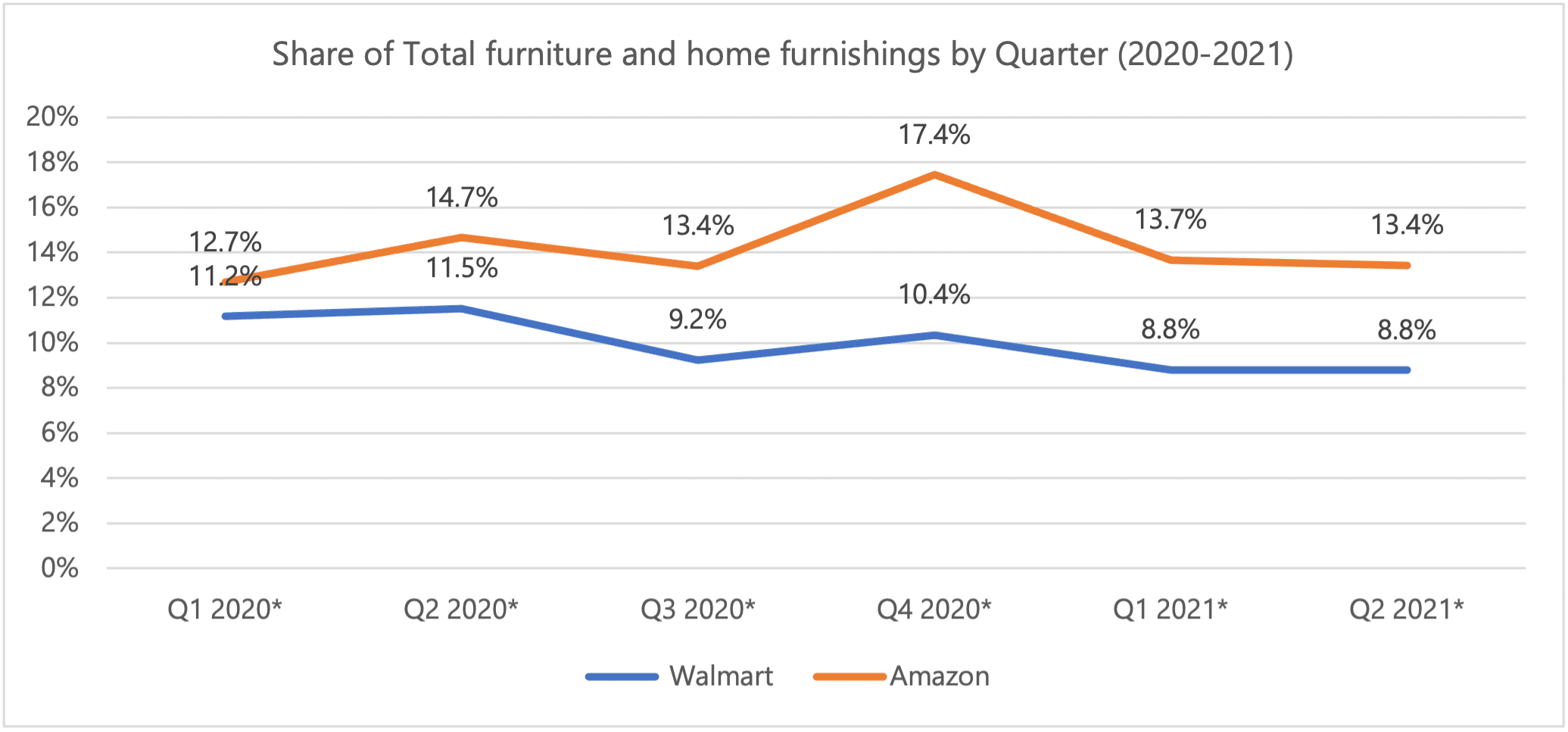

After losing its market share lead in the furniture and home furnishings category prior to the COVID-19 pandemic, Walmart has struggled to make up any ground against Amazon, which continues to reap the benefits of consumers’ continued comfort buying big-ticket items online without seeing them.

