Imagine Google Pay as a super app, loaded with more insight. And, coming soon, smart banking to boot. To that end, Google said on Wednesday (Nov. 18) that it has launched its redesigned Google Pay in the United States on Android and iOS.

The revamp, according to the company, seeks to expand the payments and commerce ecosystem across a range of platforms, devices and payment types, giving consumers greater control over transactions, and setting the stage for “smart” checking and savings accounts (or “smart DDAs”).

Wednesday, then, marked the official next step of a strategy presaged by PYMNTS CEO Karen Webster in a 2019 column, after Google confirmed that it would partner with Citi and Stanford Federal Credit Union to link those accounts in a “smart DDA.”

“Instead of trying to be the bank, Google is leveraging the brand name, banking infrastructure and reputation for trust and stability of two banks, one of which is among the world’s largest global financial institutions, to acquire new users for that product and for Google Pay,” wrote Webster.

Now it’s official. And in an interview with Webster in tandem with the launch, Google’s Caesar Sengupta, general manager of payments, and Josh Woodward, director of product management, said the open approach sets the stage for more simplified, mobile-first eCommerce and banking integrated deeply with Google Pay, which is available in 30 countries (soon to be 40) and has more than 150 million monthly active users.

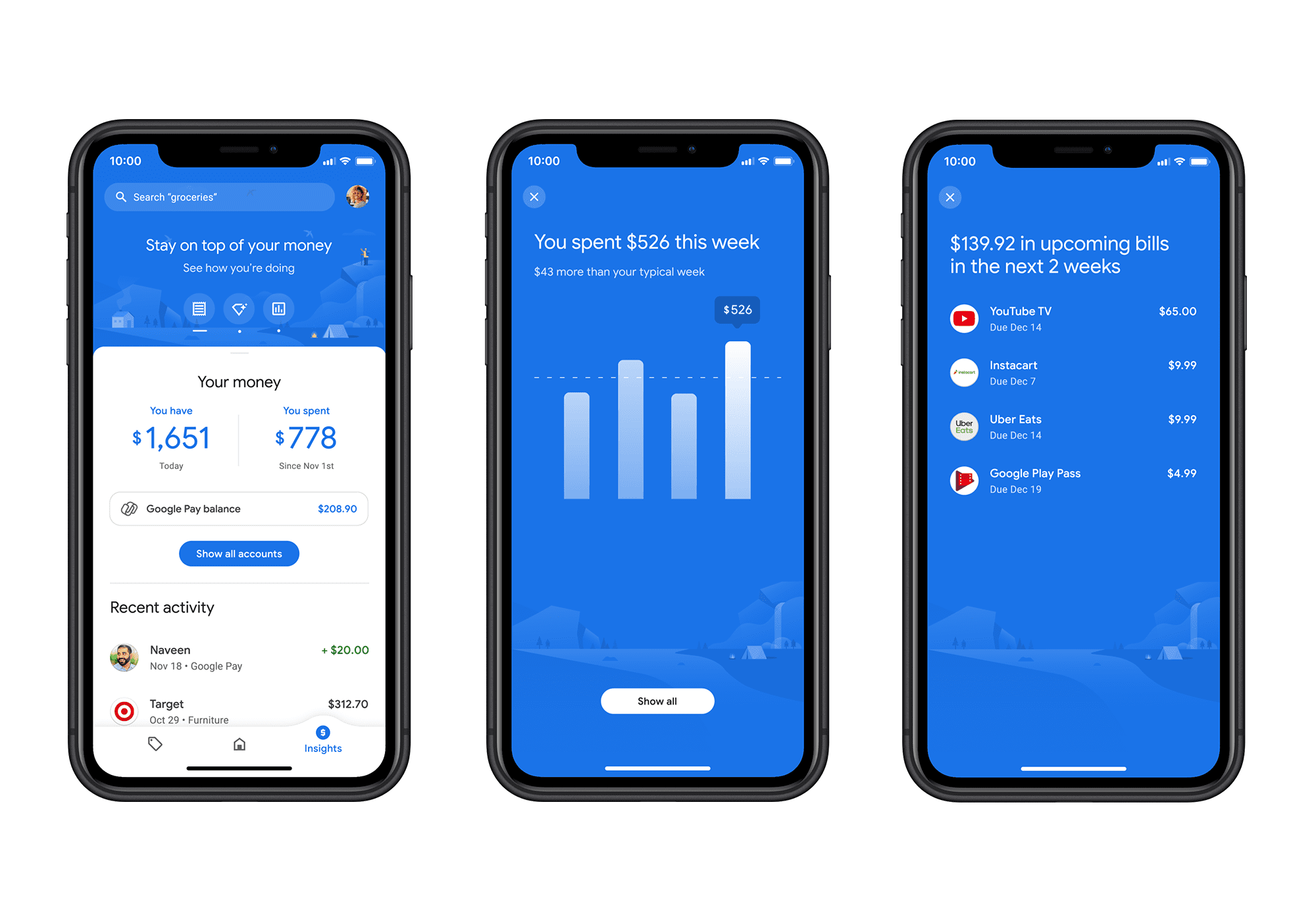

“What we’re trying to do with the new Google Pay is bring three things together in one app,” Woodward told Webster. “The first thing is paying friends and businesses. How do we make that really simple, really secure and really fast? The second thing is helping you explore offers and rewards so you can save money. And the third thing is: How can you get insights on your spending so you can stay on top of your money?”

At a high level, Google has said the new app focuses on the most frequent transactions and organizes those around tabs and “conversations” that take into account the individuals and businesses paid most often. The grouping functions, said Woodward, aid visibility, streamline transactions and track a trail of payments – much in the way that a string of emails shows the progression of communication between parties, but here with debits and credits (and even refunds) presented in a thread.

In terms of expanding its ecosystem, the firm said consumers can use Google Pay to order (and, of course, pay) at more than 100,000 restaurants, fuel up at 30,000 gas stations and pay for parking in more than 400 cities.

