Though both Amazon and Walmart began their holiday promotions weeks ago, the two largest retailers in the U.S. are still counting on the days between Black Friday and Christmas to bolster fourth quarter, with Amazon likely hoping the holiday season can help it take the No. 1 spot once and for all.

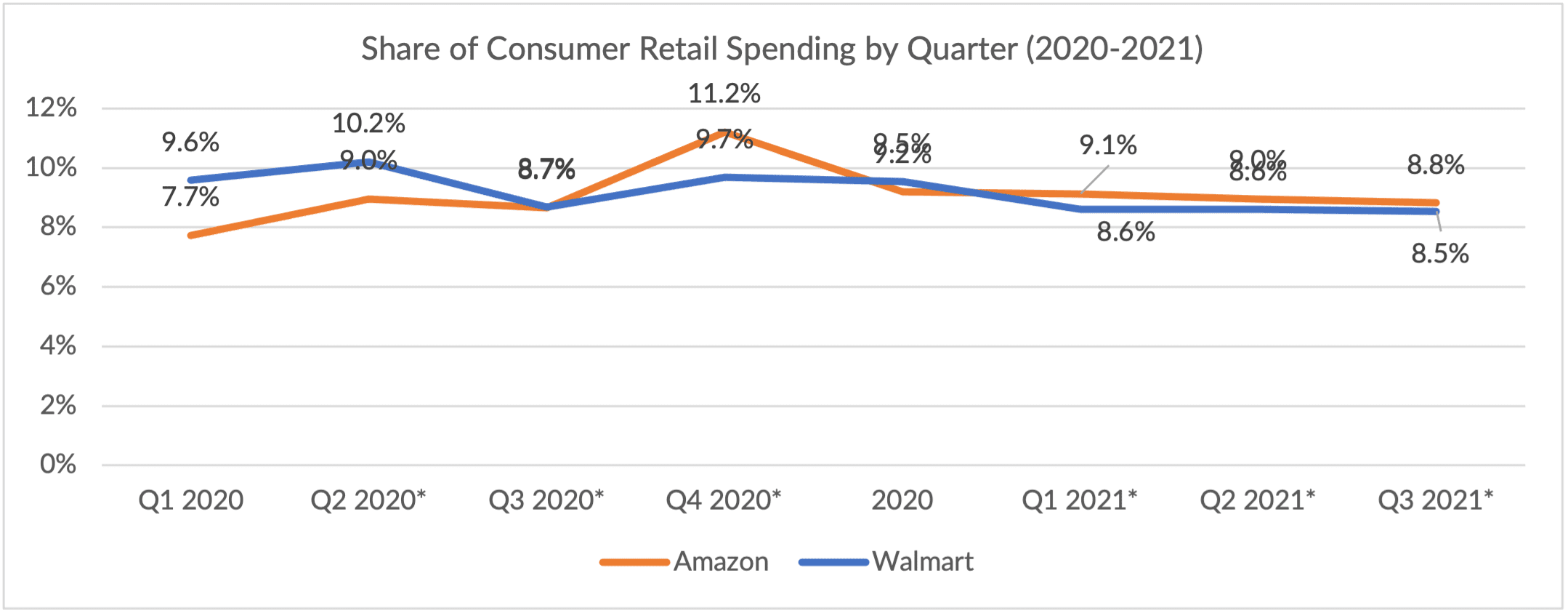

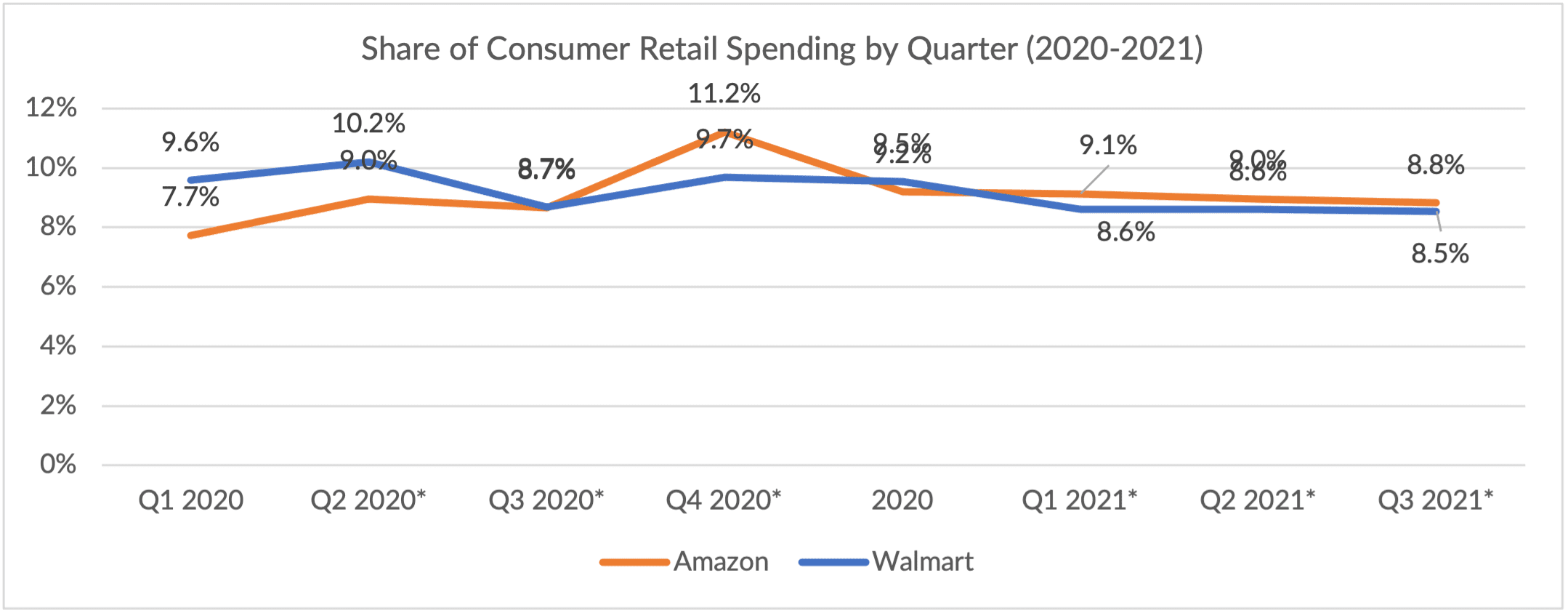

Both retailers lost some ground between the second and third quarter, though Amazon’s share of consumers’ retail spending, at 8.8% as of the third quarter, is at about the same level as this point last year. Walmart, on the other hand, has seen its share of retail spending drop by 0.3% versus this time last year, a continuation of the gradual decline seen since the middle of last year.

Source: PYMNTS data

PYMNTS proprietary data are derived from a gross market value standpoint, which tracks the full value of everything sold, not the actual revenue the companies earn by way of partial commissions on items sold through third parties on their platforms. For example, if Amazon sold a $50 set of knives but only booked $5 in revenue, assuming it charged the merchant a typical 10 percent referral fee, PYMNTS’ use of the former metric provides a more holistic view of where consumers are actually spending their money.

