“What used to seem like a cheap, cheerful, fun little trendy purchase, people are starting to see actually comes at a pretty high cost environmentally and needs to be rethought,” he said. According to the U.S. Environmental Protection Agency, Americans throw away 12 million tons of furnishings every year, nearly six times the amount discarded in 1960.

Chairish found that 70% of consumers say addressing climate change is more important now than ever, and 80% of shoppers say that quality is important when choosing furniture and home décor, as it will last longer.

President and Co-founder Anna Brockway said, though, that most consumers don’t see sustainability as an all-or-nothing situation; in some cases, new items are okay. For example, Chairish carries some contemporary pieces, such as art, beds, headboards and wallpaper, alongside its vintage offerings to fill in some of the holes in its used furnishings inventory.

“Our perspective is, let’s try to find partners who are making the product that we feel we could resell in 10 or 20 years, which is that idea of longevity and quality,” said Anna.

‘Huge Advantages’

Advertisement: Scroll to Continue

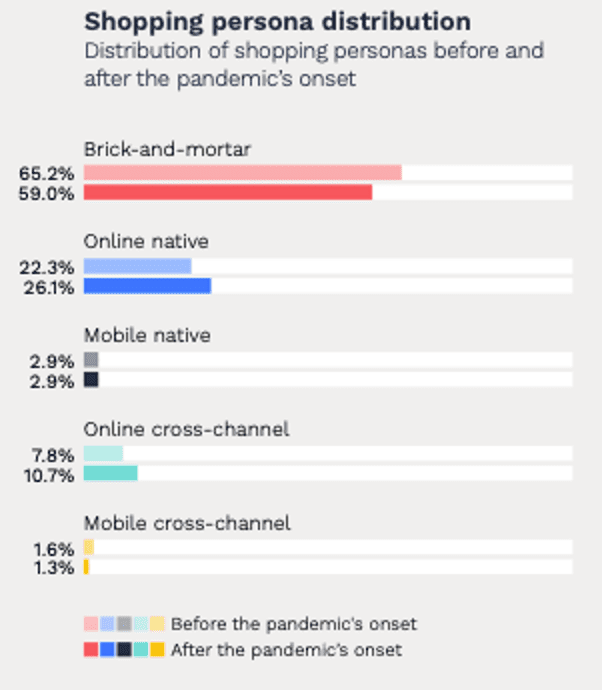

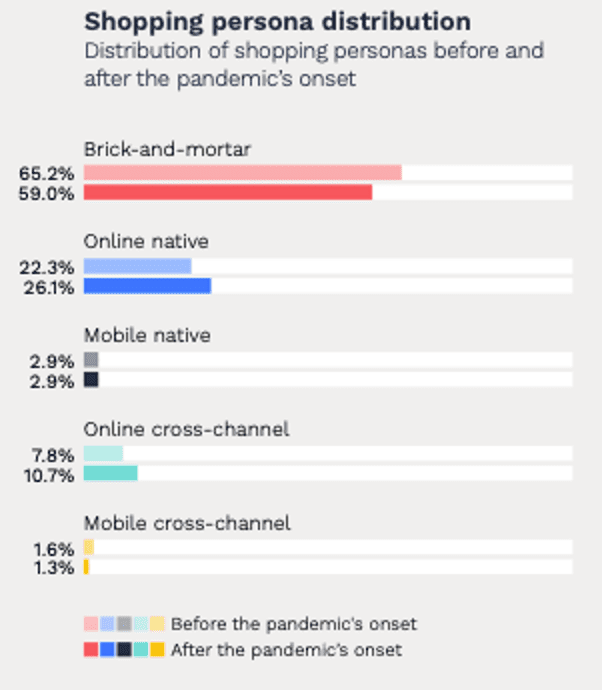

The pandemic also accelerated the growth of eCommerce, leading more consumers to get more comfortable with making nearly any purchase online. PYMNTS data shows that the share of online native shoppers has grown by at least 17% since the pandemic began, as the share of brick-and-mortar shoppers has decreased by 10%.

See also: New Data: More Than 40 Percent of US Consumers Shop Through Digital Channels … and Stay There

Online furniture and houseware sales, in particular, have seen a boost, as consumers become more accustomed to making big-ticket purchases digitally, according to Chairish’s Home Furnishings Resale Report released on Wednesday (Sept. 22). In 2020, online furniture and houseware sales reached over $36 billion, an increase of 41% and just over 46% of all furniture sales made. By 2027, the furniture and housewares market is expected to reach over $177 billion, amounting to sales growth of 127%.

“There’s just a huge renewed interest in making your space as great as it can be, on making it an expression of your personal style and a place where you’re happy spending increased hours,” said Anna.

As supply chains issues have caused delivery delays for the past year-plus, consumers have also been increasingly looking to secondhand marketplaces for products. “Vintage, by definition, is immediately available and ready to ship, and that has huge advantages in this current environment,” she added.

Related news: Chairish CEO on How COVID-19 Is Redesigning Home Design

Over the next five years, sales of secondhand home furnishings are projected to grow by 54%, or 3.5 times faster than traditional retail’s growth rate of 15%. Anna noted that new retail will still be larger on a dollar volume and unit basis, “but where you see the growth and the movement is in the reCommerce and resale space within the home furnishings industry.”

The Professional Perspective

Across the U.S., Gregg said Chairish has seen bigger growth in areas of the country that have a greater concentration of interior designers, such as population centers on the east and west coasts as well as certain areas of the Midwest and Texas.

“It’s just a reflection of where the community is, but it’s really growing wherever people are, wherever they’re facing the challenges that we’re all dealing with,” he said. “This is one of the many ways to make it a little bit better.”

Anna said that convincing interior designers to shop on Chairish and use secondhand furnishings has been an easy sell, as it allows them to create “very unique, very bespoke spaces in a way that someone can’t just go down to a big-box retailer and purchase on their own.”

Another powerful incentive, especially in the past several months, has been the immediate availability of resold furniture and furnishings. Rather than 12 or more weeks of lead time, designers are able to tell clients that it’ll be ready in “as long as it takes to roll a truck and potentially get it reupholstered, if you’re doing that,” Anna said.

“I think that it’s a very powerful combination, and certainly we’ve seen our trade business skyrocket,” she added. “It’s always been an important part of our business.”