The revamped Google Pay also allows users to redeem offers (through an Explore tab) in-app or via tap. The discounts and promotions will be automatically applied whether the transaction occurs in-store or online (the offers come directly from merchants or through aggregators).

“We’ve worked with our Google Lens team and we’ve actually integrated some of their camera technology,” said Woodward. “So you can scan product barcodes or QR codes straight from Google Pay.” Linking cards to Google Pay will also enable users to earn cash back accrued to the Google Pay balance, he said. That functionality could also let users search for and buy items across the Google ecosystem.

Users who link bank accounts to Google Pay will get in-app spending summaries via an Insights tab. Here, they can track spending habits and trends over time, and can search and group transactions over categories, receipts or merchants.

Privacy Concerns

“We know that when it comes to money, security and privacy are absolutely critical. And you’ll see us take a very strong privacy-forward design approach,” Sengupta noted.

Google Pay will not sell data to third parties or share transaction history with the rest of Google for ad targeting, he said. The personalization setting, which fine-tunes the offers presented to users, is turned off by default, but users can turn it on and try it for three months. After that, they can decide whether they want to keep the setting on or not.

“You can almost think of it as ‘snooze’ for three months,” noted Woodward. “And then three months later, we’ll prompt you for a decision.”

The redesign also lets users set controls, and alerts individuals when they might be paying a stranger. Tap-to-pay transactions are tokenized.

New Wave of Banking: Smart DDA

Woodward said Google is working with traditional financial institutions (FIs) to create Plex, billed as a mobile-first bank account that is integrated into Pay. Beginning next year, the accounts – spanning checking and savings – will be offered by 11 banks and credit unions. Google said that starting on Wednesday (Nov. 18), the company will open a waitlist for users to apply for the Plex account with Citi or SFCU.

Sengupta noted that the app offers the UX and the entry point for those accounts, as well as the integration with the banks. Financial services “becomes a lot more powerful, because now your banking experience is mobile-first and completely connected to Plex accounts” with no fees, overdraft or minimum balance requirements, Woodward told Webster.

Looking ahead, he said, the redesign should help consumers with what has been a fragmented process of navigating spending, rewards and money management.