Digital platforms facilitate everything from online shopping to ridesharing to booking a hotel. These platforms promise fast, seamless transactions, which most deliver – but when platforms focus on reducing friction for users, it can backfire and create new vulnerabilities to fraud.

An unexpected consequence of the retailer race to offer same-day and one-day delivery is increased fraud exposure. The pressure to ship faster means some traditional fraud detection checks, like manual review, have fallen by the wayside. This is a much bigger issue for digital platforms than brick-and-mortar businesses, since fraud liability lies with the seller in “card-not-present” transactions.

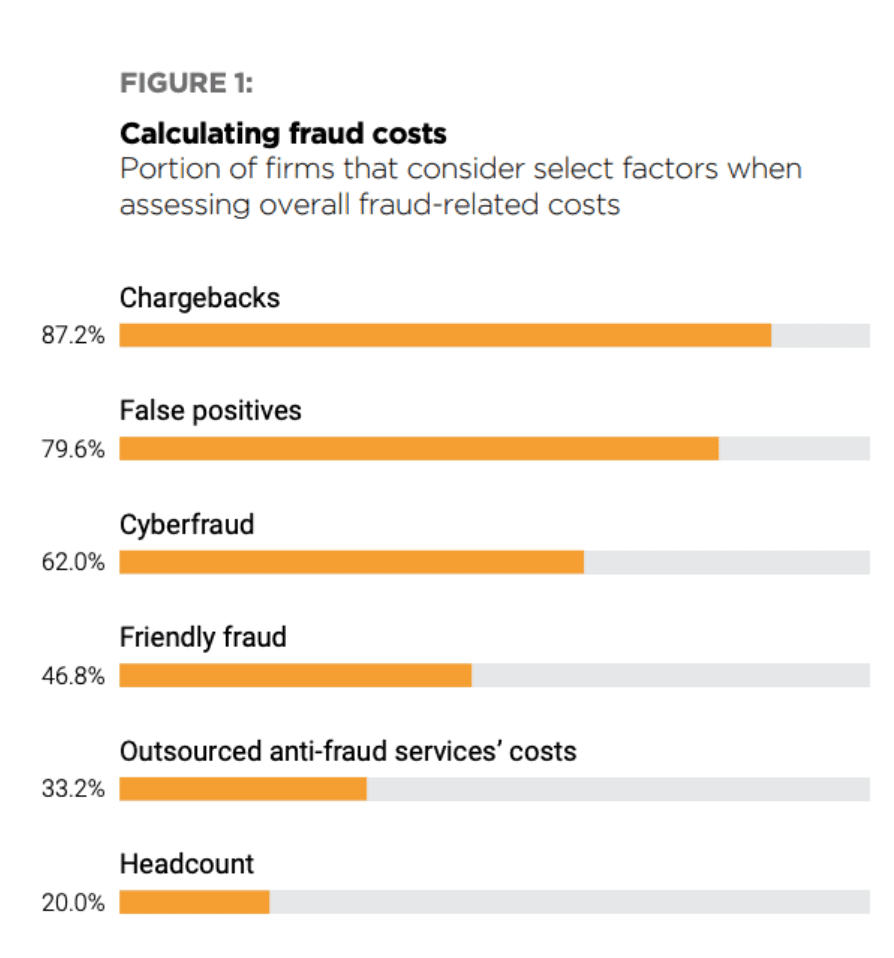

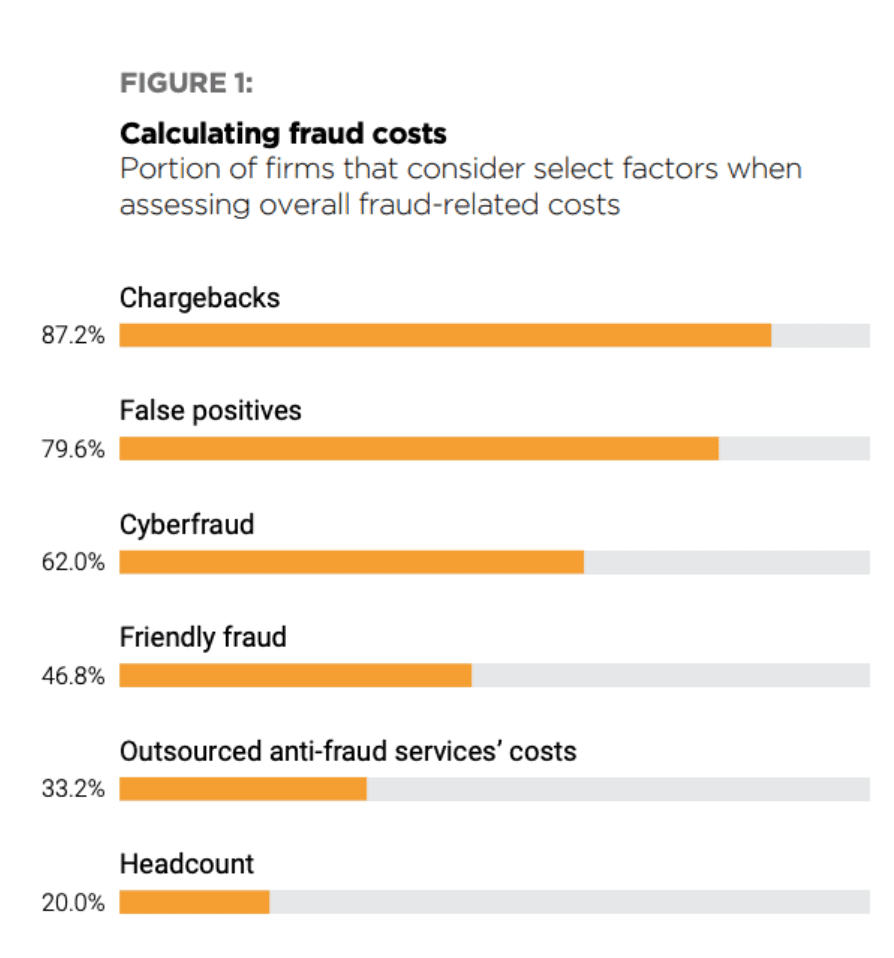

All fraud isn’t created equal, though, according to the Payments 2022 Playbook: Building A High-Performing Payments Team For Fraud Detection. When calculating fraud costs, many digital platforms give more weight to false positives than actual fraud. Only chargebacks are factored in by more (87.2 percent). Over three-fourths (79.6 percent) factor in false positives while just 62 percent consider genuine cyberfraud when assessing damage.

This is especially true for transactional platforms where false positives can hurt conversion rates. Nearly one-third (30.4 percent) of platforms consider false positives to be top friction points in their payment processes, making them the most-cited hindrance. By comparison, fraud itself is considered a top friction point by only 16.4 percent.

False positives don’t just pose problems for B2C platforms like Uber or eBay – it’s also a growing issue for B2B organizations, where declined payments can damage vendor relationships.

