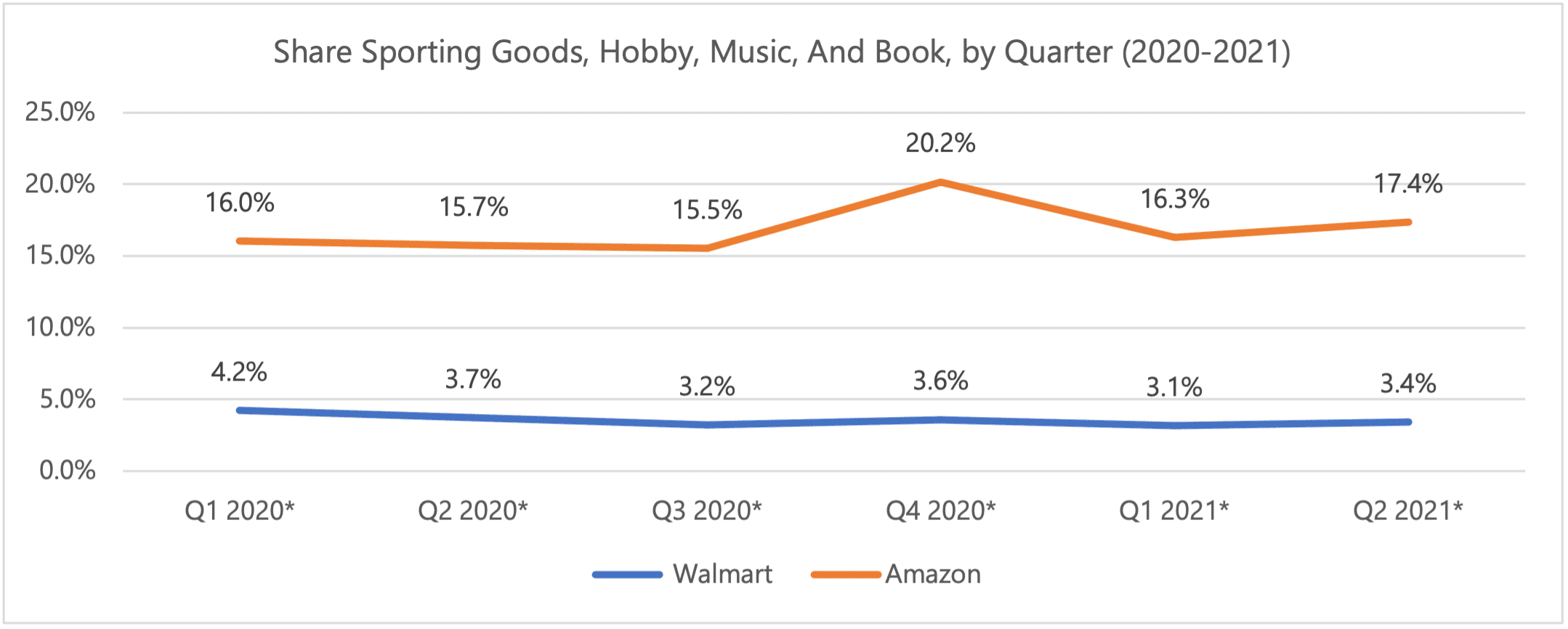

Walmart’s continued struggle in the sale of sporting goods and hobby merchandise shows there’s more to success with these items than a robust omnichannel strategy, though Amazon’s strong lead in a category that also includes music and books is perhaps unsurprising to many.

Both Amazon and Walmart saw a dip in sporting goods, hobby, music and book sales after the fourth quarter of 2020, when holiday shopping likely boosted purchases — especially for Amazon, which had one-fifth of all sales in the final quarter of last year. Walmart, on the other hand, has not been able to add market share, and has been treading water at just over 3% for every quarter in the past year.

