Last week’s brief pre-season promotional push of big-screen TVs and gadgets has instantly and unceremoniously been replaced by both retailers with a mix of Hauntingly Good Prices on costumes and candy as well as a palette of fall fashion in orange, red and gold.

The sales are over and the near-term tallies, at least from Amazon, suggest a slowing of demand and basket size compared to the summer’s Prime Day event three months ago. It also remains to be seen what the ultimate impact of the earliest holiday sales ever will have on peak season two months from now.

“Ultimately, we view this Early Access event as incrementally beneficial, as both a branding event for Prime and potentially smoothing holiday demand [by] aiding with logistics,” Merrill Lynch analyst Justin Post wrote in a note that was summarized by Seeking Alpha.

Expect the Unexpected

Nowhere was the rapidity of change and unexpected upheaval that impacts the nation’s two largest retailers on any given day more evident this week than in the proposed $24 Billion mega merger between Kroger and Albertson’s, who together did $210 billion in sales last year, compared to Walmart’s $264 billion, which PYMNTS has reported is 10x larger than Amazon’s $27 billion stake in the food category.

Whether or not the tie-up between the top two pure play grocery retailers will be completed, attract competitive bids or get blocked by antitrust regulators remains to be seen, but it has already triggered a parlor game of sorts in trying to handicap the ramifications on other players in the space.

Advertisement: Scroll to Continue

Depending on your perspective, the addition of an even larger heavyweight contender in the grocery fight could be good or bad for Walmart. On the one hand, the comparably huge Kroger-Albertson combo would essentially flank the operator of 5,300 Walmart Super Centers and Sam’s Clubs in the U.S. and leave it exposed to aggressive competitors above and below.

If nothing else, focusing on a second rival in food could diminish the attention Walmart pays to Amazon, where food and beverage stands as one of only a handful of major categories where it still holds a lead over the ecommerce giant that also owns the 500-store Whole Foods franchise.

