In a week filled with hundreds of different earnings reports, none drew more attention than the lead-up and aftermath of Amazon’s first-quarter results, which broke records on a trailing basis but stoked concerns on the guidance front, as the company said its sales growth rate would drop by 15 to 20 percentage points in Q2.

Had Amazon’s cautious outlook been made in isolation and not come on the heels of an enormous beat in Q1, it would have been easy to overlook. However, the fact that the slowing eCommerce growth rate story was repeated all week long by the likes of Google, Facebook, Shopify, Pinterest and more not only gave it credibility, but also shifted the question onto the brick-and-mortar shoulders of Walmart, which will post its own Q1 results on May 18.

While Walmart has made no secret of its ambition to grow its digital sales and expand its omnichannel selling, the fact that its 5,300 U.S. locations and 6,100 international locations account for 94 percent of its revenue cannot be ignored. In fact, while Walmart’s reliance on this physical store footprint has subjected it to derision for being late to the digital shift in certain retailing circles, that so-called liability could become an asset if and when the scorching pace of online shopping starts to slow.

To be sure, there’s a big difference between slowing growth and declining sales — and so far, that projected dip in demand hasn’t happened, as evidenced by Amazon’s Q1 sales, which rose 44 percent to $108 billion. By comparison, analysts, on average, expect Walmart’s sales to fall about 1 percent from a year ago to $131 billion — down, but still ahead of its rival.

Ahead of Amazon … for Now

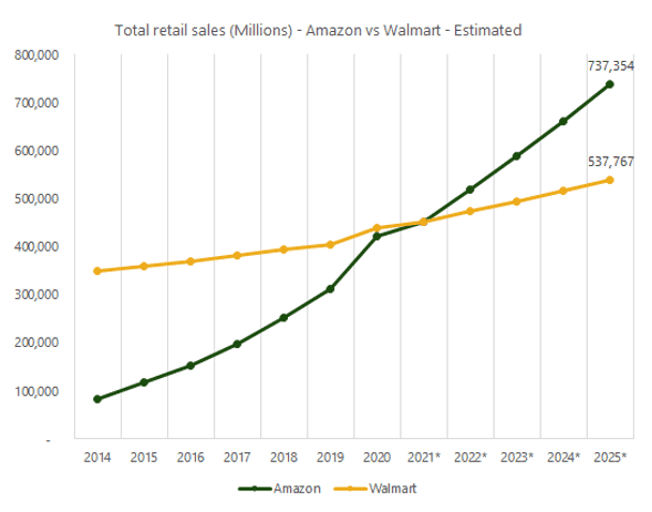

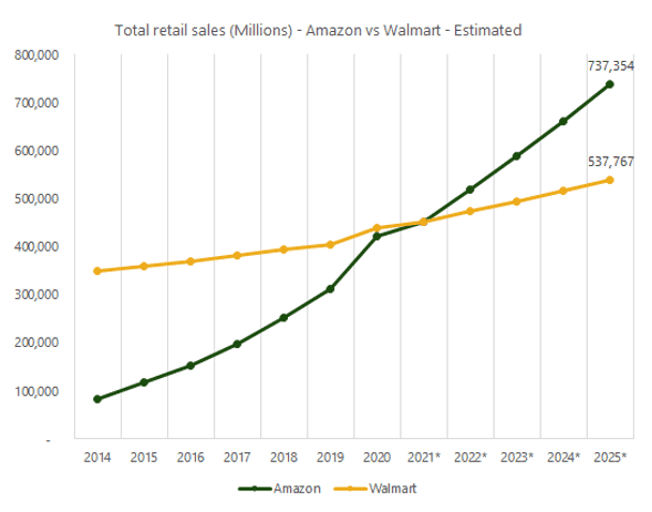

Although those numbers reflect Amazon and Walmart’s officially reported top-line revenue, exclusive new PYMNTS data — which strips out gasoline sales and factors in the full value (aka gross merchandise value) of everything sold domestically, rather than just a partial commission — shows a different story that projects the online retailer is about to start to pulling away from the big-box store giant.

Advertisement: Scroll to Continue

As the green line in the attached chart shows, Amazon’s total U.S. sales will likely stay below Walmart’s for at least another quarter or two.

