After years of obsessing over the buying behavior of millennials, retailers and brands are now pivoting to the next big thing, specifically, the Generation Z cohort, whose oldest members were born in 1997 and are now turning 25, have incomes, and shop and spend differently than their millennial counterparts.

What’s becoming critical to business is figuring out what this demographic wants in commerce and payments experiences given perceptions that have been shaped by a string of world-changing crises in their lifetimes, from the Sept. 11 terrorist attacks to the 2008 housing market crash to the 2020 COVID-19 pandemic, to most recently, a spate of rampant inflation their parents and grandparents never dealt with and the growing probability of a recession looming for 2023.

“This is really the first generation that has been hyper attuned to the missteps of past generations” Copper Banking Co-Founder and CEO Eddie Behringer said in a conversation with PYMNTS’ Karen Webster that reflected on the spending habits of yore.

“[They think] it’s cool to be smart about money,” he added.

With its debit card and bank account for teens, Copper is part of the vanguard of payments FinTechs catering to Gen Z’s increasing desire for payments tools enabling them to take charge of their financial lives when young. That’s a financial literacy wave we’ve not seen before.

Similarly, Roy Ng, co-founder and CEO of Bond, noted in the PYMNTS eBook, “What’s Your Plan? Payments Strategies for a Strong 2022 Finish” that credit building tools like secured credit cards are appealing to this group — who also tend to be gamers — noting that “Nearly 8 in 10 (79%) gamers are interested in a credit card that will reward them for in-game purchases.”

Companies are now getting serious about these young consumers, especially those that have entered the workforce, by understanding their unique demands and playing to them.

Synchrony Vice President of Innovation and Development Mike Storiale told PYMNTS: “Gen Z is really changing the shopping landscape as we know it. They’re shopping online differently. They’re using things like TikTok to search for the products. There are 7.3 million Gen Z workers in the U.S. already. When people look at Gen Z and think they are a small group, that’s certainly not the case.”

Storiale said Synchrony recently studied the Gen Z cohort as the company crafts new payments and banking products to capture these consumers early in their adult financial lives, saying Gen Zs “view their purchases very differently than generations that came before them. While they still favor things like debit over credit, their use of credit is on the rise. What we’re seeing is that they want to build a credit history.”

This cohort is also a driving force in the use of buy now, pay later (BNPL) products. As PYMNTS reported for the Buy Now, Pay Later Tracker®, “Merchants find that BNPL is especially appealing to millennial and Generation Z consumers, many of whom are less likely to have the disposable income that older generations do.”

Read more: Move Over, Millennials — Gen Z to Start Calling the Shots in Payments

Gen Zs Like Super Apps, Relationship Commerce

PYMNTS research found that Gen Zs are catching up to their highly connected elder siblings in terms of digital devices, what they do with them, and what they expect going forward.

According to Super Apps for the Super Connected, a PayPal and PYMNTS collaboration, Gen Z consumers are at near parity with millennials in terms of connected device ownership, with millennials averaging 6.1 devices and Gen Z close behind, averaging 5.5 devices.

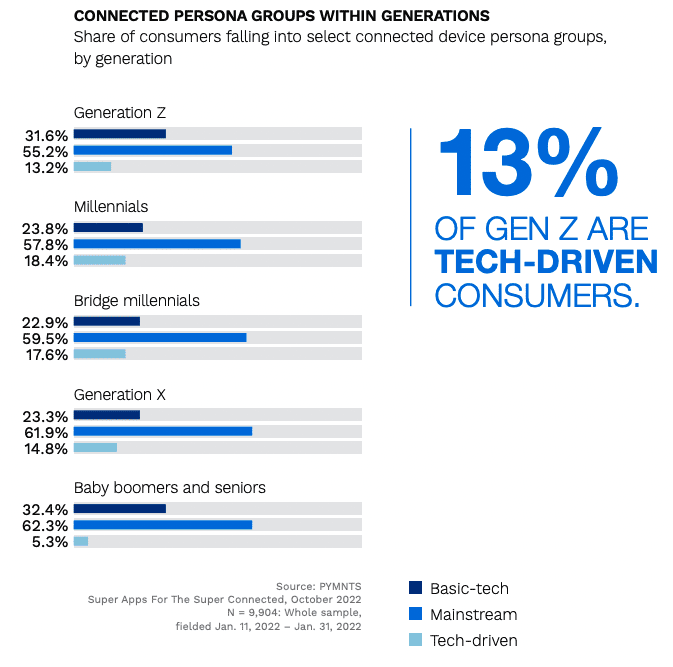

That study noted that 13% of Gen Zs qualify as super-connected “tech-driven” consumers, trailing millennials by just 5% and catching up fast. Their smartphone-centric lives are in many ways ideal for super apps that combine shopping, dining, travel, banking, payments and more in one app that simplifies and streamlines experiences.

“Bridge millennials and Gen Z consumers are far more likely than the average consumer to want to use a super app, with 35% of each generation expressing high levels of interest in one,” the study stated. “It is no coincidence that these highly online age groups also tend to be more interested in using super apps.”

Gen Z consumers closely track millennials in several ways. For example, they are catching up when it comes to realizing the benefits of commercial relationships with merchants and brands.

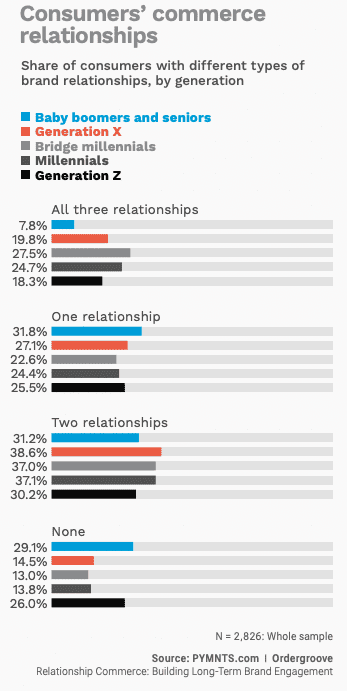

The study “Relationship Commerce: Building Long-Term Brand Engagement,” a PYMNTS and Ordergroove collaboration, noted that while Gen Z is behind millennials in the number of commercial relationships, over 18% of this cohort engages in subscriptions, memberships and loyalty programs, the three primary types of relationships studied.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.