Charles Babbage is considered “the father of the computer.” But it was Lord Byron’s daughter, the mathematician Ada Lovelace, who wrote the first algorithm that made computing machines more than just fancy calculators.

Sir Edmund Hillary is the first person to have reached the top of Mt. Everest, and was knighted for that achievement. But it was his Sherpa, Tenzing Norgay, who carried the equipment, prepared the route and took the risks to make sure that Hillary reached the summit alive.

Winston Churchill said that Alan Turing’s ability to crack the Enigma code during World War II enabled the Allied Forces to win the war — and years sooner than it might have happened. But the significance of Turing’s role was kept secret until the 1970s, two-plus decades after his suicide following his arrest, conviction and forced chemical castration in the U.K. for being a homosexual.

These unsung heroes remained largely out of sight and, therefore, out of mind for decades. More important, perhaps, than the innovations they made on behalf of their more famous lead players, was how their contributions accelerated those innovations’ time to market.

Innovation in payments and commerce has an unsung hero, too. But it’s not a person so much as it is a concept.

Distribution.

In an ecosystem in which success is defined by scale and time to market, it’s no longer good enough to have a great product, a well-known brand or a compelling technology. Success is now defined by the ability to reach a critical mass of users — consumers or businesses — efficiently and effectively … where time is an important currency, as is the ability to influence and/or control that end user experience.

It’s why I wrote at the start of 2018 that the year’s power brokers will be those who can use their scale, reach and momentum to drive innovation forward. And who will influence how innovation happens.

And it’s why, when I read last week that General Mills was rumored to have an interest in investing in and/or acquiring Boxed, I wondered whether the motivation might be distribution and controlling more of it.

Who’s to know whether they do have an interest – or whether, if they do, they’ll be successful at winning the bid? There are some other serious, motivated players courting Boxed, including Kroger, who’s said to be the frontrunner.

Regardless, it’s an interesting data point for why the country’s oldest (and one of the world’s largest) CPGs — with a market cap of $34 billion — might be willing to wager at least some part of its future on a five-year-old company with $100 million in sales that sells bulk food online.

From Betty Crocker to Boxed

Chances are you have a bunch of General Mills products in your pantry, and that you probably grew up eating many of them.

From its start as a flour mill in 1866, General Mills is now the brand behind Gold Medal Flour, Cheerios, Haagen Dazs, Nature Valley, Yoplait, Pillsbury, Progresso, Annie’s, Chex, Cascadian Farm, El Paso, Larabar and Jeno’s frozen pizza — to name but a few.

Its iconic brand personality, Betty Crocker, was created by General Mills’ PR department in 1921 as a way to sell flour by having “her” promote recipes that required it as an ingredient. In 1945, Betty Crocker was the second-most famous woman in the United States, behind Eleanor Roosevelt.

An amazing achievement for someone who wasn’t really a someone.

Speaking of someones who aren’t really someones: Alexa isn’t the first woman to read a recipe aloud to cooks from an electronic device and be regarded as a trusted “kitchen confidante.” That was Betty Crocker in 1924, when General Mills introduced Recipes by Radio. More recently, Alexa and Betty have become BFFs — there’s now an ASK Betty skill on Alexa.

The typical grocery store carries between 500 and 600 General Mills products. In a 2012 interview, then-CEO Ken Powell reported that one in four trips to the grocery store included the purchase of at least one of its products.

That was then.

Grocery shopping and eating habits have since changed. Consumers now opt for healthier food options and are shifting their spending accordingly. For instance, General Mills’ decades-long grip on the yogurt category, with Yoplait, has been loosened by “Greek” yogurt brands like Chobani, which boast less sugar and fewer calories. More recently, General Mills has introduced gluten-free varieties of its stalwart favorites, like Cheerios and Bisquick, and acquired organic brands like Larabar, Cascadian Farm and Annie’s.

At the same time, General Foods’ more recent “innovations,” like all-marshmallow Lucky Charms and Reese’s Cocoa Puffs, are selling like hotcakes. Go figure. Let’s hope, at least, they’re being eaten with organic 2 percent milk and some fruit.

