Policy abuse can cause retailers to lose more than 2% of their revenue each year, and yet only 46% of firms use internal technology to automatically identify repeat abusers, making it easier for unscrupulous customers to get away with fraud.

In Beyond eCommerce Fraud: How Retailers Can Prevent Customer Policy Abuse, a PYMNTS study done in collaboration with Forter, researchers found that 39% of retailers rely on manual review to identify repeat offenders, including over 63% of small firms making up to $250 million annually. Another 24% of companies rely on third-party technology, including 37% of the largest retailers.

The findings come from a survey conducted in late August and early September of 100 executives representing businesses in the retail sector that generate at least $100 million in annual revenue. The most common types of policy abuse include item not received (INR) abuse, in which a customer falsely reports theft or non-delivery of an eCommerce purchase; return abuse, when a customer returns items that are not eligible for return; and promotion abuse, when a consumer uses multiple accounts to take undue advantage of rewards, sales or other promotions.

See the report: Good Customers Gone Bad — Retailers Lose $89B Annually to Return Policy and Promotions Abuse

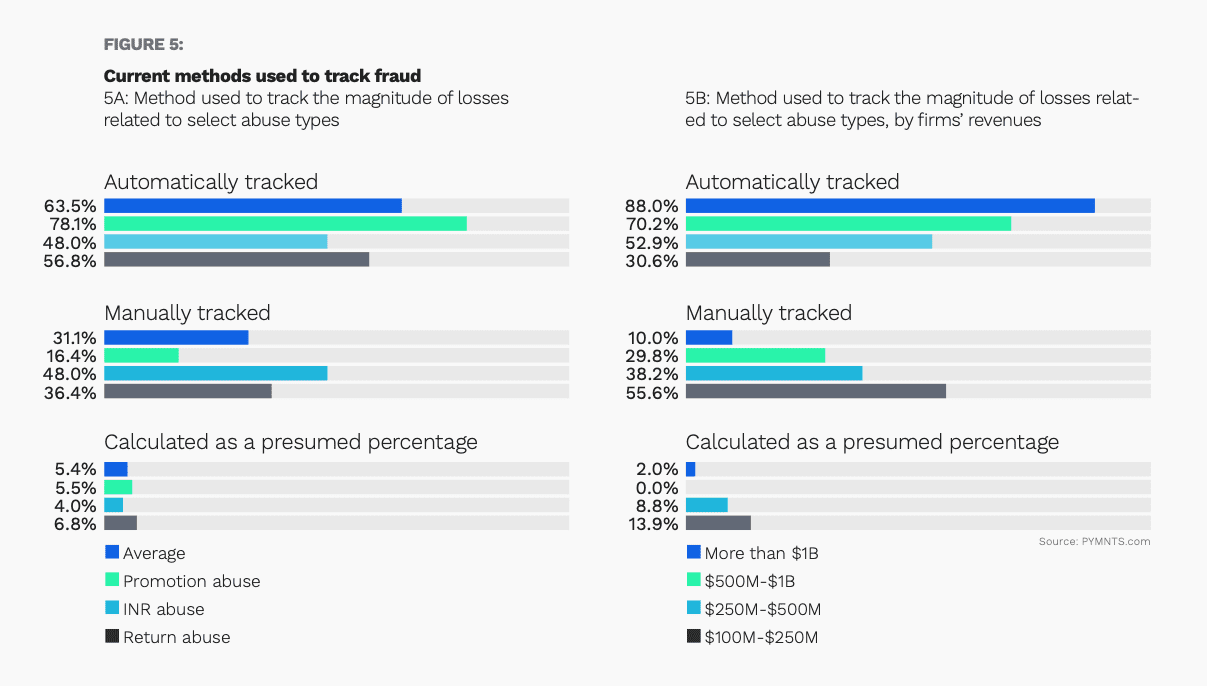

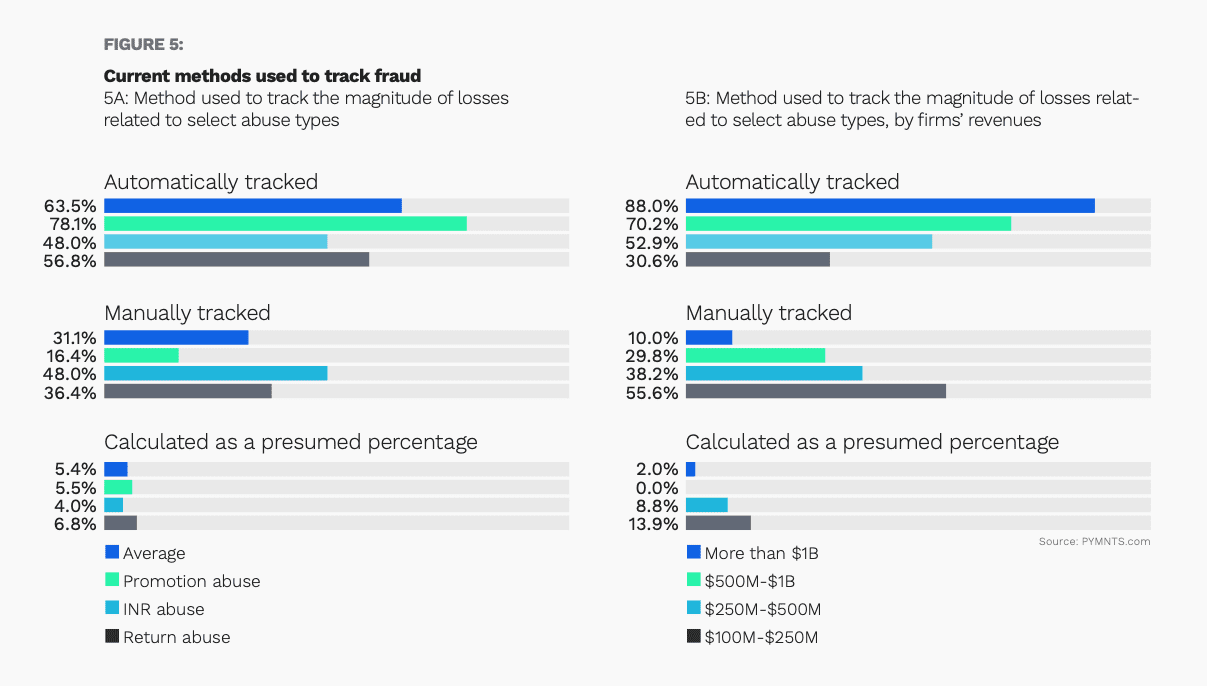

Retailers who experienced promotion abuse in the last 12 months were the most likely to automatically track the magnitude of their losses, at 78%, compared to 48% of those who experienced INR abuse and 57% who experienced return abuse. Nearly half of those surveyed manually track INR abuse, and over one-third manually track return abuse.

