The latest spate of earnings reports, across the retail sector, and across the payments space (are there any companies left to report?!) all show variations on a theme.

Consumers, with the upswing in vaccinations, with the urge to get out, and for lack of a better word, mingle, have been returning to the stores, en masse. The omicron variant may be a wild card in how long-lived that trend might be … but the pent-up demand is there.

One need only look to the big-box stores to see evidence that walking in the aisles and lining up at the register (or paying in the aisles themselves, if POS devices are handy) have some allure.

As noted in this space, online growth (yes, it’s still growth) is slowing. Across the general retail landscape, the visits to the store — and through the door — are increasing. During commentary on the call with analysts, and against a backdrop where comparable sales were up 12.7%, Target CEO Brian Cornell noted that “traffic was the primary driver of this year’s growth.” To get a sense of the magnitude, management said on the call that since the third quarter of 2019, Q3 store sales have expanded by $3.8 billion, while digital sales were up over the same period to $3.1 billion.

As for Walmart, the company’s results, also reported in November, showed a slowdown in eCommerce growth in the U.S., to 8%, but as noted in this space in the wake of the earnings report, grocery comparable sales were up in the high single-digit percentages, while general merchandise gained mid-single-digit percentage points. Importantly, traffic growth in store gained versus pre-pandemic levels.

Read more: Retail Earnings Show Online Slowdown is In-Store’s Gain

Advertisement: Scroll to Continue

There may be a significant casualty as consumers go back to tangible brick-and-mortar shopping.

As Bloomberg reported, mall operators need to fill empty space the equivalent of 16 “deserted Mall of America” — equivalent to 90 million square feet. To make at least some use of that empty space, mall operators are crafting new physical footprints — turning the unused square footage into casinos, or office or even residences.

“In 2030, you’re going to see most malls are going to be not considered a mall anymore,” said Greg Maloney, chief executive for Americas retail at real-estate services firm JLL, as quoted by Bloomberg. “They’re going to be considered a mixed-use asset.” Once rock-steady anchor tenants like Sears, pressured by changing consumer loyalties, and by the pandemic, of course, have left.

If the flight to big-box operators continues, it will hurt malls. The Walmarts and the Targets of the world are proving adept with omnichannel strategies. Yet the trend toward the digital shift, toward online shopping, over the long haul, may prove inescapable — and will hurt malls.

As Karen Webster wrote earlier in the week, “Consumers have become quite fluent in shopping online – mostly because the merchants they shop with have made it an easy, seamless and friction-free experience. Of course, physical retail isn’t irrelevant, and consumers still shop in stores as well as online. But how — and how often — they use the physical store is changing.” To be specific, stores are evolving into showrooms — where consumers look but don’t buy — or are evolving into points of pickup.

For the malls, it’s been a long, slow spiral, noted, too, by Webster in 2014 … when foot traffic was already feeling the pinch. Now the tailwind of change has turned into a tsunami.

