Money Mobility: FinTechs Turn Paper Checks Into Digital Money-In Capabilities to Attract New Customers

Today’s consumer needs more than mere convenience. They want money mobility — the option to receive any type of disbursement and transform it seamlessly into an outgoing payment or transfer it easily into any account. Seamless “any-to-any” payments and disbursements options are at the heart of money mobility networks — an ecosystem of financial institutions (FIs), FinTechs or other technology solutions providers that make interconnectivity frictionless and secure between accounts, payment methods and third-party payments platforms.

The “Money Mobility Playbook: Navigating The Challenges Of Money-In Mobility,” a collaboration with Ingo Money, looks at the barriers to creating secure and compliant disbursements experiences for consumers and presents a blueprint for FIs to remove friction from disbursements while ensuring that data and transaction processes remain secure at scale.

• Consumers’ priorities drive their choices of payments and disbursements

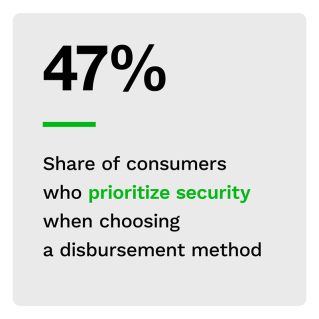

According to recent PYMNTS data, consumers care deeply about the quality of their user experiences. Nearly half of consumers said security was their highest priority when choosing a disbursement method, 36% prioritized speed and 39% prioritized ease of use. Money mobility networks provide security, speed and ease of use through a single solution, allowing consumers frictionless, rapid payments that work across any device and any type of disbursement. Not surprisingly, consumers are adopting these payments at an increasing pace.

• The share of insurance and lending disbursements using instant payments has been on the rise since 2018

Instant payments are another popular feature of money mobility networks. More consumers are choosing to receive their paychecks via instant disbursements, with 23% choosing this method in 2021, up from 9% in 2020. They are also shifting to instant for lending, insurance and investment disbursements. The share of insurance and lending disbursements using instant payments has increased more than 10 times since 2018, reaching 23% in 2021, along with increases in rapid investment disbursements (rising from 3% in 2018 to 17%). With innovation comes new risks, and many challenger banks and FinTechs are facing a new reality as they offer these new features.

• Neobanks and FinTechs face significant security challenges

According to the report, FinTechs and neobanks have led innovation efforts while bearing the brunt of new risk categories. Emergent neobanks and FinTech platforms may offer consumers new disbursements innovations before incumbent FIs, but they may find the fight against fraud attacks daunting at scale, especially from bad actors that leverage advanced technologies to take advantage of new consumer-facing disbursement features.

The problem is pervasive. Recent PYMNTS data shows that 85% of FIs reported fraud attempts during their account-opening processes, and 54% of peer-to-peer (P2P) platforms have dealt with false identities created through their authentication systems.

FinTechs must walk a fine line when developing onboarding processes. Efficiency must not compromise security, although account security requirements are constantly changing. Consumers expect account openings and funding to be consistently frictionless, even with sources that pose higher fraud risks for FinTechs.

Money mobility networks make seamless disbursements possible, even for FIs using legacy payments systems or FinTechs facing the challenge of frictionless disbursements at scale.

To discover how FinTechs and FIs can leverage a money mobility network to support secure friction-free disbursements, download the report.