Divided Prevention of Abuse

Advertisement: Scroll to Continue

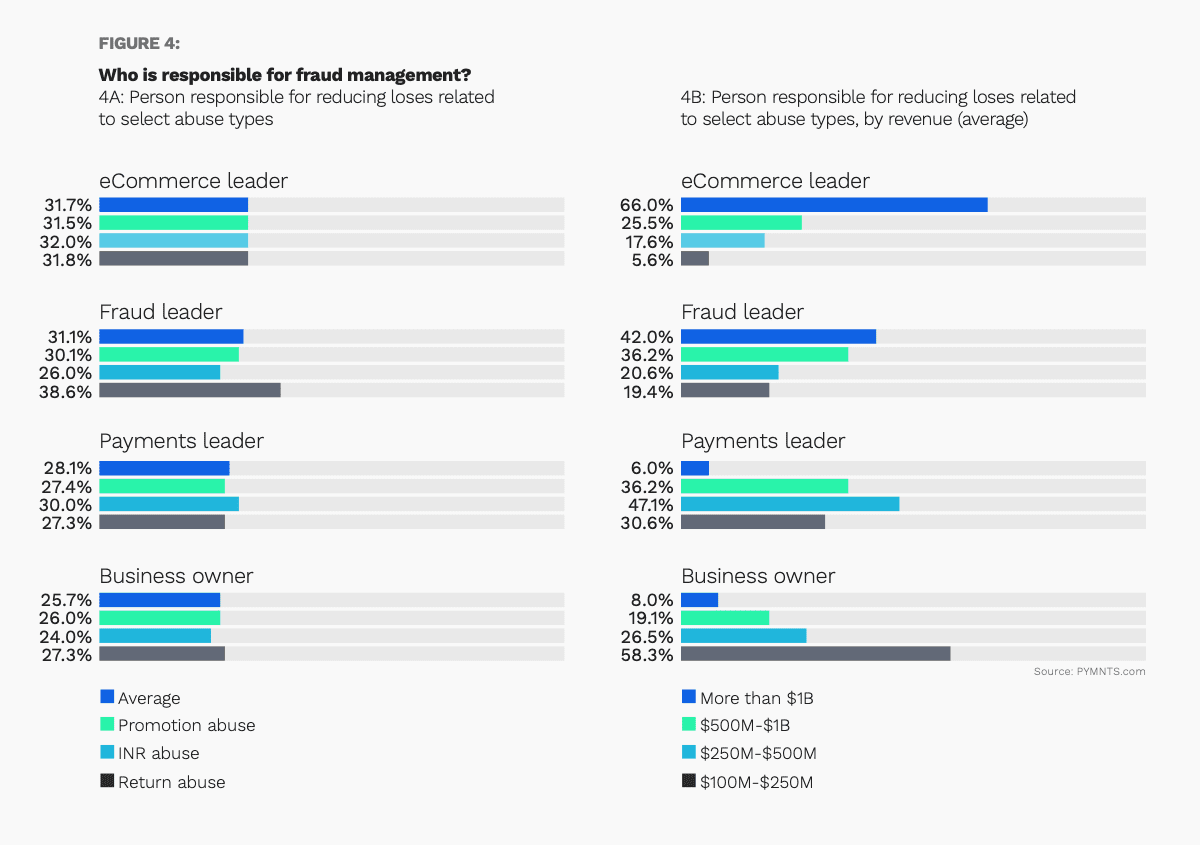

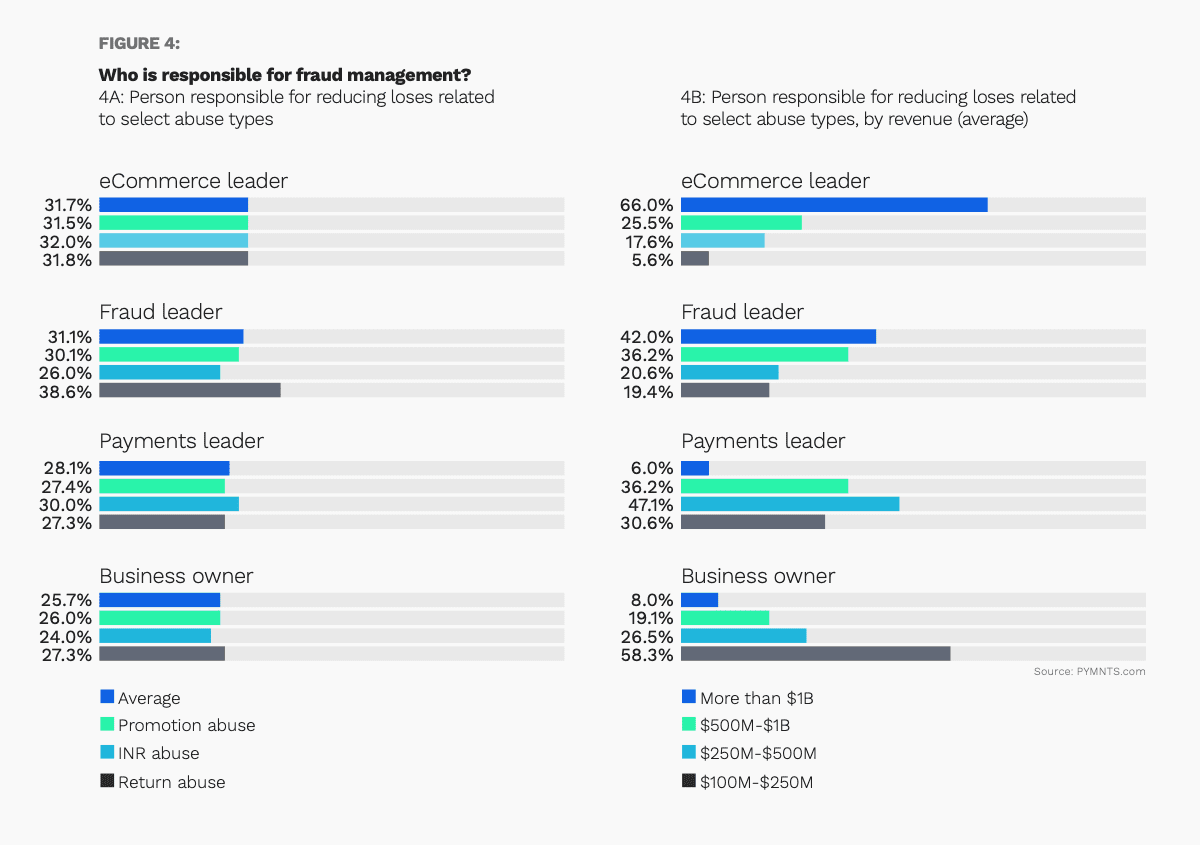

Another factor that potentially makes it difficult for retailers to manage policy abuse is the number of people who are involved. On average, only 31% of firms that have observed abuse in the past 12 months say leaders of anti-fraud efforts were responsible for the day-to-day reduction of abuse-related losses. Similar shares of firms delegate this responsibility to other managers, such as eCommerce leaders (32%), payments leaders (28%) and business owners (26%). Smaller firms are more likely to rely on business owners to reduce losses related to policy abuse, at 58%, while two-thirds of large companies say they look to eCommerce leaders.

As researchers note in the “Beyond eCommerce Fraud” report, the “generally dispersed nature of responsibility … can lead to poor management of the day-to-day challenges of assessing and addressing abuse,” and make it difficult to create cohesive, organization-wide strategies.

