Along with evergreen conifers, strings of multicolored lights and the musical stylings of Mariah Carey, long lines at retailers are a staple of the holiday season for many consumers, even as an increasing share of people are buying gifts online.

But Kohl’s and Best Buy, in a continuing attempt to remove friction from the shopping experience, are piloting different ways of helping consumers avoid the line. Kohl’s, for example, is testing self-pickup in select stores over the next two months, providing a designated area where customers can access items they ordered online, as well as self-returns, allowing customers to initiate product returns from their phone before arriving in-store.

“We know time is precious during the busy holiday months, and Kohl’s is committed to relieving stress and providing more joy throughout our customers’ shopping experience,” Paul Gaffney, Kohl’s chief technology and supply chain officer, said in a statement emailed to PYMNTS.

Best Buy is also introducing a mobile self-checkout option at select stores this year, allowing customers to use the Best Buy app on their phone to scan and purchase items in-store, then show a digital confirmation on the way out the door.

PYMNTS research has found, in collaboration with Toshiba, that nearly 28% of consumers prefer a self-service checkout experience, compared to 65% who like to end their shopping trip with an employee.

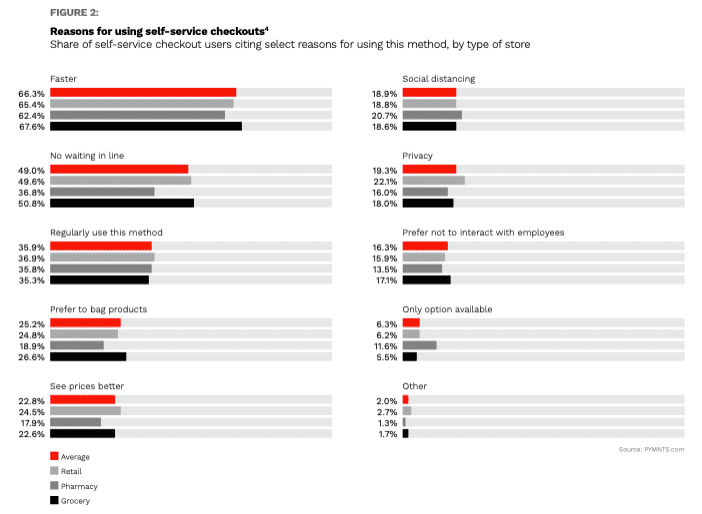

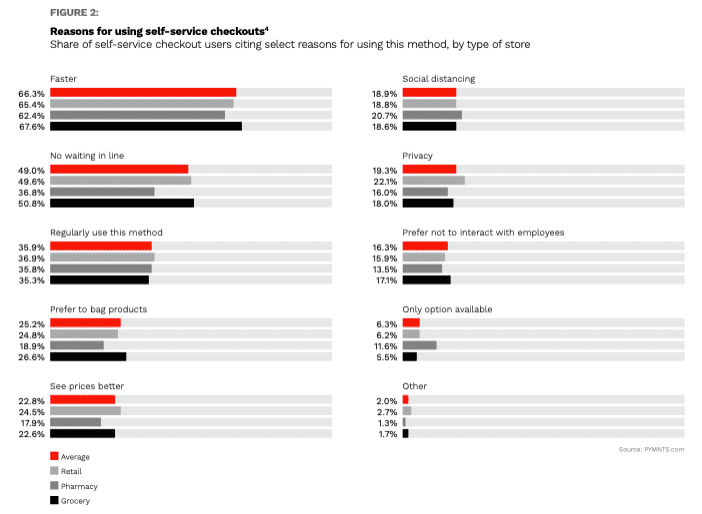

Half of retail consumers said avoiding a wait in line was the most important reason for choosing self-checkout after speed, and 37% say they regularly use self-service kiosks. Additionally, 40% of consumers who used traditional checkout methods said they did so because it’s the only option available.

Half of retail consumers said avoiding a wait in line was the most important reason for choosing self-checkout after speed, and 37% say they regularly use self-service kiosks. Additionally, 40% of consumers who used traditional checkout methods said they did so because it’s the only option available.

Advertisement: Scroll to Continue

Read more: New Study Finds Self-Service Checkout Options Gaining Favor Across Demographic Groups

While self-checkout offers expedience to some people, 29% of consumers believe that self-service is slower than traditional checkout, with 15% expecting kiosks to make a mistake when processing their order and 14% believing the technology is difficult to use. Additionally, a report from the U.K.’s University of Leicester found that theft accounts for nearly 4% of inventory for retailers with self-checkout, compared to just 1.5% with cashiers.

Adapting for Consumers

Kohl’s has been strategically working in recent years to make its business “more relevant to our customers and more efficient in how we operate,” according to CEO Michelle Gass — including through a new rewards program, launched ahead of the 2020 holiday shopping season; a partnership with Sephora to open beauty shop-in-shops in at least 850 stores by 2023; and the ability to return certain Amazon products at any Kohl’s location, which executives have credited with boosting in-store traffic.

Related news: Kohl’s Raises Full-Year Guidance After Q2 Performance

“We’re investing in the shopping experience,” Gass said on a conference call with investors in August, noting that Kohl’s is leaning more heavily into “things like mannequins and storytelling.”

During the holiday season, Kohl’s also said it’s increasing the number of curbside pickup spots and adding pop-up pickup locations within select stores, which PYMNTS data suggest could be a boon for the retailer. Research conducted in collaboration with Carat from Fiserv found that 44% of consumers would be encouraged to shop at physical stores that offer buy online, pick up in-store (BOPIS) and 42% would be encouraged by curbside pickup. Additionally, 23% said they’d be more likely to shop at a brick-and-mortar location if the merchant offered an app to pay online for purchases made in-store.

Read more: Data Brief: 42% Will Spend More at Stores With Online Ordering/Curbside Pickup and Tighter Data Security

Half of retail consumers said avoiding a wait in line was the most important reason for choosing self-checkout after speed, and 37% say they regularly use self-service kiosks. Additionally, 40% of consumers who used traditional checkout methods said they did so because it’s the only option available.

Half of retail consumers said avoiding a wait in line was the most important reason for choosing self-checkout after speed, and 37% say they regularly use self-service kiosks. Additionally, 40% of consumers who used traditional checkout methods said they did so because it’s the only option available.