Credit Unions Turn to Tech, Education to Blunt Real-Time Payment Fraud

Real-time payments are quickly becoming table stakes in the high-speed digital world.

Real-time payments are quickly becoming table stakes in the high-speed digital world.

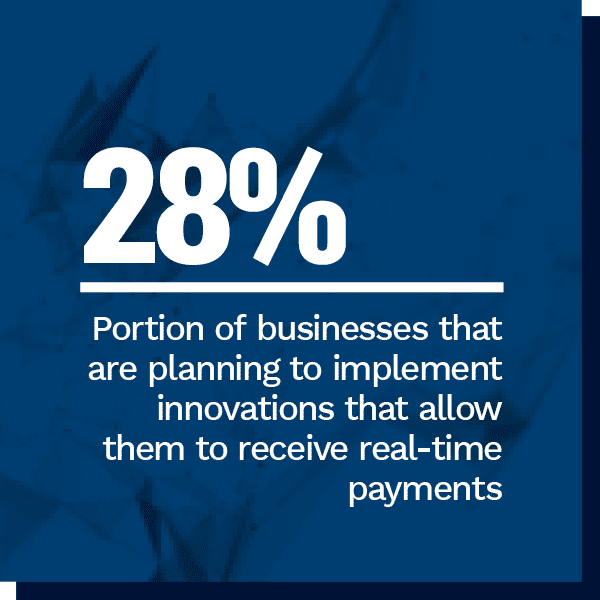

A survey found that the availability of real-time payments was a deciding factor for businesses when looking for a banking partner, for example, and four-fifths of companies said real-time payments have the power to fundamentally reshape how they conduct daily business. Almost one-third of customers said access to such payments is a significant consideration when picking a financial institution (FI).

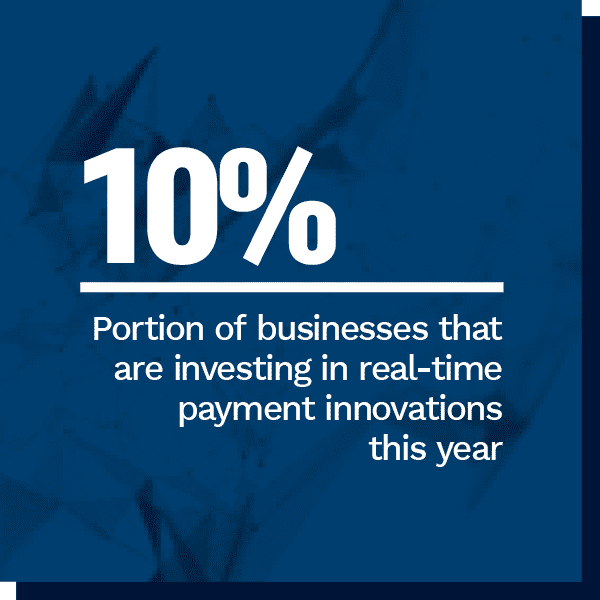

There are still obstacles and variable adoption rates preventing real-time payments from reaching an even lar ger audience, however. Real-time payments implementation has also been particularly lackluster among credit unions (CUs) in recent years, with just 10% of CUs developing such services this year, compared to 76% that said the same in 2019. FIs of all types will need to step up their game to remain competitive in the modern digital-first financial environment.

ger audience, however. Real-time payments implementation has also been particularly lackluster among credit unions (CUs) in recent years, with just 10% of CUs developing such services this year, compared to 76% that said the same in 2019. FIs of all types will need to step up their game to remain competitive in the modern digital-first financial environment.

In the August Real-Time Payments Tracker®, PYMNTS explores the latest in the world of real-time payments, including its growing popularity in the financial world, the fraud challenges that make some FIs hesitant to jump on board and consumers’ growing expectations for these payments in their day-to-day lives.

Developments From Around the World of Real-Time Payments

Speed is the name of the game for consumers and businesses when transacting, especially as the number of global payments picks up. More than 70 billion transactions were processed internationally in 2020, marking a 41% increase over 2019 levels. Even more compelling is that real-time payments are set to represent more than 17% of these global transactions by 2025. This illustrates that FIs cannot afford to overlook real-time payments as the world grows more digital.

Real-time payments are also making more headway in markets where cash has typically reigned supreme. A survey of 6,000 consumers in Indonesia, Malaysia, Singapore and Thailand found that 61% expressed a preference for real-time digital payments, with the same share citing cash as a valued option. Thailand and Singapore were the biggest real-time digital payments adopters, as 72% and 64% of respondents from these nations favored it, respectively.

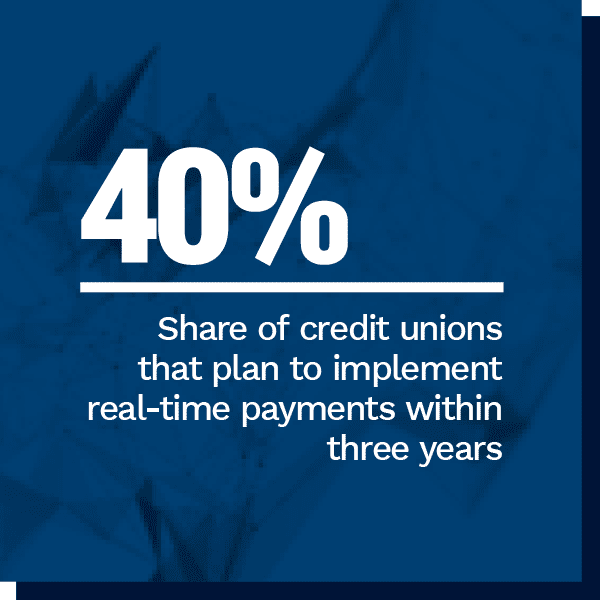

New research offers yet another testament to real-time payments’ appeal in the United States. A survey found that 15% of the nation’s mid-tier banks and CUs have already joined The Clearing House’s Real-Time Payments (RTP) network, and that this share is expected to triple by 2022. The study noted this rapid expansion underscores FIs’ need for technologies and solutions to help them support greater volumes of real-time transactions.

For more on these and other real-time payments news items, download this month’s Tracker.

How Veridian Credit Union Meets the Challenges of Real-Time Payments Implementation

Customers have grown used to lightning-fast digital interactions, and banking is no exception, with countless FIs developing real-time payment services to meet this demand. But its implementation comes with a number of challenges.

In this month’s Feature Story, PYMNTS talked with Brett Engstrom, chief information officer of Iowa-based Veridian Credit Union, about how the CU handled potential fraud risks in real-time payments through rigorous employee and member education.

Deep Dive: Why Embracing Real-Time Payments Is Critical for FIs’ Continued Growth

Deep Dive: Why Embracing Real-Time Payments Is Critical for FIs’ Continued Growth

Real-time payments are becoming a game-changer for FIs of all types as consumers and businesses seek fast, seamless ways to transact both domestically and abroad. But the adoption of real-time rails lags notably in certain FI segments, particularly CUs.

In this month’s Deep Dive, PYMNTS takes an in-depth look at why real-time payments adoption is so variable among FIs as well as how offering these payments is growing more crucial to helping them compete with FinTechs.

About the Tracker

The Real-Time Payments Tracker®, done in collaboration with The Clearing House, is your go-to monthly resource for updates on trends and changes in real-time payments.