After a momentary surge to over 17% share of the total furniture and home furnishings market in Q4, Amazon has settled back to just over 13% as consumers return to stores to buy new sofas, tables, curtains and décor. Looking just at eCommerce, though, Amazon accounts for over 43% of domestic furniture and home furnishings sales done online.

Walmart, on the other hand, has remained just below 9% share of the furniture and home furnishings market for two quarters in a row, a sign that customers lost to Amazon and other retailers may be gone for good despite Walmart’s attempts to lure them back.

Source: PYMNTS data

PYMNTS’ proprietary data are derived from a gross market value standpoint, which tracks the full value of everything sold, not the actual revenue the companies earn. For example, if Amazon sold a $50 set of knives but only booked $5 in revenue, assuming it charged the merchant a typical 10 percent referral fee, PYMNTS’ use of the former metric provides a more holistic view of where consumers are actually spending their money.

Related: AMZN vs. WMT Weekly: Retail Giants Remain In Dead Heat For Top Spot

Furniture and home furnishings likely aren’t going to make or break the race to be the top retailer in the U.S.: For Amazon, furniture and home furnishings is just under 10% of its total retail sales; for Walmart, the category accounts for about 6.6% of sales. But the category is potentially noteworthy given that Walmart appears to be making a concerted effort in its partnership with Gap to make reclaim some of the home furnishings ground it lost.

Gap Home launched online and in Walmart stores with over 400 home décor, tabletop, bedding and bath items in June, giving it just half of Walmart’s second quarter to reach consumers, many of whom may have already spent the last several months redecorating their homes after so many months stuck inside. A better barometer of the partnership’s success, therefore, might be seen at the end of the third quarter, which will also include furniture and home furnishings purchases made in preparation for college students to return to campus.

Related: ‘Gap Home’ Debut On Walmart.com Puts Pressure On Décor Rivals

To be sure, showing not even one-tenth of a percentage improvement in home furnishings after launching such a high-profile partnership is likely to be unwelcome news to Walmart and Gap Inc. executives alike. On separate conference calls with investors and analysts this month, the partnership received little discussion, except for Gap CEO Sonia Syngal noting that early results are “encouraging.”

“As our momentum builds, we have an acute focus on customer lifetime value, fueled by our marketing investments,” she said.

Online Furniture Sales

Part of Amazon’s recent success in home furnishings can likely be attributed to accelerated online demand for the category. Last month, Chairish CEO Gregg Brockway told PYMNTS that prior to the pandemic, home furnishings had low digital penetration relative to other categories, but the pandemic flipped the switch in online adoption.

“And what you’ve seen in other industries is that it never goes back,” Brockway said. “I think people have come to learn and appreciate the benefits of purchasing online.”

See more: Chairish CEO Says European Acquisition Provides ‘Next Big Step’ For International Expansion

A certain share of consumers will likely want to see and touch the furniture they’re buying before committing — perhaps at a Walmart location or future Amazon department store — but Brockway added that he expects online to be “a much bigger, more important channel for the buyers and sellers of home furnishings.”

Wayfair CEO Niraj Shah also noted earlier this month that demand for home furnishings is not going away, even if the nesting trend may be mostly over. “Interest in the home is not going away post-pandemic, even if there is some shorter-term normalization,” Shah told analysts and investors.