Source: PYMNTS data

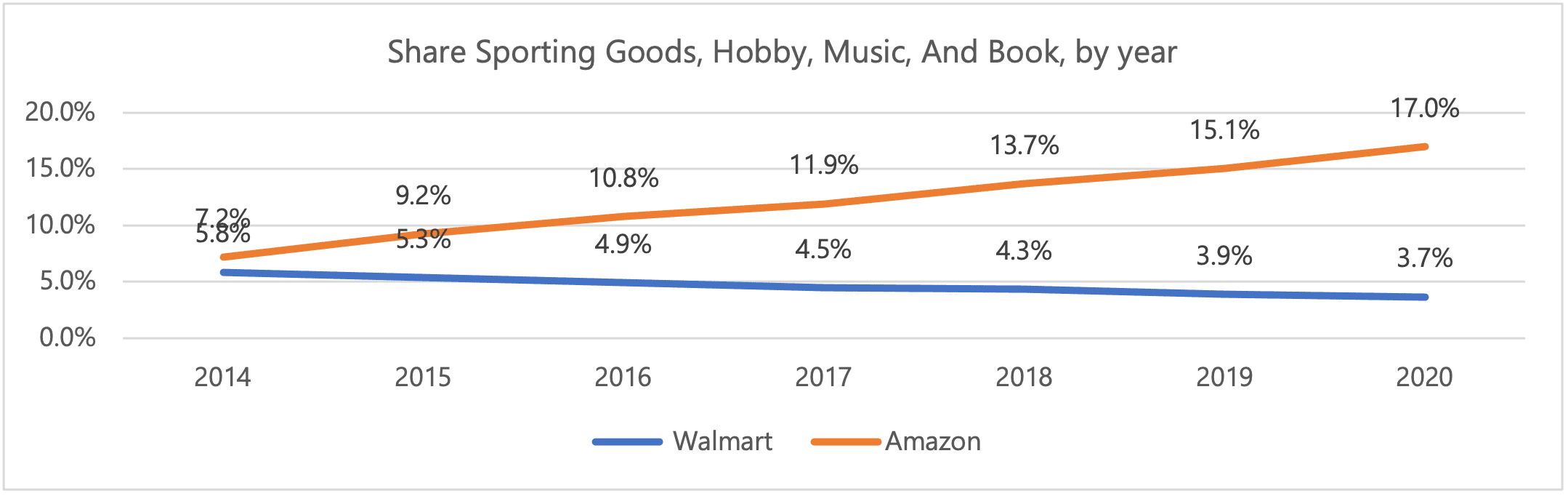

Amazon has spent years cultivating its Kindle readers and continuing to build its Music platform, but the diversity of items encompassed by sporting goods, hobby, music and books means that the eCommerce giant has also found strength elsewhere. Since 2014, the Seattle-based company has more than doubled its share of this category.

Walmart, however, appears to be struggling with these items more and more every year, even with the pandemic driving an increase in demand for these types of items. Dick’s Sporting Goods, for example, had a record, if uneven, year in 2020, with same-store sales rising nearly 10% and eCommerce sales rising 100%.

Read more: After Record Quarter And Year, DICK’S Sporting Goods Sees Return To Normal In 2021

Sporting goods and hobby is the first category in which Walmart lost the lead to Amazon over seven years ago, a sign of things to come in the electronics, apparel and home furnishings categories. At that point, Walmart didn’t have the omnichannel infrastructure that has helped it succeed today, and by the time the Arkansas-based retailer got it up and running, Amazon had already taken enough market share from other merchants to solidify its lead.

Source: PYMNTS data

PYMNTS’ proprietary data are derived from a gross market value standpoint, which tracks the full value of everything sold, not the actual revenue the companies earn. According to the data, sporting goods, hobby, music and book sales make up over 16% of Amazon’s total retail sales; the category accounts for just 3% of Walmart’s sales.

Getting Physical

With Amazon taking over 44% of all sporting goods, hobby and book sales made online, other retailers have been looking to get an advantage in the one place Jeff Bezos and Andy Jassy have yet to full take the retailer: the physical experience.

Dick’s Sporting Goods, for example, in April launched its first interactive concept store that includes multi-sport experiences beyond the traditional commercial experience offers at its 790 other stores and online. The store, called “Dick’s House of Sport,” will also be used to develop more community links via “elevated customer service” that will be provided by specially-trained and skilled employees as well as through enhanced technology.

Related: Dick’s Launches First Concept Store With Indoor And Outdoor Multi-Sport Experiences

“We believe the future of retail is experiential, powered by technology and a world-class omnichannel operating model,” Ed Stack, executive chairman and former CEO, told investors earlier this year. “We are reimagining the athlete experience, both across our core business and through new concepts that we have been working on for the past several years, which will collectively propel our growth in the future.”

Last month, Dick’s said it expects to open six new stores and eight specialty concept stores this year, including the conversion of two former Field & Stream stores into Public Lands stores. Public Lands is the company’s new outdoor-focused specialty concept; the first location is expected to open later this month.

Though specific plans for Amazon’s reported department store-style locations remain under wraps — the company told PYMNTS last month that it does not comment “on rumors and speculation” after a Wall Street Journal report came out — sporting good merchandise is perhaps among the most likely to appear when the first stores open in Ohio and California. While consumers can purchase other items, such as books, movies and music, and be fairly confident that they’ll be satisfied, sporting goods can be among the most hands-on purchases for athletes and amateurs.

See more: Amazon Hatching Strategy To Open Mega Brick-and-Mortar Stores

Still, as Walmart’s performance in the overall category has shown, it’s perhaps not enough to just have the items on the shelves — if Amazon is looking to physical spaces to continue growing its share of sporting goods, hobby, music and books, it will need to give consumers a reason to visit.