But, I digress.

The grocery wars led by Amazon and Walmart have forced grocery prices way down. For brands like General Mills, that’s a good news/bad news story.

The grocery wars led by Amazon and Walmart have forced grocery prices way down. For brands like General Mills, that’s a good news/bad news story.

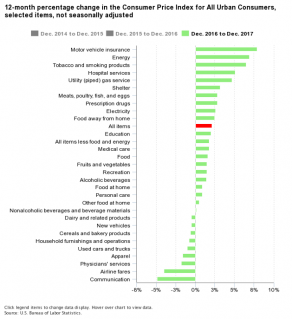

On the good news front, the cost of food eaten at home is well below the 2017 Consumer Price Index, and well below the cost of eating out. That’s a boon for consumers who see their grocery dollars buy more — and are buying more food to eat at home.

Or at their desks during their lunch hour.

In 2016, NPD reported that restaurants lost more than three billion dollars in sales from lunches that never were — reportedly the lowest dip in lunchtime sales in more than 40 years. Higher restaurant labor costs, which forced higher menu prices, were to blame.

But so were two other things.

Employees at work don’t want to spend the time it takes to go out to a restaurant to eat — say hello, mobile order ahead at QSRs. More workers are also working remotely, where lunchtime involves taking a trip to the fridge. It’s a cheaper and more efficient option for many employees, regardless of where they work, to cook more dinner the night before to take for lunch the next day — or to make lunch at home to eat at their desks while they work.

It’s a trend that, in a different time, might have made CPGs grin from ear to ear.

Last year, IRI reported that 36 percent of shoppers said eating healthier meant they spent more time and money on the items sold on the perimeter of grocery stores: produce, seafood, meats and bakery.

That leaves those center-of-store items, like soups, cereals, snacks and boxed staples (such as flour and mac and cheese) — General Mills’ sweet spot — as the discounted hooks to get shoppers into stores. Once there, shoppers are introduced to a variety of brands, including private-label store brands. For players like General Mills, competing for that center-store share is a margin-eroding experience. It’s also one that limits their opportunity to build a direct relationship with their end customer. Those decisions are the domain of the Krogers, Walmarts and Stop and Shops, who drive more than 25 percent of their business.

And now, Amazon.

The Amazon Effect on Center of the Store

Amazon’s public interest in grocery goes back to the launch of its Dash buttons in March of 2015.

Thought of then as an April Fool’s joke, these Wi-Fi-enabled plastic buttons have since evolved to become a convenient way to replenish more than 350 consumables across multiple grocery categories — now including third-party manufacturers that want to integrate the capability into their products. Later, the launch of Amazon Pantry leveraged Amazon’s brand and Prime reach to offer consumers the convenience of buying online the bulky items they once schlepped home from the grocery store.

Amazon’s 2017 acquisition of Whole Foods added 470 brick-and-mortar locations to Amazon’s ambitions of capturing more consumer grocery spend — and driving more private label sales through both its in-store and online channels. Selling Whole Foods’ 365 label on Amazon has reportedly added $11 million to its sales in the four months since the acquisition. Overall, Amazon’s 2017 private label sales are estimated at nearly $450 million — not too shabby, given that its private-label business started in 2009 with just a handful of items.

It was also a tacit admission that capturing more grocery spend required more than just relying on the natural evolution of the growth of online grocery sales. And it revealed their intention of doing that, over time, by using their scale, reach and pricing algorithms to favor their own store brands.

At the expense, of course, of the branded products offered by CPGs like General Mills.

The Battle for the (First) Basket

At $627 billion, the U.S. grocery business accounts for about 6 percent of the GDP and 6.4 percent of consumer annual spend. But for as much as we talk about grocery shopping moving online, 98 percent of those sales happen in the store.

At 2 percent of all sales, roughly $13 billion in 2017, the online grocery growth curve is only now starting to take shape.

Estimates for the growth of online grocery are all over the map, with some analysts estimating that online sales will more than triple (which would be 6 percent) less than five years from today. Both Nielsen and The Food Marketing Institute estimate that online grocery sales will hit 20 percent of all grocery sales by 2025.