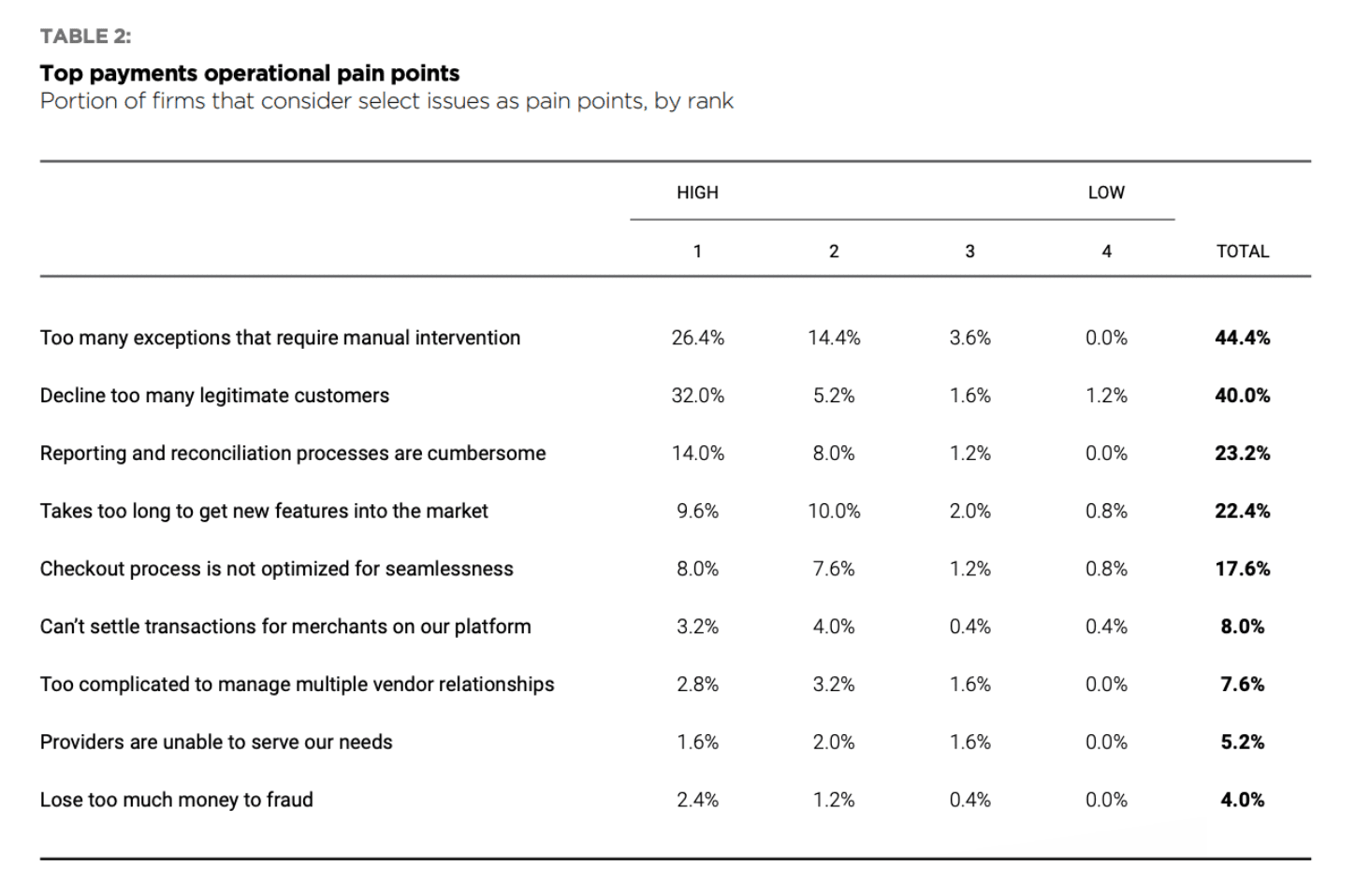

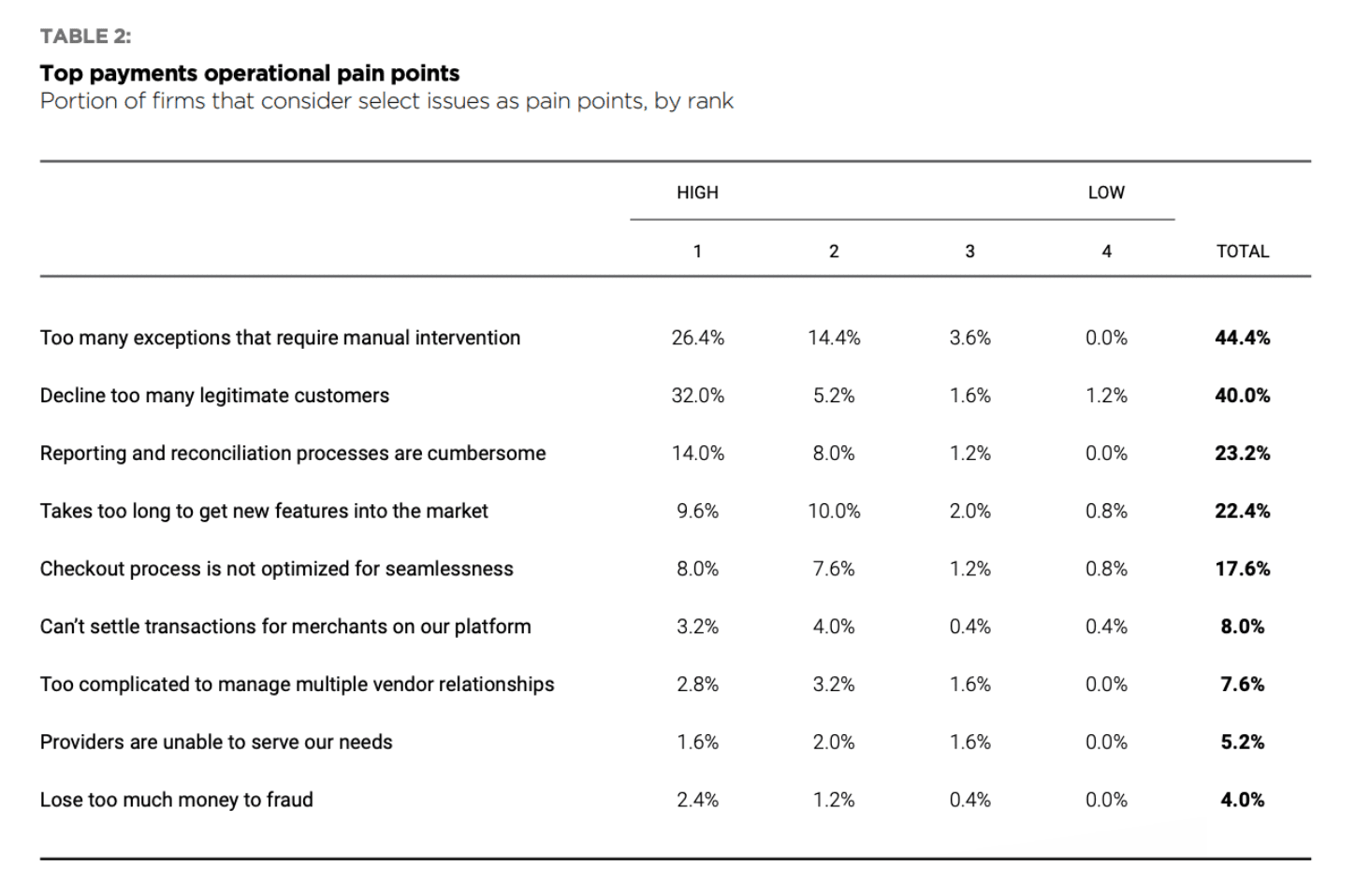

False positives aren’t just considered friction points – they are also challenging on an operational level. Forty percent of platforms consider “declining legitimate customers” as a top operational pain point, even greater than getting new features to market on time (22.4 percent) or losing too much money to fraud (4 percent).

Advertisement: Scroll to Continue

One solution has been to throw bodies at the problem. Over the next three years, 68.6 percent of platforms plan to increase teams dedicated to risk and fraud. More than half (53.1 percent) plan to seek help from third-party providers for fraud detection and monitoring, while 62.5 percent will outsource assistance with chargebacks and dispute resolution.

According to the study, digital platforms might be better served by using more advanced tools in-house rather than outsourcing to multiple vendors. More businesses are adopting artificial intelligence (AI), machine learning and other technology to fight fraud. According to the AI Innovation Playbook, 63.6 percent of FIs believe AI is an effective tool for stopping fraud before it happens, and 80 percent of fraud specialists using AI believe the technology could reduce payments fraud.