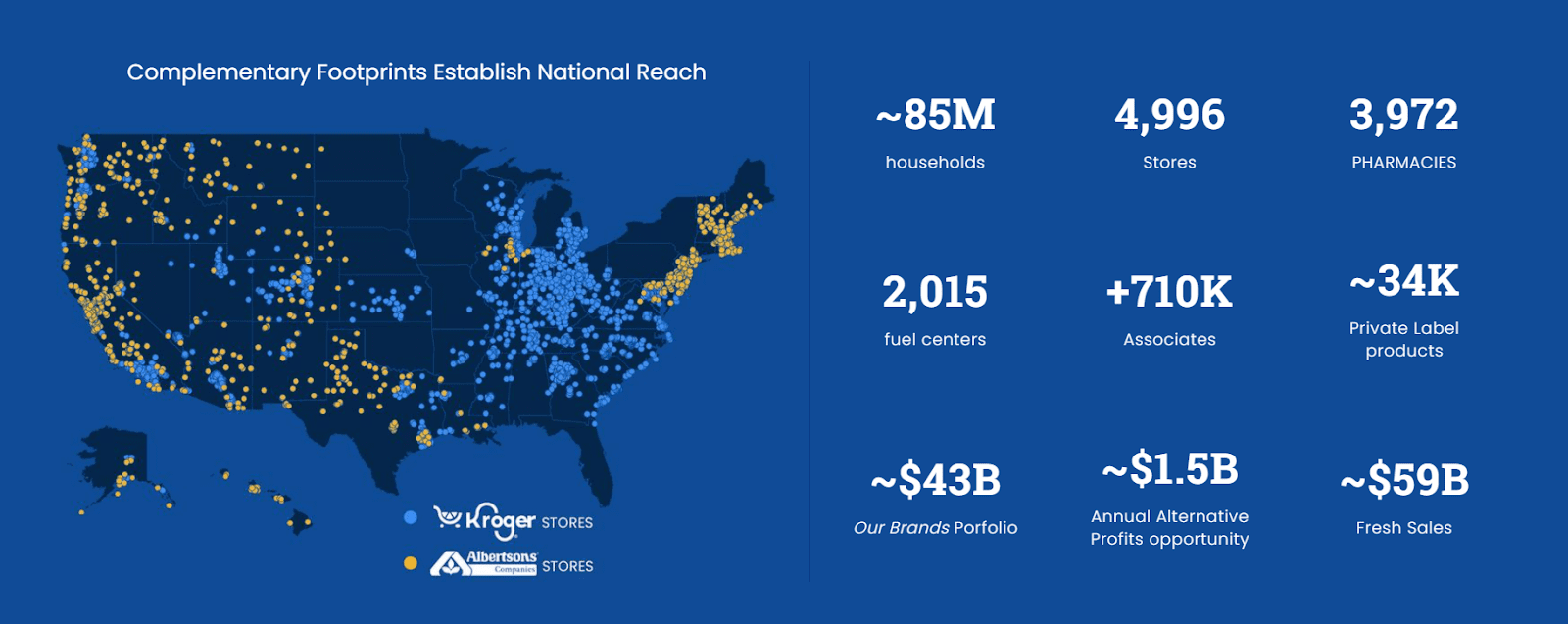

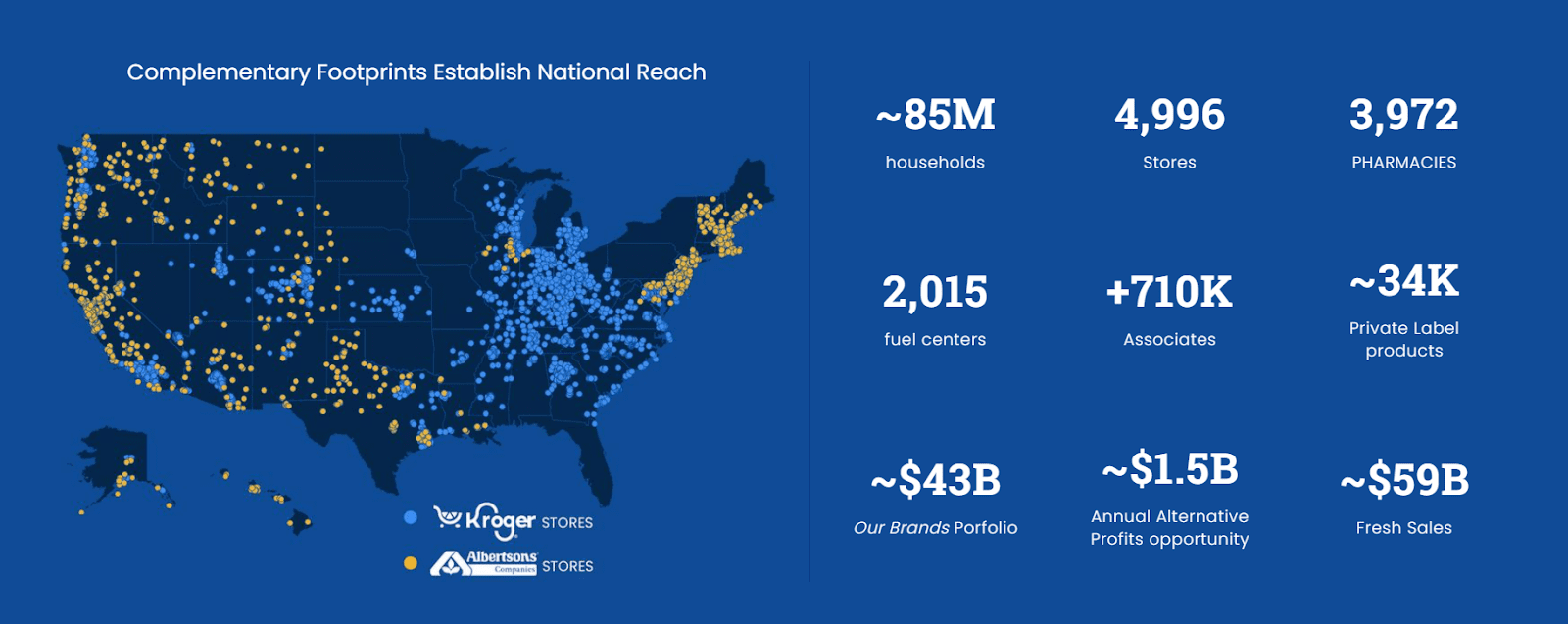

On the other hand, it’s not as if Kroger and Albertson did not already exist, as their attached combined footprint chart shows the two have nearly 5,000 stores, 4,000 pharmacies and 2,000 gas stations.

This fact alone would likely galvanize Amazon into action to more aggressively expand its physical grocery stores faster than the piecemeal rollout of the Amazon Fresh chain. A counter bid or subsequent brand buyout of its own should not be ruled out as a way to rapidly gain the necessary square footage.

The fact that all of this is happening on the very day that September retail sales came in flat and also at a time when the normally dull, low-margin grocery business has taken on a renewed importance amid high inflation and changed consumer buying habits is certainly worth noting.

Whether the short-term appeal of groceries will remain after the economy stabilizes, and what that industry will look like, is also up for debate.

What is known for sure is that a lot of fresh questions concerning consumer demand, sentiment, and strategy just entered the retail space over the past week, and that Amazon will be first up to answer them two weeks from now when it reports its third-quarter earnings on Thursday, Oct. 27.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.