The upcoming holiday shopping season is expected to break records in online spending, according to a study by Adobe Analytics. That’s even with a shorter shopping season. This year, Thanksgiving lands on Nov. 28, which is six days later than last year — meaning retailers have a whole week less to sell during the holidays.

What does this mean for retailers heading into the holiday shopping season?

Some retailers have started the shopping season early this year, while others are offering delivery incentives and utilizing apps to draw shoppers in.

For its “Which Apps Do They Want?” report, PYMNTS surveyed consumers to learn how they use the apps of their favorite merchants to enhance their in-store shopping experiences, and what in-app features might entice them to download more apps going forward.

Mobile Makes Strides This Holiday Season

Smartphones are continuing to gain importance as a shopping tool. Per Adobe, this holiday season consumers will spend 20 percent more with their smartphones than last year, for $14 billion in total, accounting for 36 percent of all online sales.

According to a new report by marketing technology firm BounceX, conversion rates on mobile have grown faster than on any other device over the past three seasons. This year, mobile conversions for Black Friday are expected to outpace desktop conversions for the first time ever.

A recent survey also found that more than 47 percent of women intend to make over 50 percent of their holiday purchases online, while 45 percent plan to make more than half of all of their online purchases from their phones.

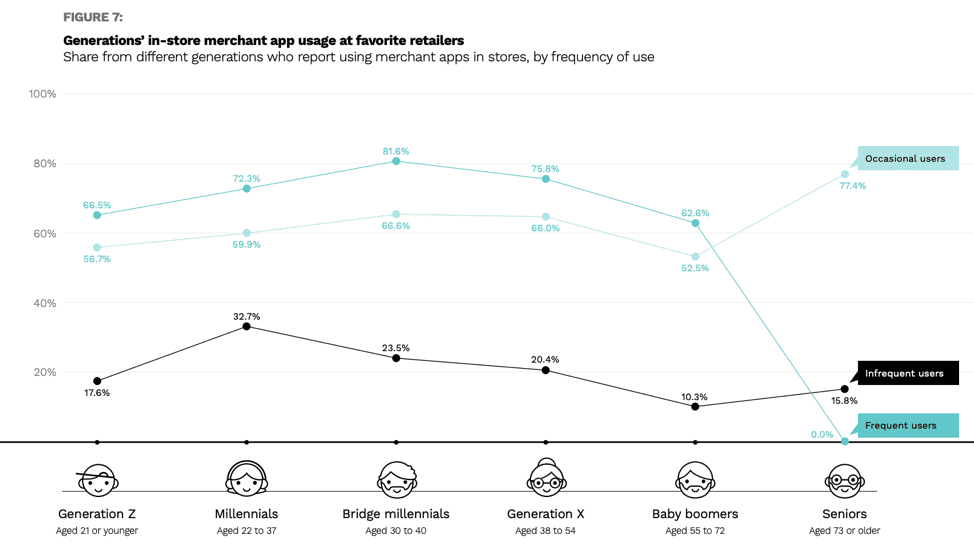

PYMNTS research suggests that while app usage is widespread among consumers of all ages, certain generations report using their favorite merchants’ offerings more frequently than others. The heaviest users are millennials, members of Generation X and bridge millennials.

Almost all generations express more interest in downloading hypothetical future versions of retailers’ apps rather than those currently offered. Such willingness is highest, however, among bridge millennials, those aged 30 to 40 who straddle the divide between millennials and Generation X. Nearly half (46.3 percent) of these consumers express interest in downloading more merchant apps now, and 54 percent say the same for hypothetical future apps.