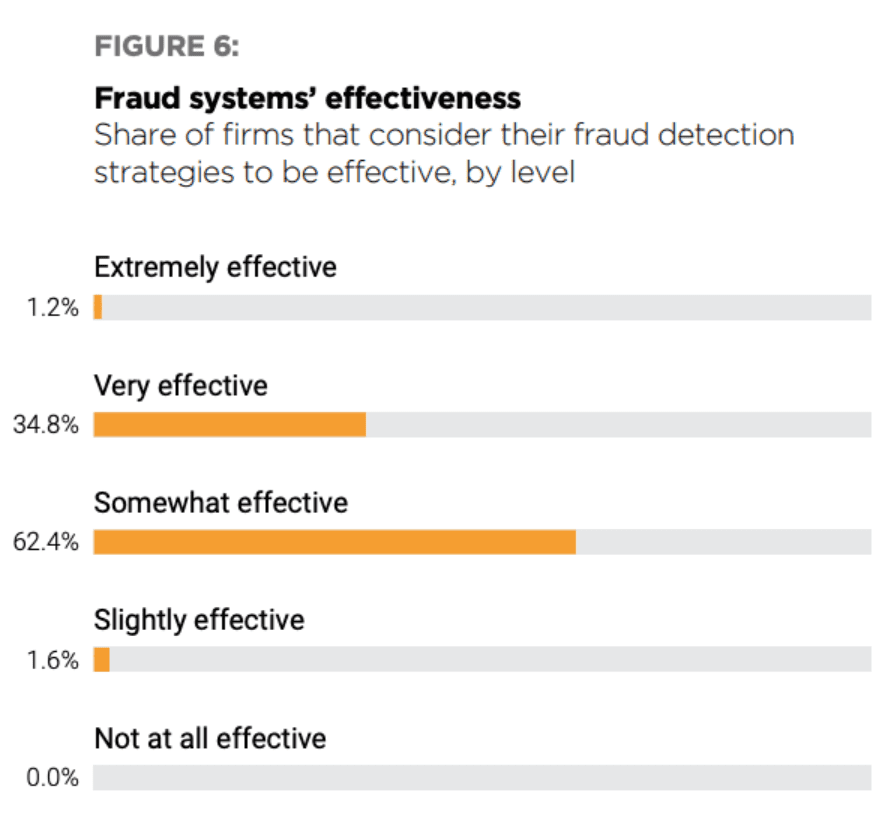

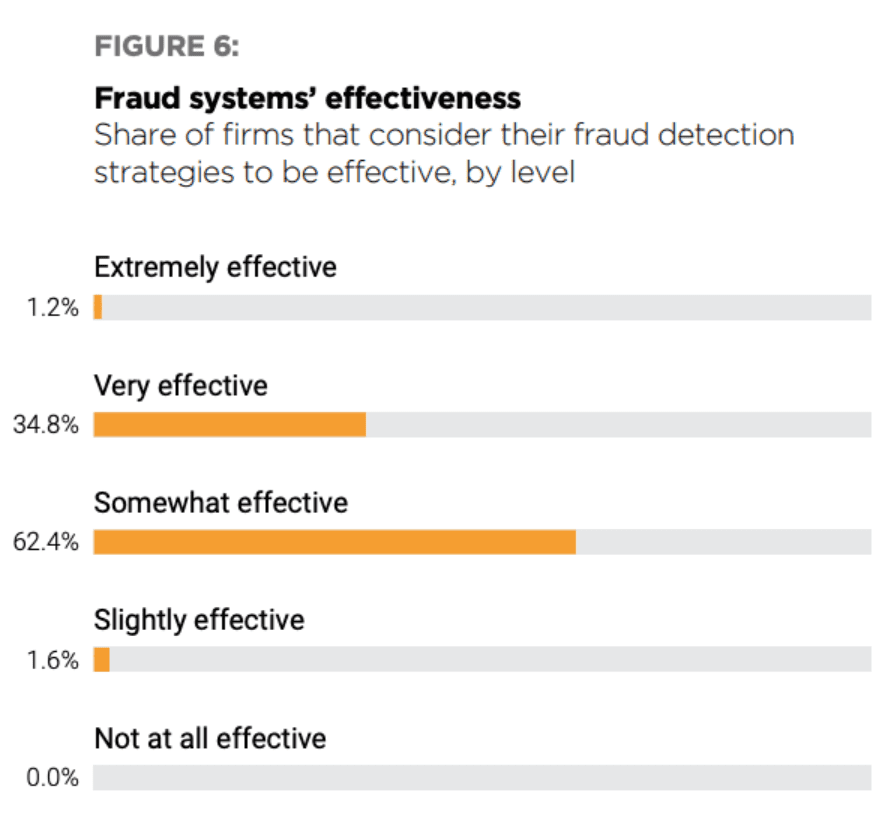

Overall, though, most (62.4 percent) platforms consider their fraud detection strategies to just be “somewhat” effective. Only 1.2 percent rated their fraud detection as “extremely” effective, which implies investments in either staff or outside vendors hasn’t given most platforms much confidence.

