This year, the program’s focus is on the future — how to move forward — with a number of high-profile speakers slated to offer their perspectives on what it will take for the retail sector to recover. A big part of the agenda is about the shift to digital in a world where, according to PYMNTS research, more than 124 million Americans have already made the digital shift for shopping for retail products, groceries and food from restaurants since March of 2020. This same research suggests that more than 75 percent of all digital shifters say they plan to keep some or all of their digital habits.

The digital shift, as PYMNTS defines it, is doing less in the physical world and more in the digital world for the same activity.

The digital shift, as PYMNTS defines it, is doing less in the physical world and more in the digital world for the same activity.

Let’s hope the discussion isn’t much too little and way too late, but is more about how to respond to retail’s COVID-19 wake-up call.

COVID-19, of course, didn’t cause physical retail’s steep decline — it just accelerated it. I wrote a piece in 2014, right around this time, that made the strong case for the decline of physical retail. The 2013 holiday season then began to show signs of the shift to online and digital, and away from brick-and-mortar retail. The first three quarters of 2013 showed eCommerce sales growth of 17.4 percent — already enough to chip away at physical retail’s sales and the shoppers who once showed up at the mall.

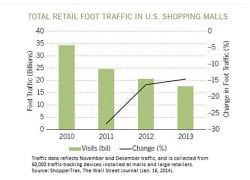

To a shopper in the malls that year, the lack of foot traffic was palpable. Gone was the hustle and bustle of shoppers milling around looking for that perfect holiday gift. The shopkeepers I asked in the malls confirmed the waning foot traffic — not just that year, but also prior years. Data assembled by ShopperTrak and published by The Wall Street Journal in January of 2014 only quantified the steepness of that decline — starting as early as 2011.

Advertisement: Scroll to Continue

Over the years, a healthy, employed consumer in a strong and vibrant economy masked the reality of physical retail’s slump. So did Census data, which still reports that 84 percent of retail spend is done in the physical store.

But as every retailer knows, it’s the devil in those details that paints a far less optimistic picture.

Like this one.

Mastercard’s Spending Pulse data for holiday 2020 showed that eCommerce sales were up 49 percent between the extended holiday shopping season spanning from Oct. 11 to Dec. 24. Department store sales — the poster child for physical retail sales and the anchors in the malls that once drove foot traffic and spend — were down 10.2 percent. That in itself isn’t surprising, as consumers still fearful of COVID stayed away.

But those same shoppers didn’t shift their spend to those stores online. For that category of physical retail, eCommerce sales grew only 3.3 percent. The gap between the department store’s 3.3 percent sales growth and the overall growth rate of 49 percent are those shoppers who went elsewhere to buy what they needed during retail’s make-or-break holiday sales season.

Which means the conversation about physical retail’s future is about a lot more than making it more digital.

The lines between physical and digital, once blurred, have now collapsed. Retail’s survival is now about making physical a part of a digital shopping experience.

And that leads to the must-have conversations about the five retail realities that transcend channels and tactics, but will decide who gets this very digital-first shopper’s attention – and her spend.

Retail is now about logistics and the last mile.

The “Amazonification of retail” isn’t just because Amazon made it easy for consumers to find what they want to buy among the 350 million products in its marketplace and then pay for it. It’s also because Amazon made it fast and easy for consumers to get what they want to buy — and for an Amazon Prime member to get it delivered fast and for free.

In the burgeoning bring-it-to-me economy, retail is now about meeting the consumer where she wants to shop — increasingly at home — and letting her take possession of those purchases at her doorstep.

PYMNTS research shows that nearly five times more consumers want products delivered to them than picked up curbside. A far less desirable option for consumers is to pick up items ordered online in the store.

It’s not surprising.

Many retailers haven’t mastered the logistics to make the in-store pickup experience anything but friction-filled. Whether it’s having to park the car and go into the store to pick something up, or being presented with an in-store pickup option days past the time of the order, the associated hassles are causing consumers to increasingly opt for delivery — and they expect that delivery experience to be free.

Yet, as the Global Digital Shopping Index shows, retailers continue to invest in pick up in-store options because it’s what they want consumers to prefer. For a digital-first consumer who’s already opted to shop and pay online, it’s an option — and therefore a retail investment — that more reflects the retailer’s interest in getting feet in-store for an additional sale than what their customers want and use.

