It’s no great surprise that, given consumers’ stay-at-home lifestyles during the pandemic, avoiding contact wherever possible, many have sought out remote alternatives for their pre-COVID grocery habits. What may be more surprising, however, is the number of consumers who have not changed their habits at all, despite the dramatic increase in pickup and delivery options that have become available in the past year.

Even as businesses ranging from international grocery giants to national chains to smaller, more local companies have been ramping up remote options to make low-contact grocery shopping available to more consumers, many shoppers have opted to stick with the traditional brick-and-mortar experience.

Small But Sticky Habit Changes

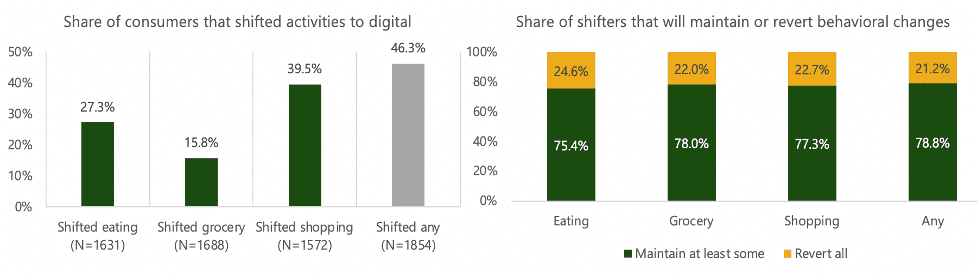

PYMNTS data has found that consumers have gone online for grocery shopping far less than for other activities. While four in 10 consumers have shifted their non-grocery shopping habits to digital more so than before the pandemic, less than half that share — only 16 percent — have shifted to digital grocery shopping. However, what these shifts lack in quantity they may make up for in long-term value — 78 percent of grocery shoppers who have shifted to shopping more online reported that they intend to maintain at least some of these changed behaviors. In fact, these grocery-centric habit changes are stickier than changed dining habits and changed non-grocery shopping habits.

A Lifetime of Loyalty

A Lifetime of Loyalty

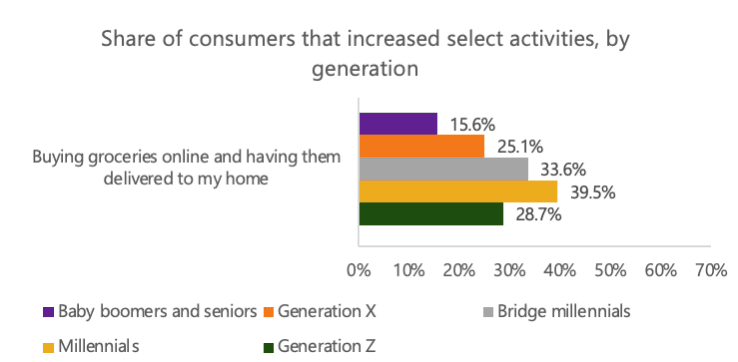

The largest group of consumers who have increased their use of online grocery delivery options are millennials, which is good news for grocers. Apart from Gen Zers, ages 6-24, who tend to be too young to do their own grocery shopping or to do so with significant disposable income for higher-value purchases, millennials represent the youngest group surveyed. Converting these shoppers’ behaviors can lead to decades of future loyalty.

Even older consumers, however, have been trying out grocery delivery in far-from-negligible amounts. One in every six consumers above the age of 57 has turned to these services more than before the pandemic, as has one in every four Gen X-ers.

Consumers Are Largely Happy With Their Grocery Habits

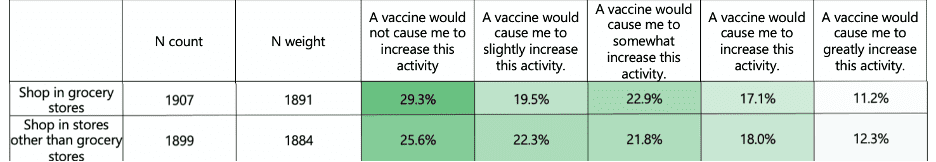

More than half of consumers are happy with their current grocery shopping habits, reporting that even after the vaccine rollout, they would like to continue to shop in grocery stores about the same amount as they currently do, which is significantly higher than the share of consumers who are happy with their current level of non-grocery in-store shopping.

Meanwhile, 38 percent of consumers reported being interested in shopping in grocery stores more often than they currently are. Plus, even if consumers are not reporting that they are especially eager to get back into grocery stores, over 70 percent said that they expect to shop in grocery stores at least slightly more often post-vaccination than they are currently doing. This number is only slightly below the non-grocery in-store shopping levels.

Meanwhile, 38 percent of consumers reported being interested in shopping in grocery stores more often than they currently are. Plus, even if consumers are not reporting that they are especially eager to get back into grocery stores, over 70 percent said that they expect to shop in grocery stores at least slightly more often post-vaccination than they are currently doing. This number is only slightly below the non-grocery in-store shopping levels.

Older Consumers Are Most Eager to Get Back in Stores

Baby boomers and seniors are most eager to return to in-store grocery shopping, followed, somewhat counterintuitively, by Gen Zers. As younger consumers crave the convenience of leading digital features and older consumers seek out the comfort of familiar shopping experiences, brick-and-mortar grocery stores will face a unique challenge: making hybrid technologies such as contactless payments and digital checkpoints widely available, while maintaining the feeling of the more traditional in-store experience.