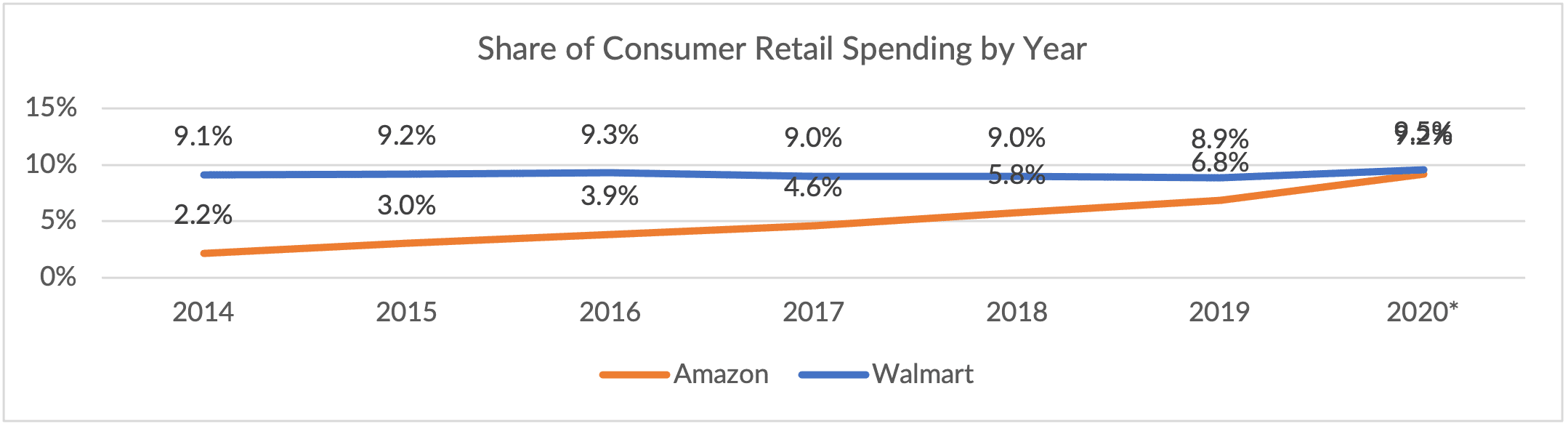

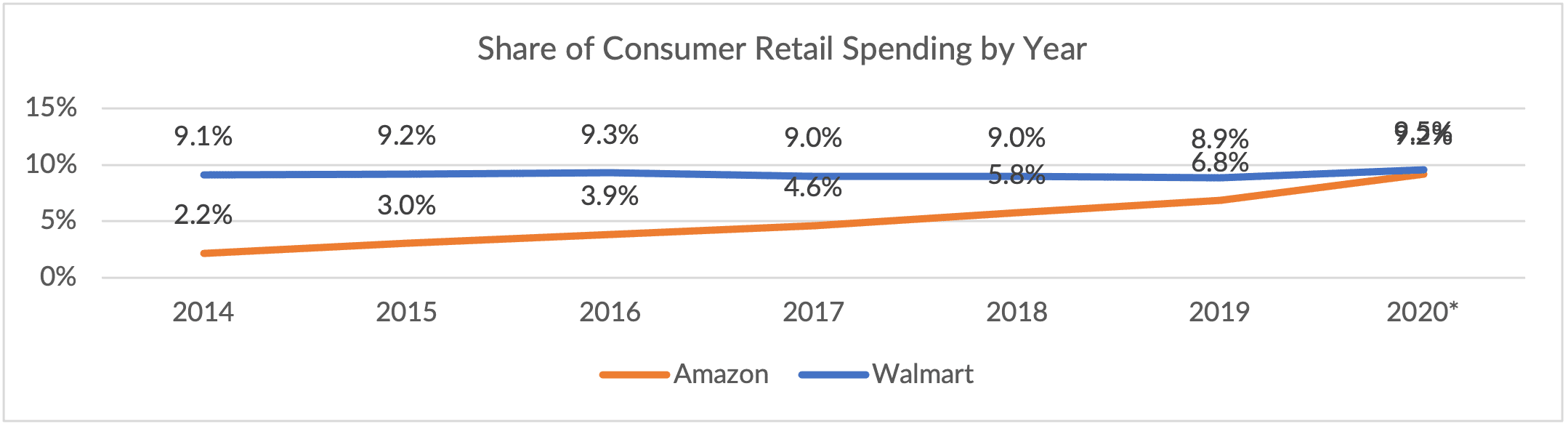

Amazon’s growing market share, of course, extends beyond the start of the global pandemic — since at least 2014, the eCommerce giant has been steadily accumulating more of consumers’ retail spend as well as total spending overall. Five years ago, Amazon had just under a 4% share of retail spending, while as of last year, the company had a 9.2% share.

Source: PYMNTS data

To be sure, a slew of recent earnings reports from retailers show that in many cases, online sales growth has slowed from the rapid pace seen a year ago, and in some sales, digital sales have outright declined. Amazon’s own momentum is also slowing; third-quarter revenue growth was 15% compared to last year, down from the 28% year-over-year revenue growth seen in the second quarter. Walmart, on the other hand, saw 9.2% same-store sales gains in the U.S. in the third quarter, outpacing its online growth slowdown.

Related: Retailers’ Q3 Online Sales Slowdown May Mark End of eCommerce Hypergrowth

Advertisement: Scroll to Continue

Digital Advantage

Still, PYMNTS data show that nearly everyone will be shopping online this holiday season, a likely boon to Amazon’s eCommerce operation that sees nearly 57% of the digital purchases made. Research conducted in collaboration with Kount found that 87% of consumers plan to shop online this holiday season, a 10 percentage point jump from last year despite many consumers returning to reopened stores.

Read more: Holiday Shopping Outlook Suggests ‘Amazon Christmas’ May Be Underway