Forward-thinking retailers understand this, and are investing in the last-mile logistics that tap into the consumers’ interest in skipping the in-store shopping experience. Whether it’s investing in their own delivery capabilities, tapping into third parties with logistics experience, or experimenting with delivery robots or delivery drones, retail’s survivors will see the future for what it is — consumers who would rather shift the first and last mile of the shopping experience to the retailer, who can, literally, deliver that for them.

It’s not what the consumer can do for the store – it’s what the store can do for the consumer.

Consumers have a newfound appreciation for time, and for the digital tools that make it easy for them to save that time and shift it to other, more valuable activities. Consumers also say that the digital experiences of retailers large and small have made doing online business with them easier than ever before. Retail’s survivors will recognize that reality, and will invest in the digital tools and technologies that don’t force consumers into the physical store, but bring the physical store to them.

That means using digital channels to make the online and in-store shopping experience seamless for shoppers, as the savviest retailers are now doing. Video apps that enable stylists, designers and knowledgeable store associates to interact with a shopper, show her things that she might want to buy, curate a room of furniture or an outfit, show her how to apply makeup, and make the store less the destination than a virtual showroom that she can engage with over Zoom. Retail’s survivor will turn the in-store buying experience on its head. Rather than forcing consumers to make the sale in the store, it will enable the sale to be made in the home after a series of those video encounters — up to and even including bringing those items into the consumer’s home for them to see, or maybe even try, before they buy.

Retail survivors and thrivers will invest in the apps and digital tools that eliminate friction from the shopping experience.

This year, in something of a departure from results in years past, the annual How We Will Pay study of a national sample of 6,000 consumers in August of 2020 shows a consumer much more motivated to try apps that increase the likelihood that what they buy online will fit their needs. Consumers now express a strong interest in using AR (augmented reality) and VR (virtual reality) technologies that offer more clarity about how the things will look on them or in their homes or offices before they buy, including apps that virtually simulate how clothes will look and fit. Visual search, and voice assistants that assist with shopping, including sending consumers suggestions about what to buy, eliminate shopping friction by making a trip to the store an option, not a requirement. These options save the consumer time — and time is the currency that consumers now think long and hard about before spending it.

Retail survivors will also recognize that it’s just as high of a priority to make the store more accessible to a consumer for which delivery fees make an entirely digital shopping experience too expensive and out of reach. According to PYMNTS research, the in-store shopper for retail products is lower-income, on average earning less than $50,000 annually. For those consumers, the store can invest in the apps that make the physical store more accessible — the capability to digitally order and pay ahead for curbside pickup, touchless payments to make the in-store shopping experience safer and more secure, and alternative credit options that offer a responsible way to finance bigger-ticket purchases.

Retail’s competition is the marketplace, not other category competitors.

Okay, that might not be a newsflash. But for a retail community that still seems to find great solace in the fact that 84 percent of retail sales still happen in-store, it’s certainly worth repeating.

Take Macy’s — the once-iconic department store with a market cap today of $4 billion. Its biggest competitor for clothing and accessories isn’t Kohl’s (market cap of $6 billion) or Ross Stores (market cap of $41 billion) or the specialty retailers that once lined the malls. It’s Amazon.

According to PYMNTS analysis, as of Q3 2020, Amazon had a 14.3 percent share of all clothing and apparel sales, up from 9.5 percent a year earlier, and a 42.5 percent share of online clothing and apparel sales, up from 40.6 a year earlier. (By contrast, Walmart’s share of apparel is 7.4 percent for the same period, down from 10.5 percent a year earlier.)

Furniture stores — and even Home Depot and Lowe’s — may compete with each other, but the competitor they’re all eyeing is Wayfair, which as of Q3 2020 was reported to have a 33.7 percent of online furniture and household accessories in a category that has increasingly shifted that way.

Local consignment stores and antique shops no longer compete with each other for the supply of used clothing and accessories and the shoppers to buy them, but instead, they compete with online marketplaces like Tradesy, Poshmark, The RealReal, Chairish and 1stDibs.

Consistently, in every consumer study PYMNTS has done over the last several years about the retail shopping behaviors of the U.S. consumer, it’s product — not price — that is the No. 1 reason cited for deciding where to start their shopping journey.

In an online world, where things are delivered to the doorstep, location is irrelevant. Choice is in — and marketplaces are the most efficient way for a consumer to get items, completely unconstrained by the location of the product she wants to buy.