Related: Retailers Getting Hit With $90B of Bogus Returns, Promo Abuse

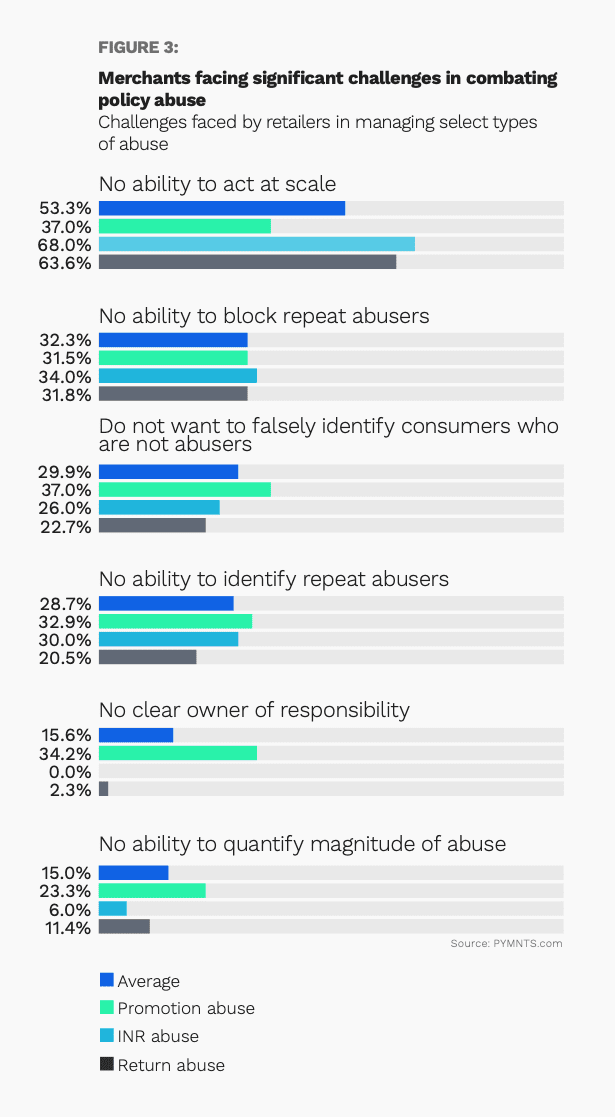

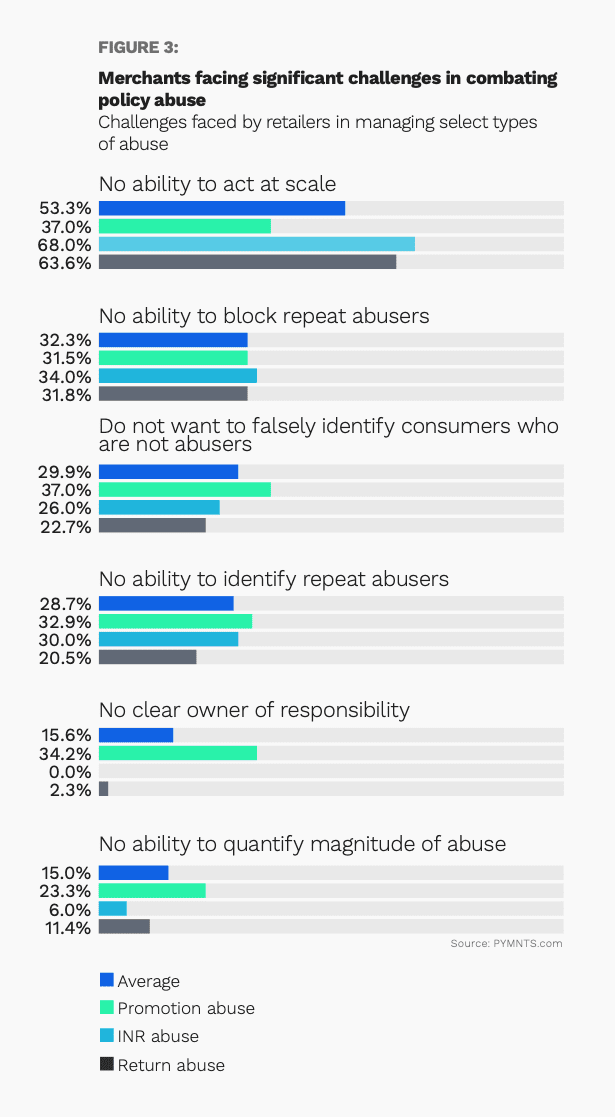

The data show that over half (53%) of merchants say the lack of an ability to act at scale is a significant challenge in preventing fraud, with 29% having no ability to identify repeat abusers and 16% citing the lack of a clear owner of responsibility as major barriers. Fifteen percent of retailers say they have no ability to quantify the magnitude of abuse.

Read the study: Beyond eCommerce Fraud: How Retailers Can Prevent Customer Policy Abuse