Today, Amazon is said to control the biggest chunk of those online sales, at 18 percent; Walmart is second at 9 percent.

For General Mills, the shift to online, even if tiny, has been a boon for their sales.

CEO Jeffrey Harmening reported on its Q2 2018 earnings call that even though eCommerce is less than 2 percent of its sales, internet sales have jumped 82 percent so far this fiscal year. In two years, the company expects that share to more than double to 5 percent, driven almost entirely by online sales in the U.S. market.

The center-of-the-store items that grocery shoppers are paying less attention to in the store, they’re paying more attention to online.

General Mills likes that, for the obvious reason. Right now, regardless of where consumers shop online, they’re buying their brands using a channel that is increasingly convenient for them to access.

But it’s more than that.

General Mills is out to capture what they call the “first basket” — something my mom used to call the big weekly shopping. For her, that meant going to the store once a week to stock up on the “staples” needed to prepare meals for the household. Every week, Mom would buy more or less the same brands and the same quantities of those brands to replenish what she used the week before. She’d change it up only if there was a sale on the things she always bought — and then she’d buy more.

The items in her first basket were the brands that stayed in our pantry at home for a very long time.

That’s what General Mills says it sees happening today with sales coming through the online channels.

Shawn O’Grady, SVP of General Mills’ Global Revenue Management, said in an interview last summer that consumers who buy groceries online tend to be “full basket” shoppers, with an average spend of $150. That spend, he observed, is nearly four times the typical in-store shopper’s basket size.

General Mills’ strategy is to ensure that the consumer’s “first basket” has as many of their products in it as possible. If they are able to achieve that, they’ll see sales increase in a channel that is poised for rapid growth. They’ll also establish preference for their brands by making it easy and automatic for consumers to replenish those products. Online shopping just makes it easier for consumers to be reminded of what they last purchased — and to do it again.

Amazon and Walmart — the one-two punch of online grocery sales — represent important online channels for General Mills to capture that first, full-basket opportunity online. General Mills products offer important hooks to draw in a diverse group of grocery customers.

Moving forward, it’s not so sure. And if you are anticipating 10 years ahead, which any good CEO should, you might realize that you’d rather not put all of your eggs in the online baskets of those two retail giants.

Capturing the Center of the Store

Boxed was founded in 2013 by two 20-somethings with a million bucks and a vision to give urban consumers the same great bulk food deals found at suburban warehouse clubs. Without the membership fee, using mobile and with door-to-door delivery.

Warehouse clubs are a $200 billion business, highly concentrated among a few big brick-and-mortar players: Costco (the largest), BJ’s and Sam’s Club. Back in 2013, wholesale clubs were clubs, requiring an annual membership to shop there. In an interview last year, Co-Founder Chieh Huang said that what attracted him and his co-founder to the business — and the investors who’ve ponied up $160 million over the last five years — is the massive market opportunity that is less than 2 percent of all grocery sales online, only 2 percent of warehouse club sales online and 0 percent of those sales on mobile.

For Boxed, it was nothing but upside.

What has been dubbed the “Costco for millennials” sees 81 percent of its sales coming from consumers ages 25 to 44 who buy 10 items each time they order. Those customers also include offices and schools who buy in bulk to stock snack rooms, vending machines and micro-markets.

Those center-of-the-store products are also General Mills’ sales engine.

Would the acquisition of Boxed cure all of what ails General Mills and all CPGs facing the shift in consumer grocery spend, as well as the intermediaries who now control access to that consumer and that spend? Of course, it seemed unlikely. But it does offer important insight into how CPGs are thinking about their future — and the growing importance of online distribution as a way to drive preference and future spend.

Not to mention, real-time data about how consumers make those decisions. What CPGs know today is whether consumers in grocery stores leave with their items in their baskets. What they don’t know is what influenced those decisions, and what might have tipped the scales in their favor. If General Mills asked Betty, she’d probably say $500 million — what some say it will take to buy Boxed — is a small price to pay to keep all of their options open and learn more about this new generation of grocery shopper.

Asking Alexa would probably yield a different answer.