Brands and products, not stores, will drive the search for the products consumers want to buy — even for many well-known brands for which marketplaces may also regarded as a competitive threat. Going where the eyeballs and consumers are searching with an intent to buy can be an on-ramp for their own direct-to-consumer sales and brand-building, offering one set of experiences on a marketplace and a more personalized experience on their own D2C channels — as well as a way to become part of a larger, broader ecosystem where their products may be a relevant complement. The physical store becomes less relevant as digital marketplaces open the doors much wider to new customers and potential sales.

For innovators, there’s an opportunity to aggregate the longer tail of D2C brands and Main Street businesses to be found on marketplaces, and for their products to be easily searched and purchased that way — making the store a smaller part of their retail sales mix. In fact, we see it happening. Research shows that the Main Street Businesses that have embraced digital channels and marketplaces to sell their products have performed better over the last ten months than those who did not. Their physical storefronts are still open but drive less of their overall sales.

Today, that experience can be very fragmented for both the buyer and the seller – there are too many places to look, with a lack of density of buyers and suppliers to keep them interested and coming back. One of the most clever applications in retail that saw this trend before anyone else is Farfetch, a public company founded in 2007 with a market cap of $19.7 billion that created a network of independent boutiques all over the world to sell their designer clothes to anyone with a PC or a smartphone.

It’s a model, and a network, that’s the foundational concept for antiques and vintage home goods and accessories like Chairish and 1st Dibs and restaurant aggregators like DoorDash and Grubhub. No doubt others with the vision to do that at scale for retail will emerge.

Voice will make commerce on demand and stores invisible.

We’ve seen a steady uptick in the number of consumers who’ve embraced voice for commerce over the last several years, a trend that the work-from-home dynamic has only underscored. According to PYMNTS’ latest research, 9 percent of all U.S. consumers have ordered something using voice as the channel, most often when making purchases of food (groceries and takeout).

Voice not only makes commerce on demand, it multitasks it. Adding items to a shopping cart while standing in front of the fridge or pantry, or asking Google or Alexa to order takeout in between Zoom calls, is fast, convenient and efficient. In fact, this same PYMNTS research suggests that voice is the most relevant commerce enabler when consumers are engaged in doing something else — driving their car, taking care of the kids, making dinner — and a commerce enabler that 39 percent of all consumers now say they’d most like to integrate into their shopping experience.

It’s also still pretty nascent as a commerce driver — but perhaps not for long. In many ways, voice is the ultimate enabler of a seamless shopping experience — one that transcends physical and even digital channels. For voice to emerge as a powerful commerce enabler, it needs to be part of a multimodal experience — where consumers speak, see and then say “buy,” either via their mobile devices or computers. For the consumer, it’s easier than clicking or swiping. For retail stores, it pushes the store brand to the back, the fulfillment part of a shopping experience where ordering by voice saves them time.

The digital shifters drive retail spend — and they aren’t going back to the stores as they once did.

Forty-one percent of retail shoppers have shifted digital since March — a steady increase over the last 10 months, now representing some 103 million consumers. And 75 percent of them say they have no intention to return to the stores the way they once did. A consumer who was already very digitally engaged has, over the last 10 months, further honed her digital habits.

These digital shifters are also retail’s biggest spenders. Forty-three percent of them earn more than $100,000 per year, and are college-educated and employed. They have the means, and they have options for how and where to spend their money — and they are increasingly spending it online and having their purchases delivered.

Of course, it’s not as if the physical store isn’t on their radar — these digital shifters are not digital-only shoppers.

But they are the advance guard for what the retail experience will look like, the physical store when going to one is a welcome part of the shopping experience, and the profile of the retail shopper that retailers will increasingly covet.

The five realities that I laid out for physical retail may seem harsh, but its future doesn’t have to be.

The lessons of the last ten months have shown how resilient the retail sector can be when challenged to think differently about serving its customers, and using new business models and methods to do so. The mistake is in thinking that the reopening of the physical economy — and we all hope that is sometime soon — will snap things back to where they were in December of 2019. Of course, there will be pent-up demand to shop in the store, but the consumer’s expectation of that experience will be different.

Consumers in the U.S., U.K. Australia consistently rate the in-store shopping experience as the least satisfying, in part, because the digital tools and experience they have online are missing when they do shop in stores.

For the physical channel to remain a relevant part of the retail mix, retailers must consider that data point in their 2021 call to action.

The

The