The consumer packaged goods (CPG) industry had a banner year in 2020, as homebound consumers upped their consumption of toilet paper, paper towels, cleaning supplies, canned goods, laundry detergent and snack foods.

But what happens in 2021, as the vaccine gets out into circulation and consumers start getting back out there — returning to their offices, going out to eat and even hopping on airplanes and traveling to new destinations? The CPG surge, most experts agree, is likely coming to an end — though the situation is a bit more complex that it seems at first glance. Some CPGs are heading for a slowdown, while others, it seems are gearing up for a pick-up as 2021 get up and running.

1. The CPG Sales Inversion Is Coming

According to research firm IRI, sales are certainly set to fall in certain segments of the consumer packaged goods segment, with the biggest decreases on deck for things like canned soups and shelf-stable meats and vegetables, which IRI forecasts will fall by about 20 percent in the early months of 2021. Frozen foods are also expected to take a hit of roughly 10 percent in 2021.

But not every segment will be taking a hit — candy, cosmetics and bottled water are all expected to bounce back in 2021 as consumers get back out there. The categories expected to see the biggest spikes this year were the bottom performers of last year — lipsticks, breath fresheners, gum, face makeup, hair spray, shaving lotion, men’s fragrances, hair styling gel and snack bars are all forecast to make a comeback.

Mobility, the report notes, and consumers’ lack of it is what pushed growth in some categories (canned foods) and declines in others (cosmetics). The new normal, according to the report, is set to start six months after the vaccine is widely available, based on accessibility and distribution.

“The new normal assumes a 5 percent loss to pre-COVID-19 levels because of newly formed habits that will persist as well as long term work-from-home adoption,” the report states.

2. Where Consumer Preferences Changed, CPG Makers Are Shifting Products

Among the harder hit categories during the pandemic, again related to homebound lifestyles, shaving goods took a big hit. Working from home, according to Gillette’s sales data, meant men were skipping their morning shave in favor of growing a beard.

So Gillette decided to go into the beard care business, with King C Gillette, its first beard care balm. According to Procter & Gamble (Gillette’s parent company) Chief Product Office Marc Pritchard, the brand had dabbled in beard care before, but this was its first big foray into the market that it has seen rapid emergence over the last year.

“This was the first [product] designed to make sure that it really focused on people that wanted beard care. It’s got ways to condition the beard, ways to trim, it’s got the whole thing,” Pritchard said in an interview.

It is one of many product offering upgrades P&G has made in the last year as it has moved to meet consumer demand that has suddenly surged in staple segments like toilet paper and household cleaners.

“What we’re now doing is looking at what are the problems that need to be solved,” Pritchard said. “What we want to do is try to make it simpler.”

3. D2C Is Becoming An Increasingly Popular CPG Strategy

It’s been a big year for consumers seeking to interact with brands directly. According to an IAB report, 97 percent of consumers have heard of at least one leading direct-to-consumer (D2C) brand in the U.K.; 39 percent have bought from one and Sprout Social finds 57 percent spend more on brands they feel connected to.

And CPG brands have followed that consumer interest. Pepsi recently debuted two D2C websites, PantryShop.com and Snacks.com. Kraft Heinz launched its first-ever D2C business line, “Heinz To Home,” with warehouse club-sized packages of staples like beans and spaghetti for home deliveries. Impossible Foods, known for plant-based meat substitutes, also launched a new D2C site in June, and Coke re-introduced its subscription offering for consumers, which promptly sold out.

Moreover, according to Deloitte data, the digital shift has pushed CPG brands investment, indicating the D2C is the strategy going forward as opposed to a limited-time response to an unusual market. Among GPG executives surveyed, of those making investments, 80 percent are allocating resources to improving their eCommerce and shopping platforms, including a full 60 percent investing in their digital D2C channels.

4. Consumers Are Looking For A Better Bundle

Consumers are not only increasingly enthused about D2C connections with brands, particularly in subscription form, they are also rediscovering their love of bundles when it comes to those subscriptions — particularly when they get to control what’s in the bundle, according to PYMNTS data. Sixty-one percent of consumers reported they’d prefer bundling if they could choose the elements.

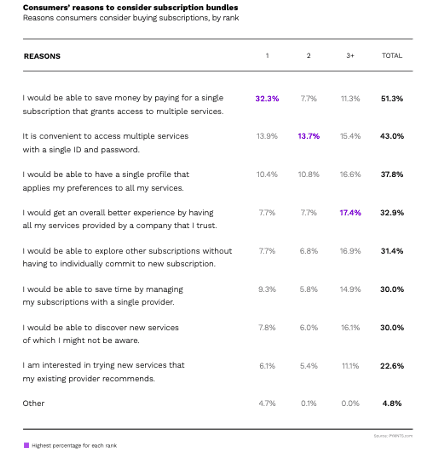

As for why consumers like bundling, PYMNTS data shows 51 percent of consumers rank saving money among the top three reasons for considering buying subscription bundles, and about one-third of consumers consider it to be the most important reason.

Convenience is another factor that weighs heavily in consumers’ decisions when it comes to purchasing subscription bundles, with 43 percent of consumers choosing “the convenience of being able to access services through a single account and login” as one of the most important factors that make subscription bundles valuable.

Consumers also ranked the ability to bundle elements in a subscription as an overall better experience and the ability to try out new elements without having to commit to a whole new and entirely separate subscription as positive elements to bundling.

5. Being Flexible Is Key To Keeping Consumers

The last year has demonstrated the world is an ever changing place — meaning consumers’ wants and needs are also a moving target. Meaning, Vindicia CEO Sharath Dorbala said in a recent PYMNTS panel discussion, brands looking to build strong and lasting D2C connections with consumers via subscription need to build in flexibility at every point of the process — including giving the customer the option to step away from the subscription as needed.

“Subscription fatigue is a real thing,” he said.

Smart providers understand that consumer choice really drives subscription services and is what keeps the customer engaged in the long run. That means giving them choice, even when it comes to wanting to unbundle their services to cut out a few things or hit the pause button from time to time when the fatigue is setting in.

Read More On Retail: