With just over two weeks left before Christmas, consumers are starting to enter crunch time for holiday shopping, and Walmart is continuing to push to stay top of mind in these final 15 days.

Earlier this week, the box store giant expanded its partnership with Yahoo! to include a new game on Instagram, a video series about holiday décor that includes augmented reality (AR)-powered shopping experiences, and the return of the “30 Days of Savings” program, which offers a TikTok extension that allows audiences to preview gift ideas.

Read more: Walmart, Yahoo! Beef up Social Commerce, AR Offerings for Holiday Shoppers

During Black Friday, Walmart was the most popular brick-and-mortar destination, according to PYMNTS research, with 59% of consumers saying they visited the Arkansas-based chain during the annual shopping event. But that still falls short of the 71% of consumers who said they visited Amazon’s eCommerce site during Black Friday; only 41% of shoppers said they visited Walmart digitally.

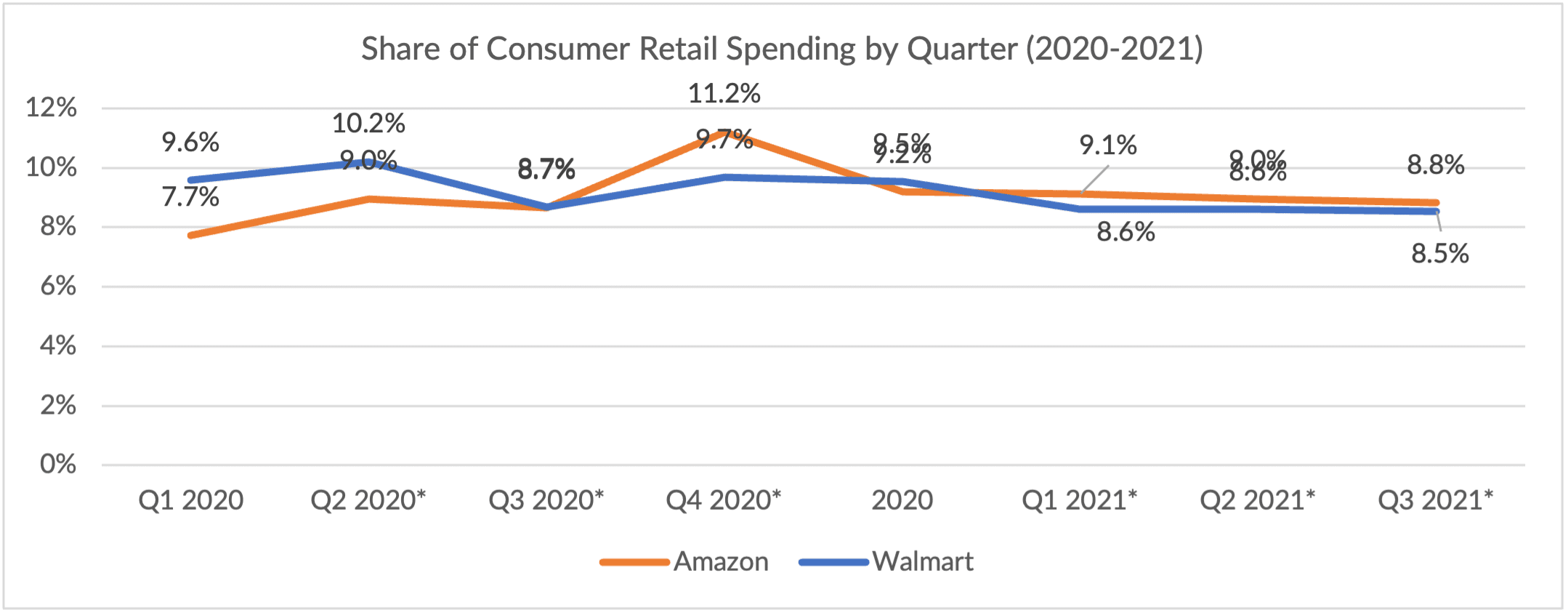

And amid a year in which Amazon has consistently bested Walmart for consumers’ retail spend quarter after quarter, losing the battle for holiday shoppers may bring about the inevitable end of Walmart’s reign as the top U.S. retailer. In 2020, Amazon and Walmart were virtually tied for share of consumer retail spending, at 9.2% and 9.5% respectively. In the third quarter, though, Amazon was slightly ahead at 8.8% share, compared to Walmart’s 8.5% share.

Related news: Amazon Poised to Take Top Retailer Spot From Walmart

Related news: Amazon Poised to Take Top Retailer Spot From Walmart

Getting Products Delivered

However, selling the most items means nothing if you can’t get them to customers in a timely fashion, which is why this week it was reported that Amazon has been making its own containers, chartering private cargo ships and embarking on other initiatives to give it a leg up amid the supply chain bottlenecks plaguing much of the world.

