It was a little too much to hope that the world would somehow magically revert back to the way things were a year ago when the clock struck 12 on New Year’s and 2021 kicked off. But slowly but surely the year-long COVID-caused hibernation has left consumers with a lot of pent-up demand to get back at least some of their old lives. In fact, according to PYMNTS data, people miss seeing friends and family, traveling domestically, dining in restaurants and even working in their offices. In those areas at least, they would like to wind back the clock.

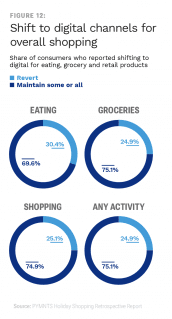

On the other hand, PYMNTS data also demonstrates that consumers are also increasingly committed to the new habits they’ve taken on. Seventy-five percent report plans to maintain their new digital shopping habits even after the pandemic has ended. Normal, when it does eventually return, seems increasingly likely to look quite a bit different than it did when it departed the scene in early March 2020.

On the other hand, PYMNTS data also demonstrates that consumers are also increasingly committed to the new habits they’ve taken on. Seventy-five percent report plans to maintain their new digital shopping habits even after the pandemic has ended. Normal, when it does eventually return, seems increasingly likely to look quite a bit different than it did when it departed the scene in early March 2020.

But that consumer pent-up demand is starting to make itself felt as more and more industries are tapping into long-suppressed consumer desires. Two industries in particular are ready for prime time: apparel and travel.

The Gap And An Apparel Comeback

A year of consumers couchbound and out of the public eye has not, on the whole, been a positive thing for the apparel industry. Some segments did experience a lift from new sartorial patterns — pajamas, sweatpants and comfort cloths of all kinds saw their sales go up. But workwear, formal outfits, shoes and apparel as a general market took a profound hit across brands and retailers.

But that trend, looking at the Gap’s latest earnings report, is showing at least early signs of easing. Gap stock shot up 4 percent when it reported earnings Thursday (March 4) and forecast a return to normal when it comes to apparel sales as consumers began resuming their social lives once more.

While in Q4 Gap’s Old Navy and Athleta brands showed strength, the Gap and Banana Republic brands both reported sales declines during the quarter, and Gap noted it would be building more of the former and closing down more of the latter. The retailer affirmed that while the first half of the year may continue to see lingering COVID-19 effects, the second half of the year looks more cleared for a return to more normal apparel-buying trends.

And Gap isn’t the only firm touting a coming return to getting back out there.

The Travel Industry’s Upbeat Outlook

Consumers who have been homebound for the last year, Flywire’s Colin Smyth observed in a recent conversation are hungry to get back out in the world. Those signs of were visible, he said, when the U.K.’s prime minister lifted travel restrictions for Brits effective in late spring and traffic shot up by 500 percent on U.K. travel websites.

“I think among people who want to travel for leisure, those who will be vaccinated anyway, they are fine to do whatever is required as it comes together. Their attitude is, ‘Yeah. I’ll sign up for [clearance] or whatever I have to, prove I’m vaccinated and I’ll get to the airport an hour earlier to walk through and demonstrate it,” Smyth said.

Demand, however, remains depressed at present.

According to the U.S. Travel Association only around one out of every eight Americans are planning a trip this year for spring break. And travel intentions are still falling, according to the report, travel, with the 12 percent from this study down from 16 percent from a week ago when the question was first posed.

The same report, however, demonstrates the direction consumer demand is trending as they are making the jump to travel. The largest reason reported among consumers for their spring break trip this year was to escape stress, with 73 percent citing that as a reason, and 71 percent reporting they wanted to spend more time with family. Seventy-one percent said they wanted to escape boredom and 68 percent said they wanted to explore new places. Sixty-seven percent said they wanted to “get away from daily life.”

Travel, the USTA data demonstrates, is poised for a return, but the pandemic and when it actually comes to a decisive end is still the controlling factor when it comes whether consumers will get back to traveling.

“A true travel comeback can also only happen once the pandemic is decisively behind us,” said U.S. Travel Association President and CEO Roger Dow.