Roughly a year and a half after launch, Walmart’s membership program, Walmart+, seems to be falling short of the key goals part of any commerce subscription plan: Getting consumers to spend more, and more often, each time they visit.

Doing so will be critical as Walmart strives to capture more share of retail spend against Amazon. But so far, the data indicate that some structural issues are acting as headwinds — the members are not filling their baskets as heavily in Walmart’s aisles as they are at rivals.

In the latest PYMNTS report, “The Benefits Of Membership: Mass Retailers And Subscription Services,” across the broad spectrum of Walmarts competitors — including Amazon, Target, Costco and Sam’s Club — members are spendng more, especially online, than non-members, often by significant sums.

But that traction, at least so far, is not evident at Walmart.

Read here: The Benefits Of Membership: Mass Retailers And Subscription

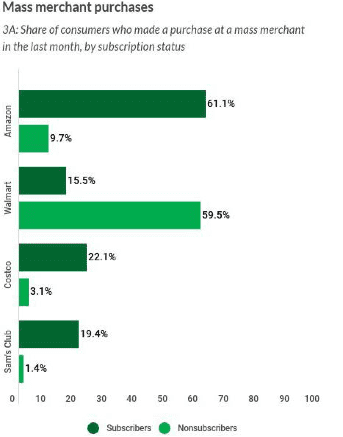

PYMNTS data show that Amazon Prime members spent 113% more than nonmembers. By way of contrast, Walmart+ members spend only 15% more than nonmembers each month when shopping online.

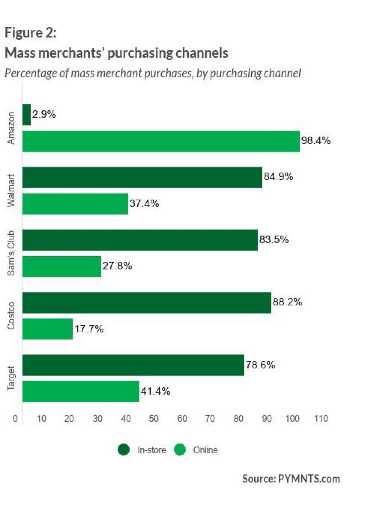

And perhaps most starkly: They spend 10% less than nonmembers when shopping in-store. We also found that the roughly 85% of all transactions made at Walmart were made at brick-and-mortar locations, as seen in the chart below:

Thus, Walmart’s top line remains tied to to non-members coming through the doors, and spending. Delivery, as a competitive advantage — a key selling point for Amazon, naturally — falls by the wayside, since individuals are getting what they want at the point of physical interaction, loading up the car trunk and driving home. Walmart’s subscription service offers free shipping, free deliveries on orders of at least $35 and members-only discounts on gas. For the members shopping on site, it is the latter offering that holds appeal.

Dig a little deeper, and Walmart’s upside-down metrics — non-members are the key to growth, at least in physical commerce — are company specific. At Costco and Sam’s Club, members spend 101% and 109% more in-store than nonmembers, respectively (Sam’s Club has in-store metrics similar to Walmart, where roughly 85% of customers choose that channel). Same channels, different results, which implies that the rewards the Costco and Sam’s Club programs are offering are proving successful.

Refining the membership benefits on offer will be important, especially in an inflationary environment. Walmart’s niche is “everyday low prices.” The respondents tracked by PYMNTS across all mass merchants show that 36% of respondents declared an annual income of more than $100,000 — indicating that they have spending power but will likely want something beyond delivery and discounts on gas to sign up, and keep spending once they are signed up. Price is no longer an overarching competitive advantage, since only 25% of respondents say that the price tag is the most important consideration when choosing their retailer.

There’s overlap here too: If 166 million consumers are subscribed to Amazon Prime, and 38 million hold Walmart+ memberships, a significant percentage of the population are members of both clubs.

Roughly 61% of Amazon members made a Prime purchase in the past month, but only 15% of Walmart+ members did so in that timeframe (see chart below), which indicates that when subscribers want to take advantage of rewards, they’re doing so, online, with Amazon, for factors beyond price.