With the private cargo vessels, Amazon is reportedly able to skip over the most congested ports. Making its own shipping containers has also reduced its costs, as the price of containers is up tenfold compared to before the pandemic.

Also see: Amazon Charters Private Cargo Vessels for Greater Supply Chain Control

Amazon executives noted in the company’s quarterly earnings call in October that they expect “several billion dollars of additional costs” to manage labor supply shortages, global supply chain issues, and increased freight and shipping costs in the fourth quarter, though CEO Andy Jassy committed to minimizing the impact on customers and third-party sellers.

“It’ll be expensive for us in the short term, but it’s the right prioritization for our customers and partners,” Jassy said.

Read more: Amazon Warns of Billions in Additional Costs to Meet Holiday Demand

Walmart this week also unveiled a new infrastructure project meant to help it keep up with consumer demand: a 925,000-square-foot automated fulfillment facility in Tennessee, set to open next fall. The facility will use a combination of associates, artificial intelligence (AI) software and robots to speed up the shipping of orders to customers.

In July, Walmart said it planned to automate at least 25 of its 42 regional distribution centers using robotics and other technology; in October, it announced plans to build a high-tech fresh and frozen food distribution center in South Carolina, which will be the retailer’s largest grocery distribution center to date.

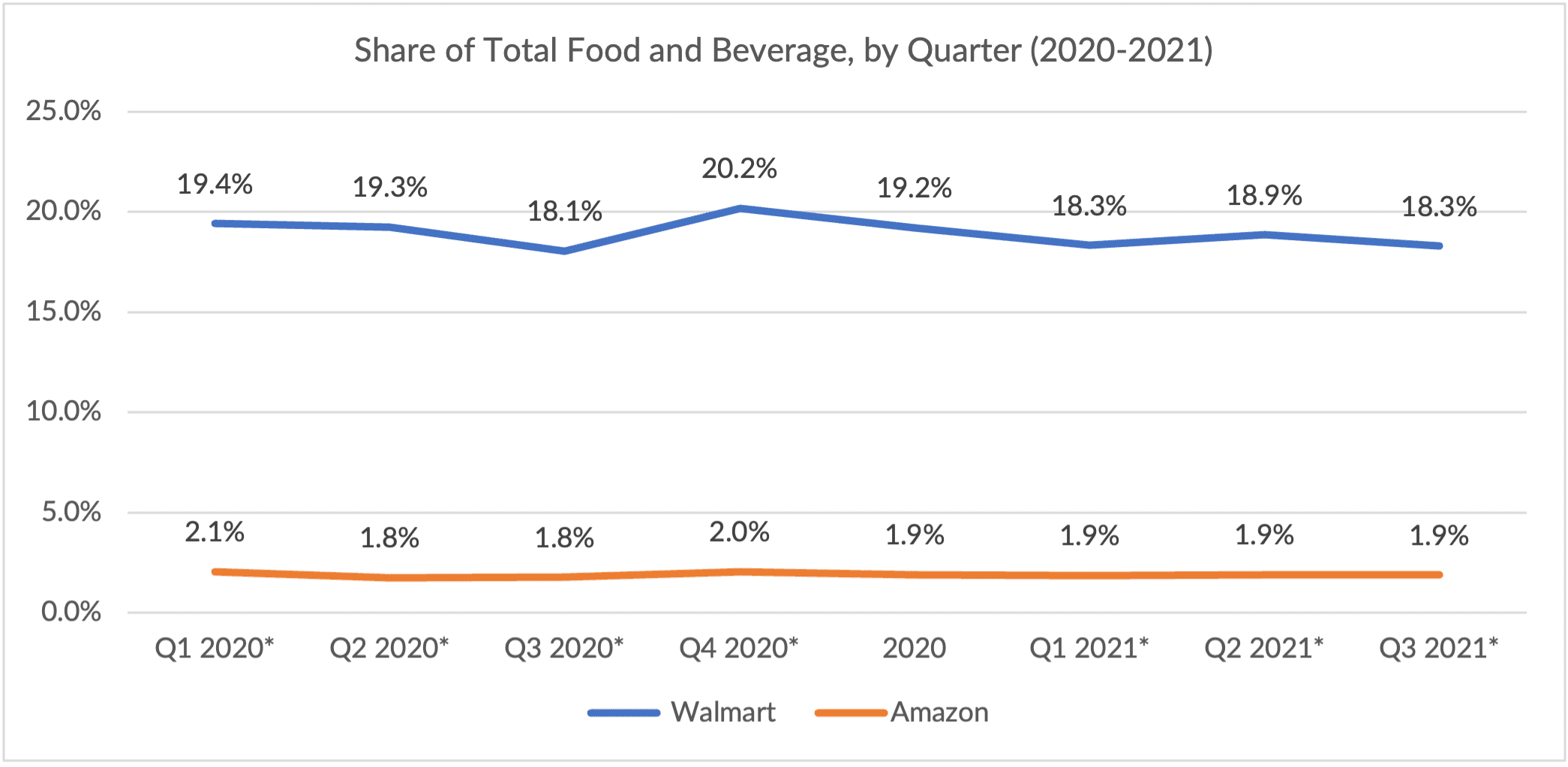

Food and beverage is one of the last remaining product categories where Walmart has a lead over Amazon, with the box store giant holding an 18% share compared to the eCommerce titan’s 2% share.

Expanding Alexa’s Capabilities

Expanding Alexa’s Capabilities

Beyond retail, Amazon is also making moves to expand its healthcare offerings to consumers. This week, the company launched its Alexa Together service, which connects seniors and caregivers to provide fall detection, activity alerts, communication channels and Remote Assist, which allows authorized caregivers to set reminders, create shopping lists and program music, among other tasks.

Read more: Alexa Together Service Debuts, Calling on Advances in Remote Connected Eldercare

Though not directly tied to retail, Alexa Together — and, really, the entire Alexa ecosystem — makes Amazon a centerpiece of consumers’ lives, and potentially the first thought when a new prescription, a gallon of milk or new batteries are needed.

Additionally, it pushes Amazon further into healthcare — which, according to PYMNTS data, accounts for 16% of consumers’ annual spending. Walmart also has been making moves in healthcare, with its in-store clinics and the acquisition of telehealth provider MeMD.

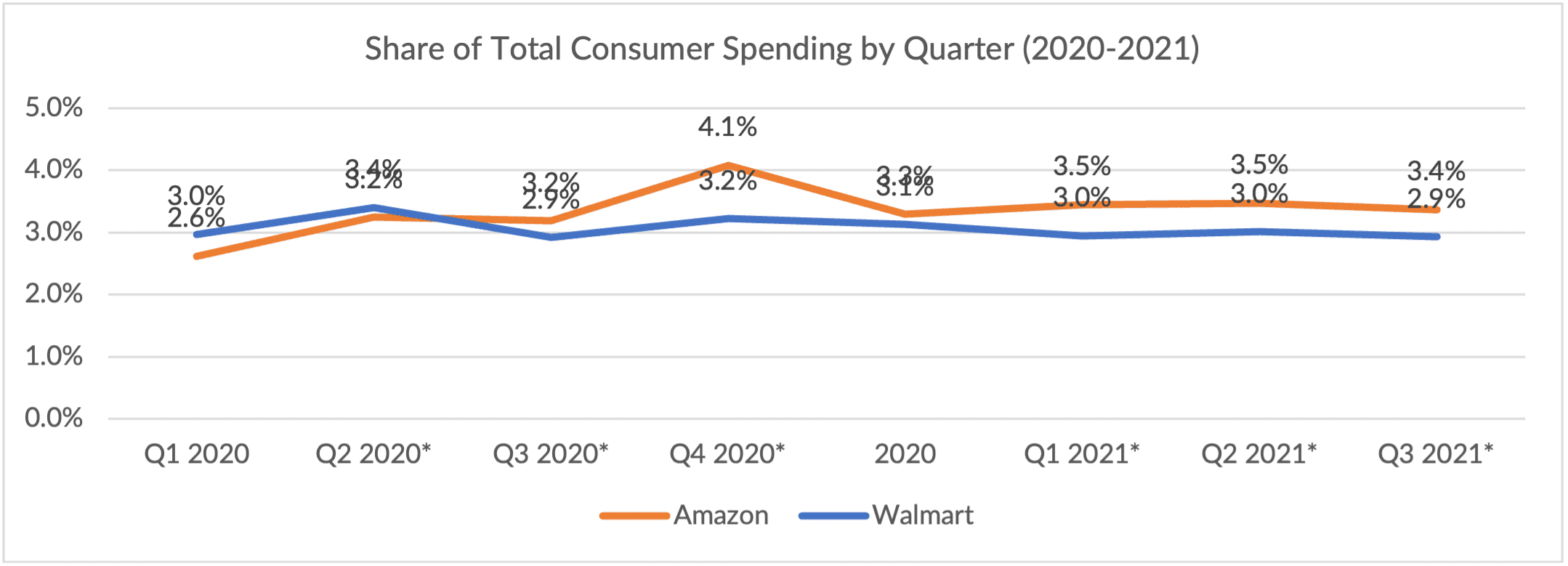

As of the third quarter, Amazon had a 3.4% share of total consumer spending, while Walmart had a 2.9% share.