Last month, however, Amazon executives warned the company will likely incur billions of dollars in additional costs to meet holiday demand as labor shortages and supply chain interruptions continue to plague companies across the retail sector. In the third quarter, labor costs and inflation added approximately $2 billion to Amazon’s operating costs; Chief Financial Officer Brian Olsavsky said these costs will likely balloon to nearly $4 billion in the fourth quarter.

See: Amazon Warns of Billions in Additional Costs to Meet Holiday Demand

Omnichannel Operations

That isn’t to say, though, that brick-and-mortar doesn’t have its place. Walmart’s earnings report, released last week, showed that shoppers are returning to stores, with strong gains in grocery and back-to-school sales over the past few months demonstrating that consumers are continuing to move away from early pandemic behaviors.

“A strong consumer, a degree of inflation and government stimulus are all factors, but I also like what I see in the core of the business,” Doug McMillon, president and CEO of Walmart Inc., said on a conference call with analysts.

Read more: Walmart Adds Workers, Touts In-Stock Affordable Items for Holiday Shopping

Additionally, Chief Financial Officer Brett Biggs said Walmart added about 21 million new items to its digital marketplace in the third quarter, with the retailer’s omnichannel model providing “substantial competitive advantage as shopping behavior continue to evolve.”

“Customers want choices in how they shop, and our unique set of assets with a network of stores, expanding digital capabilities, robust distribution networks and innovative services very effectively serve their evolving needs,” Biggs said.