Even more alarmingly, the more resources platforms allocate to their payment systems, the less likely they are to be satisfied with their fraud detection capabilities. Forty percent of those that spend between 1 and 2 percent of their annual revenues on payment processing consider their systems to be “very” effective, while just 19.6 percent of the platforms that spend 3 to 5 percent of their revenues say the same.

As mentioned above, platforms are taking false positives seriously. They can cost companies in terms of lost sales, as well as eroding trust. Platforms that factor false positives into their fraud costs are more likely to spend a greater share of their revenues on their payment operations.

For example, 90.2 percent of those that spend 3 to 5 percent of their annual revenues on payment processing factor false positives into costs, as do half of those that spend less than 1 percent.

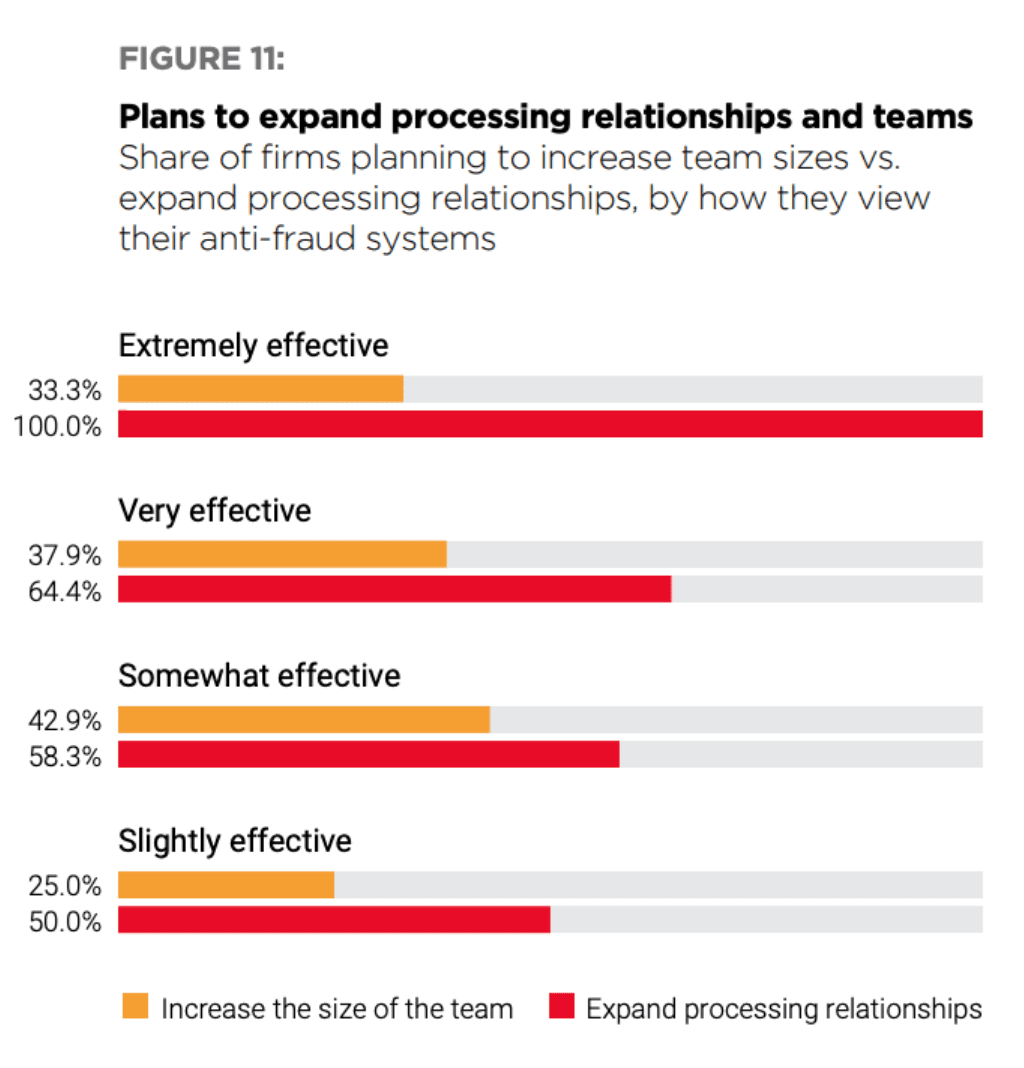

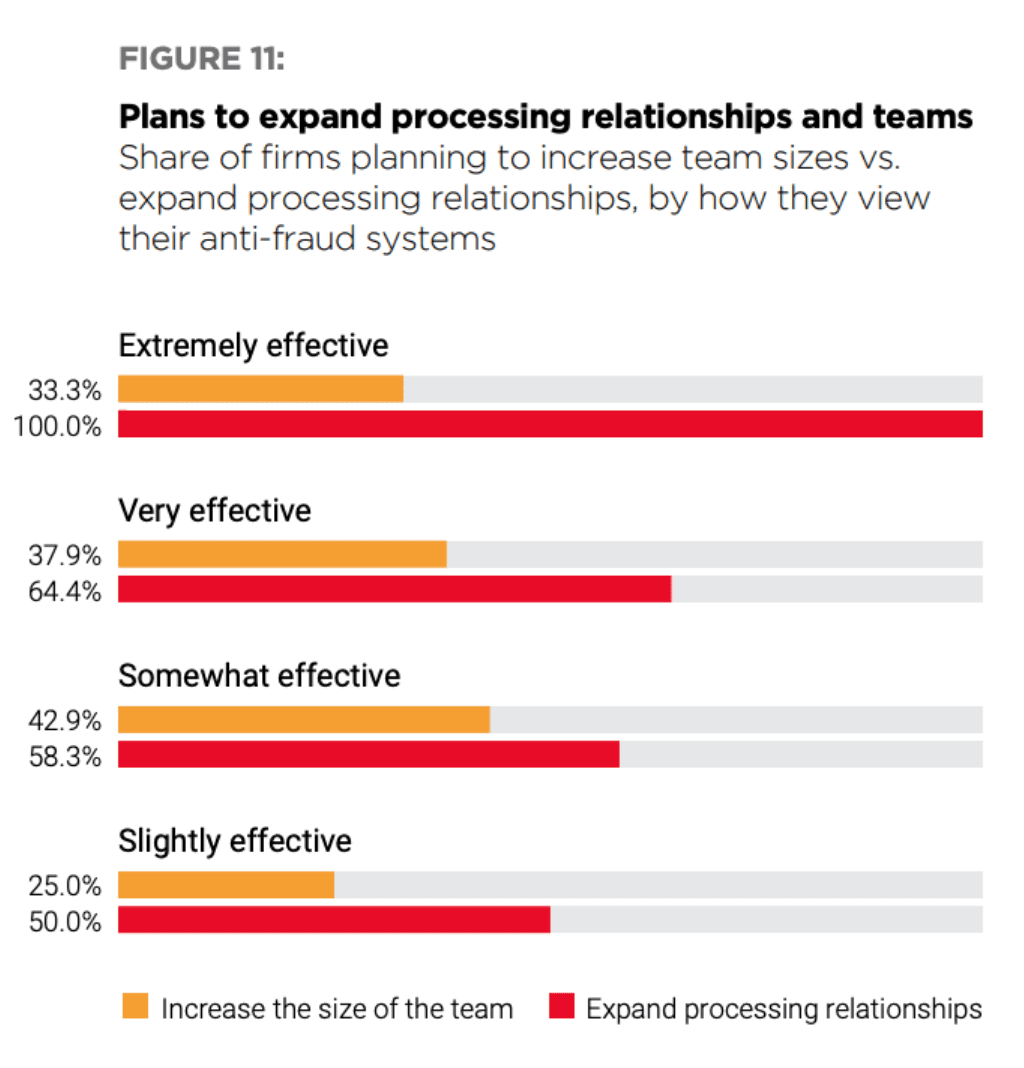

Expanding processing relationships is at the center of most digital platforms’ growth strategies. According to PYMNTS research, 60.8 percent plan to do so, and to a greater degree than adding team members (40.8 percent) or boosting vendor relationships (25.6 percent).

Based on the study, it appears that expanding processing relationships might be the right way to go about growth. Among the tiny number of platforms that are “extremely” satisfied with their fraud detection strategies, 100 percent of them will expand processing relationships, while just one-third will focus on hiring.

The message is that having large payments teams and budgets does not necessarily mean more effective fraud detection.