Read here: The Coming Physical Retail Death Spiral

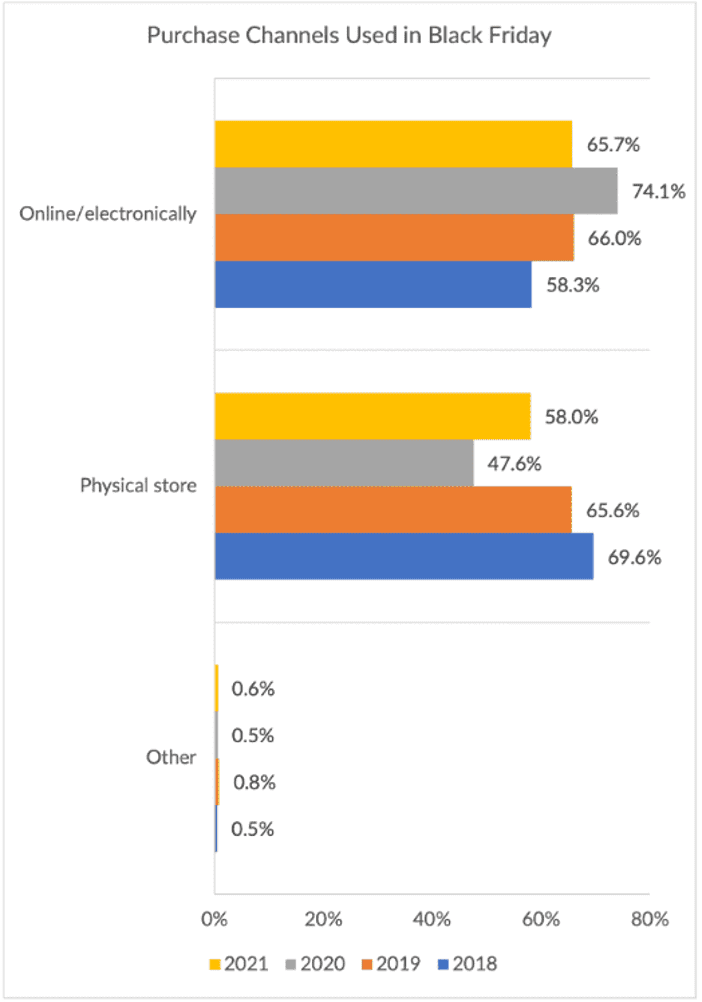

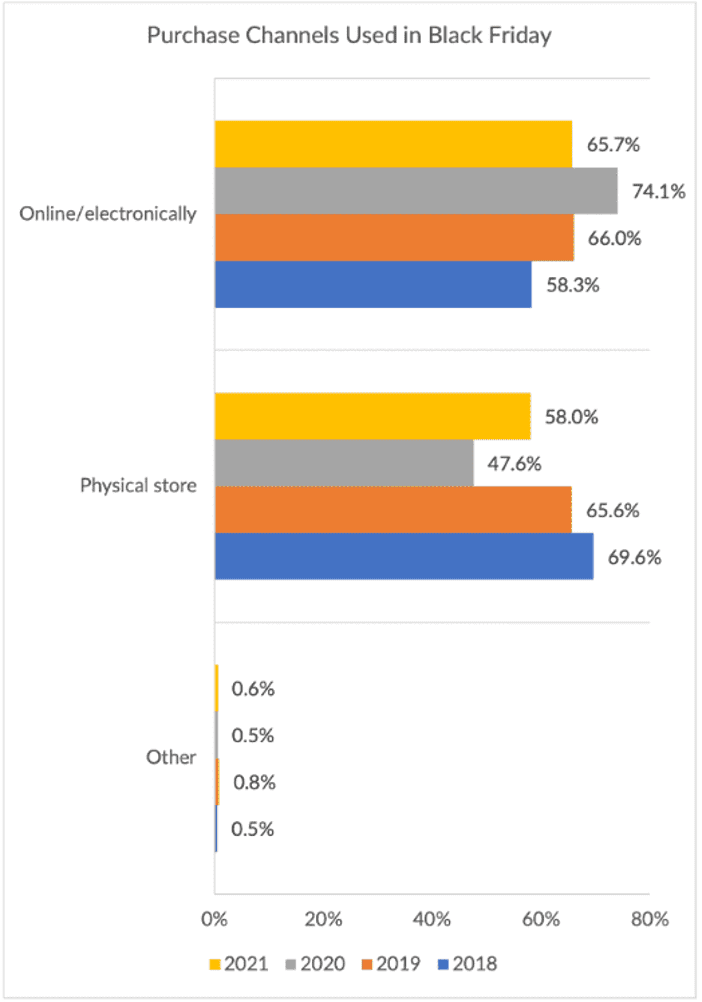

And it’s not really the case that a rising in-store tide has lifted all boats. PYMNTS’ own data has shown that, overall, physical foot traffic declined during the all-important Black Friday shopping season, at least as defined against 2018 — which for retail overall, means that the trend for in-store shopping, in general, has been … well, downward. For the retailers that make their bread and butter on brick-and-mortar conduits, the ongoing challenge will be to become marketplaces that offer the same convenience/streamlined experiences that consumers have found so valuable online. For malls, the pivot means trying to maintain at least some relevancy in retail, while figuring out how to re-invent themselves — no easy task for these operators, which were once the “go to” bastions of commerce.