Lease-To-Own Options Can Help Durable Goods Merchants Reach 79 Million Retail Invisibles

Consumers seeking alternatives to traditional credit are turning their attention to lease-to-own options when purchasing durable goods.

Lease-to-own allows consumers to acquire new items without the commitment of purchasing or incurring long-term debt. That means that consumers who may not be able to afford an outright purchase can make a series of small, affordable payments to lease an item and can purchase at the end of the rental period if they choose, thereby expanding their buying power.

Finding Retail’s Invisibles: Leveraging Flexible Digital Payments To Reach New Durable Goods Customers, a PYMNTS and Katapult collaboration, offers findings from a survey of 2,122 U.S. adult consumers. The report reveals that consumers are drawn to brands and retailers that offer an array of payment options, including lease-to-own payment programs. It also shows the impact of retailers’ and brands’ ability to engage America’s “invisible” consumers — the millions of Americans with blemished credit who find attaining traditional credit to be a challenge.

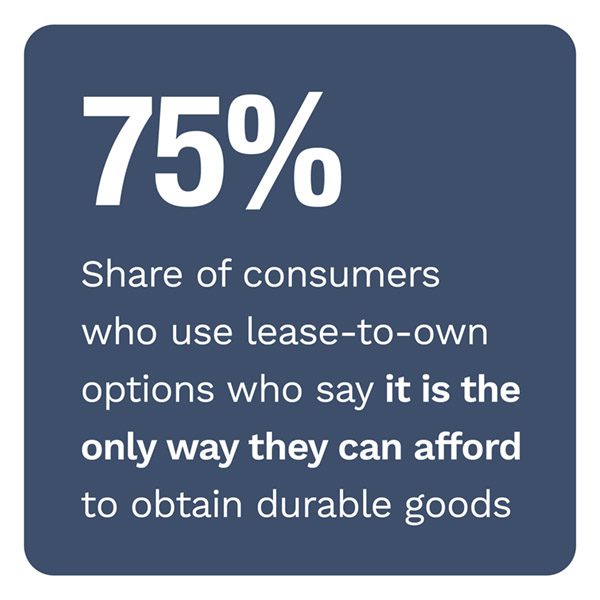

Lease-to-own has become a popular option among consumers who are facing or have endured financial hardship. According to the report, many consumers said lease-to-own options were the only way they could afford to complete a transaction (75%) and that it allowed them to obtain items they needed right away (73%).

The flexible structure of lease-to-own programs makes it appealing to customers. Leasing to own allows consumers to make payments on a product over time while using it — along with early purchase options or the choice to return it without further obligation if it no longer is needed or wanted.

The report also revealed findings that showed lease-to-own options as incentivizing purchases. The survey showed that 43% of former users of a lease-to-own program felt that seeing the payment option at checkout encouraged them to shop with a particular merchant, and 22% of all consumers said the same.

Surprisingly, affluent consumers are also adopting lease-to-own as a new, affordable way to purchase goods. PYMNTS research found that 21% of those who make more than $100,000 annually have used lease-to-own, a percentage that exceeds those in lower income brackets.

Lease-to-own options are also most popular among younger consumers, such as millennials and Generation Z customers, as a way to purchase higher ticket durable goods such as medical and sports equipment.

To learn more about the impact of lease-to-own, download the report.