the quick-service restaurants (QSRs) who already opted into Pay Places and Restaurant to expand that program to the local retailers who’d like nothing more than to align themselves, their brand and the spending power of the Prime customer with their brand.

The ask is the same: Ask customers walking into the store to become a Prime member to get deals, or link their Prime account to the store app or store point of sale to get access to Prime member-only deals. Local merchants could ditch spend on third-party apps and loyalty programs that require a huge spend on customer acquisition to get a small number of consumers to convert with whom they could now have a relationship. At the same time, they benefit from the spending power of an Amazon Prime member, who outspends non-Prime members by nearly two to one ($1,300 for Prime annually versus $700 for non-Prime).

Amazon Prime can be an onramp to a local community of sellers who need foot traffic to their stores to compete, ironically, with Amazon. For Amazon, it’s a way to add more value to Prime, capture more consumer spend and align with, rather than compete with, smaller retailers who are the fabric of their local communities.

Trust in Amazon Prime and the known value it adds, plus trust in the local merchant the shopper knows and shops, starts to grease the local marketplace flywheel — and redefines the blurring of the online and offline worlds to now include a local retail segment that gets the benefit of a digital customer base with money to spend and an incentive to shop local more often too.

Amazon and its potential to assemble a marketplace of QSRs and local restaurants wrapped around Amazon Pay is a topic I addressed last week and suggested was possible given Amazon’s ability to assemble a critical mass of local suppliers, coupled with the logistics expertise to deliver the last mile to the consumer. Logistics is the hardest piece of the puzzle for those merchants. Why not extend the concept of the local marketplace to include non-food retailers too?

Prime for a Payments Switch

I am also one of the Prime members who renewed my Prime membership even though it was $20 more than last year. The studies that suggested 59 percent of consumers wouldn’t renew must have it wrong. Prime members are affluent and spend a lot of money on Amazon. Twenty dollars isn’t material relative to the value they get.

If there were that much churn, Amazon wouldn’t have raised the price and wouldn’t have kept doing it.

But what both Amazon and Whole Foods probably do know is that they’ll win on the same three fronts my own behavior proved out on Saturday.

They will score new Whole Foods app downloads for Prime members and hook them into using Amazon Pay to checkout when they shop — at the expense of cards and other digital wallets.

They will probably manage to snag more of their grocery spend than they already have since it will just get easier and easier to shop with Whole Foods, which could increasingly mean not even stepping foot into the store.

And, in my case at least, they could even get some consumers to switch from the payment methods they use in the store to those linked to their Amazon Pay account.

When Amazon Pay becomes available at the Whole Foods I shop, it will be bye-bye Bank of America debit card — the way I have paid for my groceries at Whole Foods for the last 17 years — and hello Amazon/Chase Prime Rewards card, the card registered to my Amazon Pay account.

Without thinking about it at all — not even for a nanosecond.

Grocery stores may not be the only ones feeling the impact of the Amazon Prime plus Whole Foods proposition.