Deal-Seekers Pulling Trigger on Essentials Drove Amazon Prime Day Spending 40%

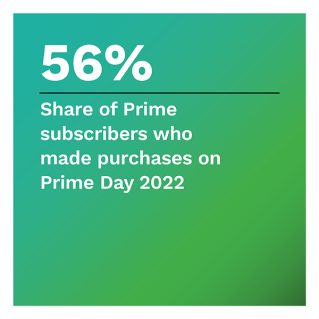

Amazon Prime Day 2022 came at a time of skyrocketing inflation and fears of a recession, but Amazon’s flagship annual extravaganza still recorded a strong turnout. Median spend rose significantly, fueled by consumers’ purchasing of a variety of small-ticket items.  Fifty-six percent of Prime subscribers made purchases, down slightly from 2021, while Walmart+ Weekend 2022 experienced a notable 24% participation decline from last year’s event.

Fifty-six percent of Prime subscribers made purchases, down slightly from 2021, while Walmart+ Weekend 2022 experienced a notable 24% participation decline from last year’s event.

“Prime Day 2022: Inflation Hits But Amazon Still Wins” examines how shoppers are handling Prime Day and Walmart+ Weekend during a stormy year, taking a deep dive into the recent major sales. PYMNTS surveyed 2,199 Amazon and Walmart subscribers between July 14 and July 18 and 3,245 shoppers in total to gauge how the two events performed among their respective membership bases and reveal the meaning of new purchasing patterns across demographics and product segments.

Our findings include:

• Prime Day shoppers spent 40% more on average in 2022, despite cutting back on big-ticket items.

• Prime Day shoppers spent 40% more on average in 2022, despite cutting back on big-ticket items.

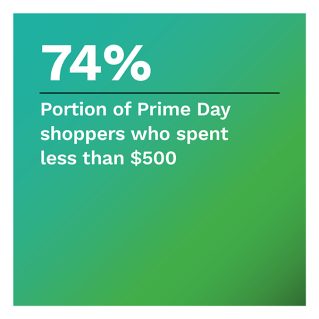

This year, Prime members who shopped on Prime Day increased their median receipts to $175, up 40% from 2021, but nearly three-quarters of shoppers spent less than $500. However, many shoppers likely accelerated purchases to secure savings, cannibalizing future sales. We also noticed increased purchases in nearly every major category, suggesting that value-minded consumers aimed to buy many smaller goods from a variety of industries this year.

• Consumers who participated in both Prime Day and Walmart+ Weekend this year tended to prefer Prime Day.

Among consumers who belong to both Prime and Walmart+ and shopped at both eTailers’ flagship events, 44% pointed to Prime Day as offering better deals, and only 30% preferred Walmart+ Weekend.

• Inflation significantly dampened Prime Day spending, yet the most financially pressured consumers actually ramped up their spending.

Large shares of Prime members who were aware of Prime Day 2022 said they either skipped the event or bought less due to inflation. Nearly one-quarter of Prime members who earn less than $50,000 per year said they did not buy because prices were higher, while 11% of those earning over $100,000 indicated the same.

Prime members who live paycheck to paycheck and struggle to make ends meet ramped up their Prime Day spending, however. Their median receipts rose $48 year over year, reflecting strategic deal-seeking more than splurging.

“Prime Day 2022: Inflation Hits, But Amazon Still Wins” examines how Prime and Walmart+ are faring during a stormy year and takes a deep dive into the recent major deal events.

To learn more about how consumers are handling the two sales events, download the report.