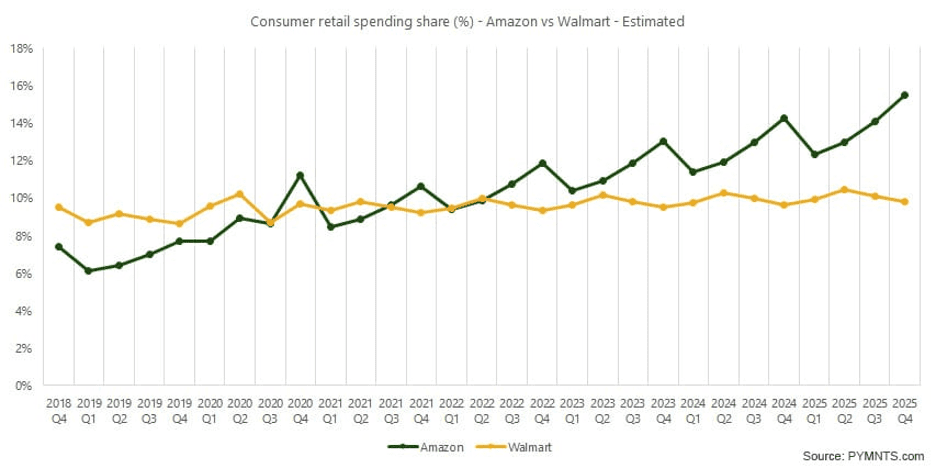

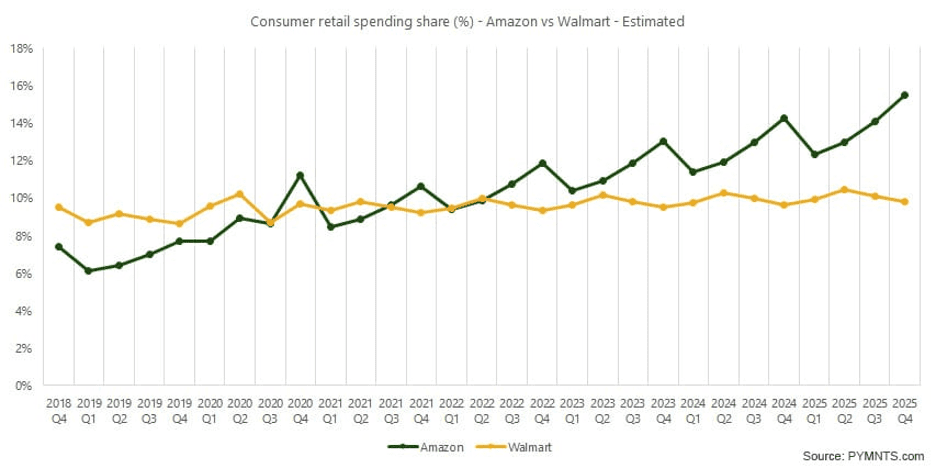

However, by this time next year, PYMNTS’ research suggests that Amazon’s long-term revenue uptrend will have begun to start pulling ahead of Walmart’s flatter sales trajectory, and ultimately widen to a full four-percentage-point market share margin by 2025.

However, by this time next year, PYMNTS’ research suggests that Amazon’s long-term revenue uptrend will have begun to start pulling ahead of Walmart’s flatter sales trajectory, and ultimately widen to a full four-percentage-point market share margin by 2025.

Using those metrics, PYMNTS data projects Amazon to break the two retailers’ current 9 percent tie in U.S. retail sales, and open up a $200 billion gap with $737 billion in annual sales by 2025 versus $537 billion for Walmart.

The Grocery Gambit

The Grocery Gambit

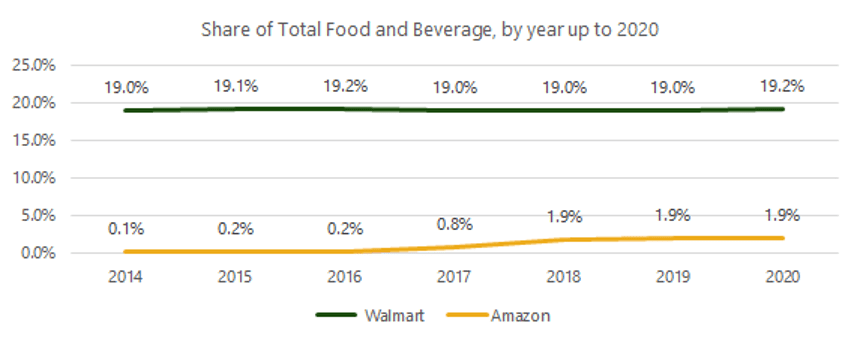

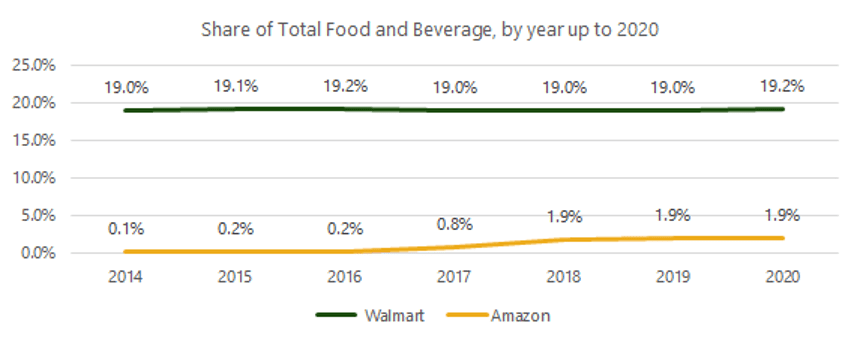

At the heart of this leadership battle is the food and beverage category, which Walmart currently dominates. At last count, PYMNTS data showed that the “food fight” between the two titans was a conspicuous mismatch, with Walmart’s $245 billion or 19.2 percent share of the category in 2020 holding a notable 10x lead over Amazon’s $24.3 billion and 1.9 percent share.