Part Of A Bigger Picture

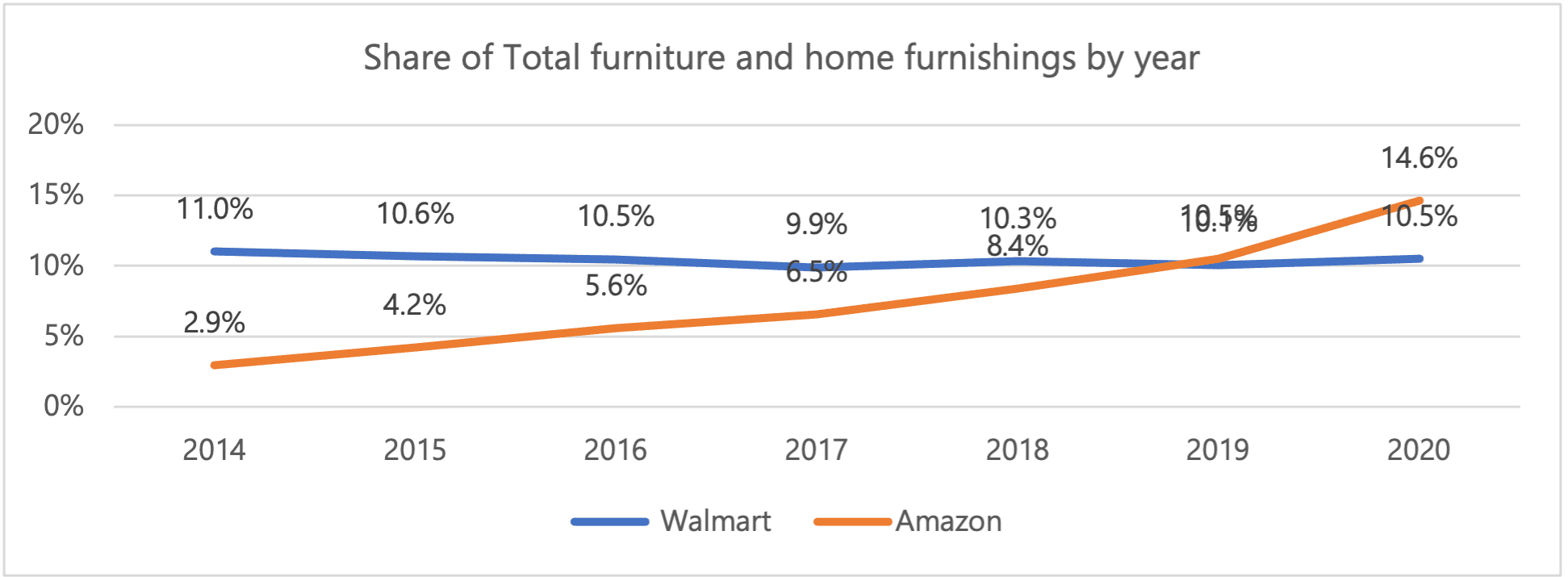

Home furnishings is also an interesting category in that it potentially provides a glimpse at the future trajectory of the overall battle for consumers’ wallets that Amazon and Walmart are currently waging.

Source: PYMNTS data

Five years ago, Amazon’s share of the total furniture and home furnishings market was almost half that of Walmart; by 2019, the two retailers were neck-and-neck; and by the end of last year, Amazon had solidly pulled ahead of the box store giant.

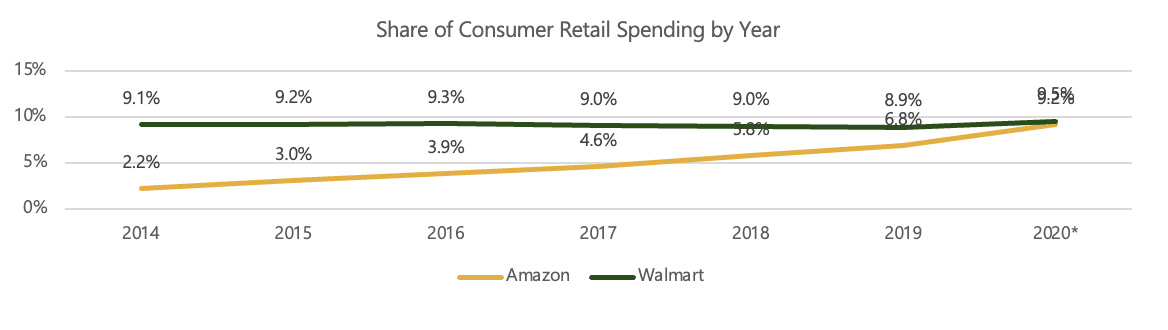

While the same can’t be said for all consumer spending just yet, Amazon last year reached the “neck-and-neck” stage of the race, and previous PYMNTS data has shown that the eCommerce company is set to officially overtake Walmart by the middle of next year — though a 4 percentage point jump akin to that seen in home furnishings is incredibly unlikely.