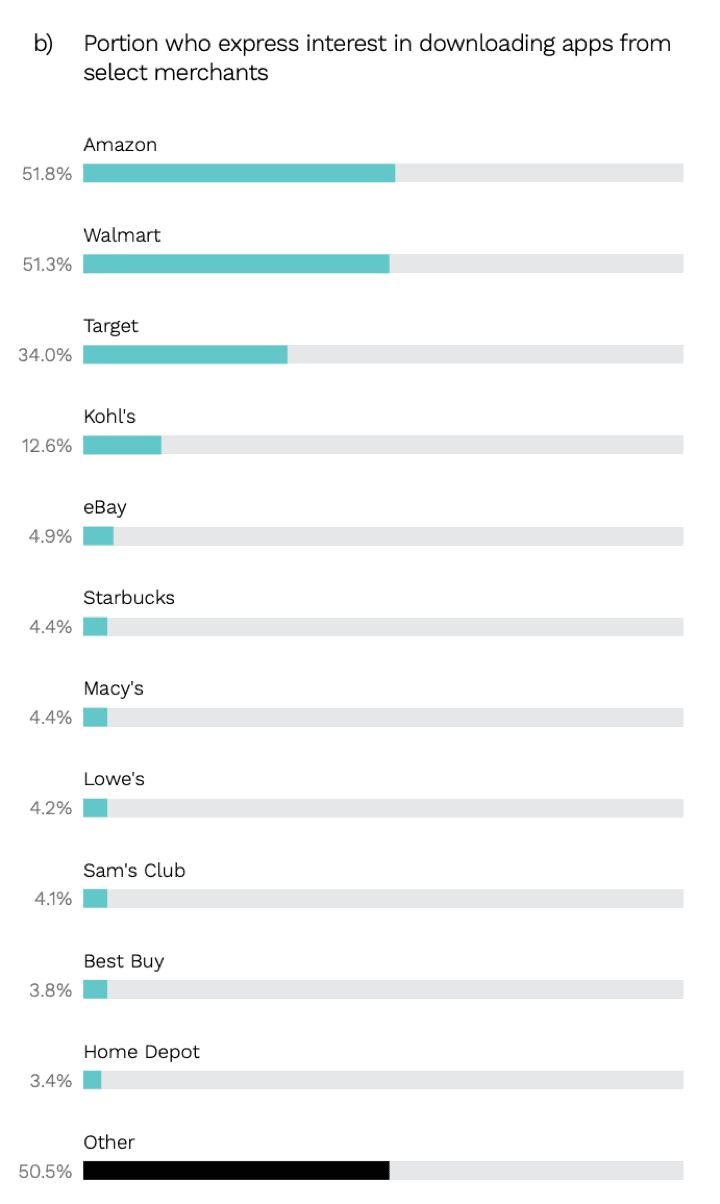

Concerning retailer apps, mass merchants have the best likelihood of consumer downloads. Eight in 10 (83.3 percent) of all consumers would like to download apps offered by mass merchants they visit frequently.

In terms of specific retailers, Amazon, Walmart and Target represent the top three apps consumers are most interested in downloading, cited by 51.8 percent, 51.3 percent and 34 percent, respectively.

Kohl’s (12.6 percent), Macy’s (4.4 percent) and Sam’s Club (4.1 percent) follow, meaning six of the top 11 retailers in whose apps respondents have expressed interest are mass merchants.

Retailer App Trends

Macy’s is promoting a “Style Inspo” app feature for holiday shoppers, which gives users daily fashion recommendations based on personal style. The retailer is also offering in-store pickup via mobile, as well as in-store maps.

Target has started a new program called “Drive Up,” which will allow customers to order items on the retailer’s app, and then have those items brought out to their car. The app also features a virtual tree finder. In-store shoppers can take pictures of artificial trees in multiple sizes and using artificial intelligence (AR), can see how the trees would look inside their homes. This comes hot on the heels of Target’s Halloween promotion using AR via Snapchat.

Walmart is tapping into AR for the holidays. This year, the retailer is integrating the tech into its print catalogs. Walmart app users can scan pages in the holiday toy catalog and make purchases.

Wayfair also recently launched new AR features in its mobile app to help visualize products in users’ rooms, a room planning design tool and enhanced visual search.

Furniture has become a prime candidate for AR, with 3D product spins setting the standard, enabling potential buyers to see the item how they want it, customized and all, to get a keen visual handle on what they are actually buying to display in their living room.

Spotlight on AR and VR

PYMNTS recently spoke with Beck Besecker, CEO and co-founder of Marxent, a company that sells 3D commerce technology. He noted that if a room view is offered on a merchant product page, that tool gets used at least 50 percent of the time. Additionally, consumers who use that tool tend to have a 60 to 70 percent increase in shopping cart additions than other consumers. And for pages or products that include augmented reality (AR) features, consumers spend four times longer on them than what would normally be the case.

According to the PYMNTS “Virtual Reality in Retail:2019 and Beyond” report, by 2022 virtual reality (VR) will generate $1.8 billion in retail and marketing spend, with revenue from VR retail initiatives expected to increase by 3,000 percent over the next four years.

When it comes to VR and AR, you can count on more efforts in the new decade thanks to the fledgling deployments of 5G mobile network technology.