Put another way, groceries are Walmart’s single largest revenue driver, accounting for 56 percent of its domestic sales last year, PYMNTS data show. In terms of total share, food and beverage is Amazon’s smallest category and second smallest by revenue, only ahead of its $12 billion auto parts business — which also trails Walmart’s share, but by a much smaller margin.

Against this backdrop, both retailers are taking steps to bolster their positions, including reports this week that each was getting into the in-home delivery business, in which groceries are actually brought into the consumer’s home or garage and put into the refrigerator — a service that is seen as a life-saver to some, but a little invasive to others.

The thinking behind the in-home service is that many consumers simply do not want to commit to a four-hour delivery window to make sure they are home to accept their order and put their groceries away before they spoil or melt. Another factor is that many customers who have gotten used to grocery delivery are starting to head back to the office rather than working from home.

The Prime vs. Plus Battle

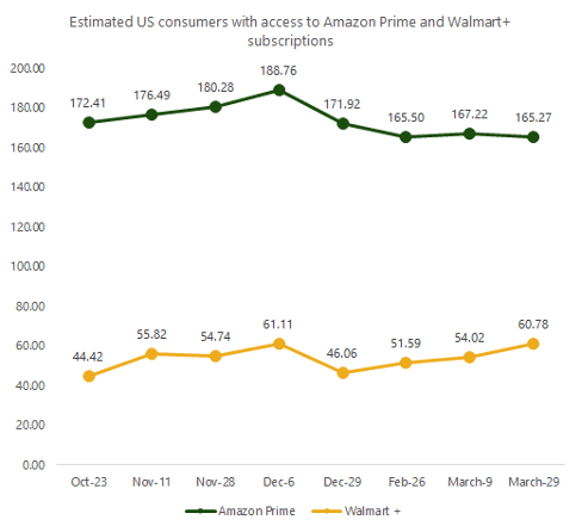

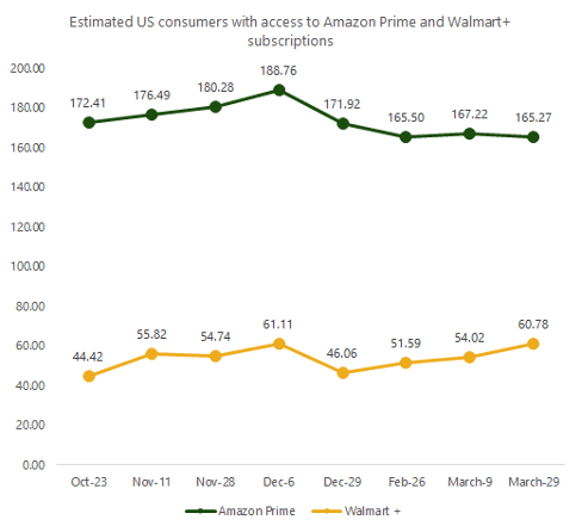

In general, the delivery wars come down to a battle of members, and how many Amazon Prime subscribers there are versus those who use the new Walmart+ option that launched last September.

According to PYMNTS’ research, in just seven months, the Walmart+ membership program has built a base of more than 60 million U.S. consumers who subscribe to the $98-per-year service, which provides delivery, in-store savings and convenience offerings.

According to PYMNTS’ research, in just seven months, the Walmart+ membership program has built a base of more than 60 million U.S. consumers who subscribe to the $98-per-year service, which provides delivery, in-store savings and convenience offerings.

Although the total gap with rival Amazon Prime is still a huge 100 million members wide, the upstart entry from Arkansas has been trending higher in the first quarter of 2021, at a time when the dominant digital leader has experienced a few months of domestic slippage in its overall share of the category.

So while Amazon can claim a 100-million-member lead, Walmart can point to the fact that in just four months, that margin has narrowed by roughly 30 million subscribers.

However, by this time next year, PYMNTS’ research suggests that Amazon’s long-term revenue uptrend will have begun to start pulling ahead of Walmart’s flatter sales trajectory, and ultimately widen to a full four-percentage-point market share margin by 2025.

However, by this time next year, PYMNTS’ research suggests that Amazon’s long-term revenue uptrend will have begun to start pulling ahead of Walmart’s flatter sales trajectory, and ultimately widen to a full four-percentage-point market share margin by 2025. The Grocery Gambit

The Grocery Gambit

According to

According to