Food prices are soaring the quickest they have since the early ’80s. The U.S. Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) released Thursday (March 10) shows that in February prices for groceries increased 8.6% year over year. This increase marks the greatest 12-month increase since April 1981.

This dramatic change could have a significant impact on which grocery brands are chosen by consumers since price is the top factor influencing consumers’ selection of grocery merchant, according to data from PYMNTS’ study Decoding Customer Affinity: The Customer Loyalty to Merchants Survey 2022, created in collaboration with Toshiba Global Commerce Solutions.

Get the Full Report: Decoding Consumer Affinity: The Customer Loyalty To Merchants Survey 2022

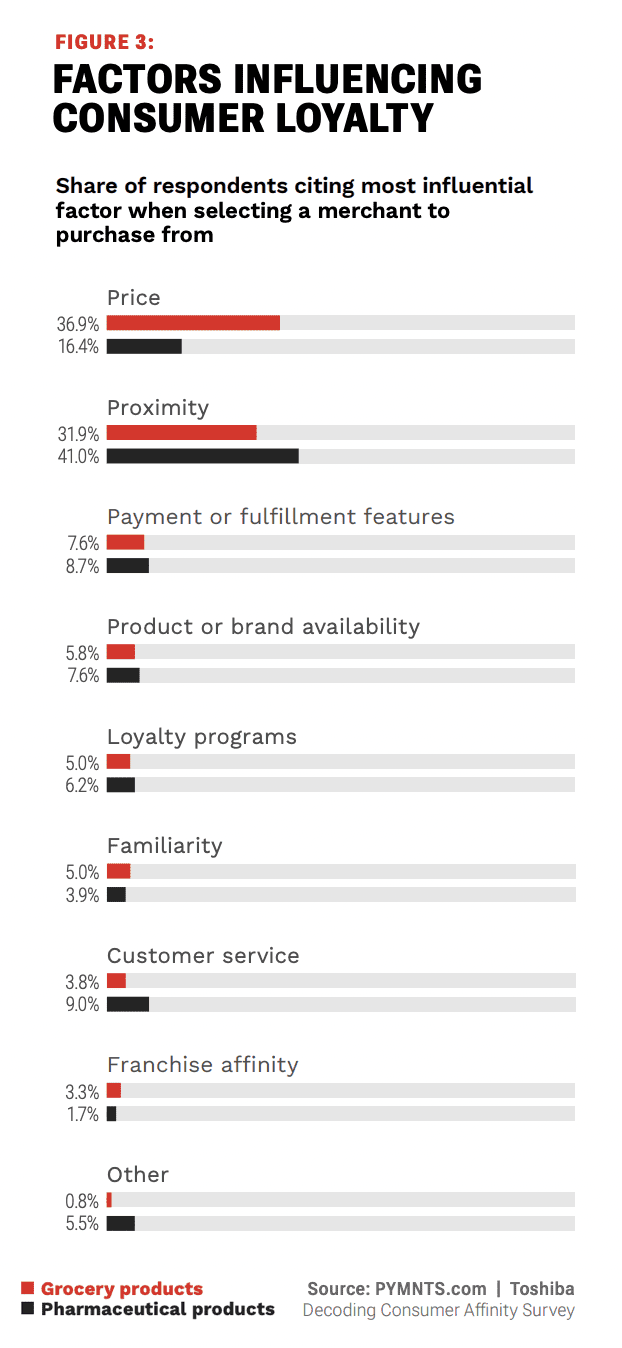

The study, which drew from the results of a survey of a census-balanced panel of more than 2,000 U.S. consumers conducted in the late fall, found that 37% of consumers rank price above all other considerations when selecting a grocer to purchase from, ahead of the 32% who prioritize proximity, the 8% who seek out payment or fulfillment features and the 6% who look for product or brand availability.

This prioritization works to the benefit of the largest grocers, which are able to utilize their scale to keep prices relatively low, and to the detriment of smaller brands, forced to raise prices or incur losses.

Walmart, for one, the world’s largest grocery retailer, has been taking advantage of this dynamic. On a call in February discussing the company’s fourth quarter and full-year 2021 results, Walmart president and CEO Doug McMillon explained to analysts how the company leverages its position to solidify customer loyalty in this time of price anxiety.

“We talk about … our price leadership position … because prices are relative, and it’s more fluid in an inflationary environment like this,” said McMillon. “We think about things like opening price points and protecting for a lower-income family some of the things that they need from a staples point of view … We use rollbacks to communicate not only the reality of prices are coming down at some places, but the emotion or perception we want customers to have about us being there for them.”

Additionally, Kroger, the United States’ leading pure-play grocer, is taking a similar approach, using the resources afforded by its scale to price out smaller competitors.

“We are investing where it matters most to our customers using our proprietary data to be strategic in our pricing and personalization,” Kroger Chief Financial Officer Gary Millerchip told analysts earlier this month. “Our strategic approach is helping our customers manage their grocery budgets more effectively and is allowing Kroger to maintain a strong price position relative to our key competitors.”

“We are investing where it matters most to our customers using our proprietary data to be strategic in our pricing and personalization,” Kroger Chief Financial Officer Gary Millerchip told analysts earlier this month. “Our strategic approach is helping our customers manage their grocery budgets more effectively and is allowing Kroger to maintain a strong price position relative to our key competitors.”

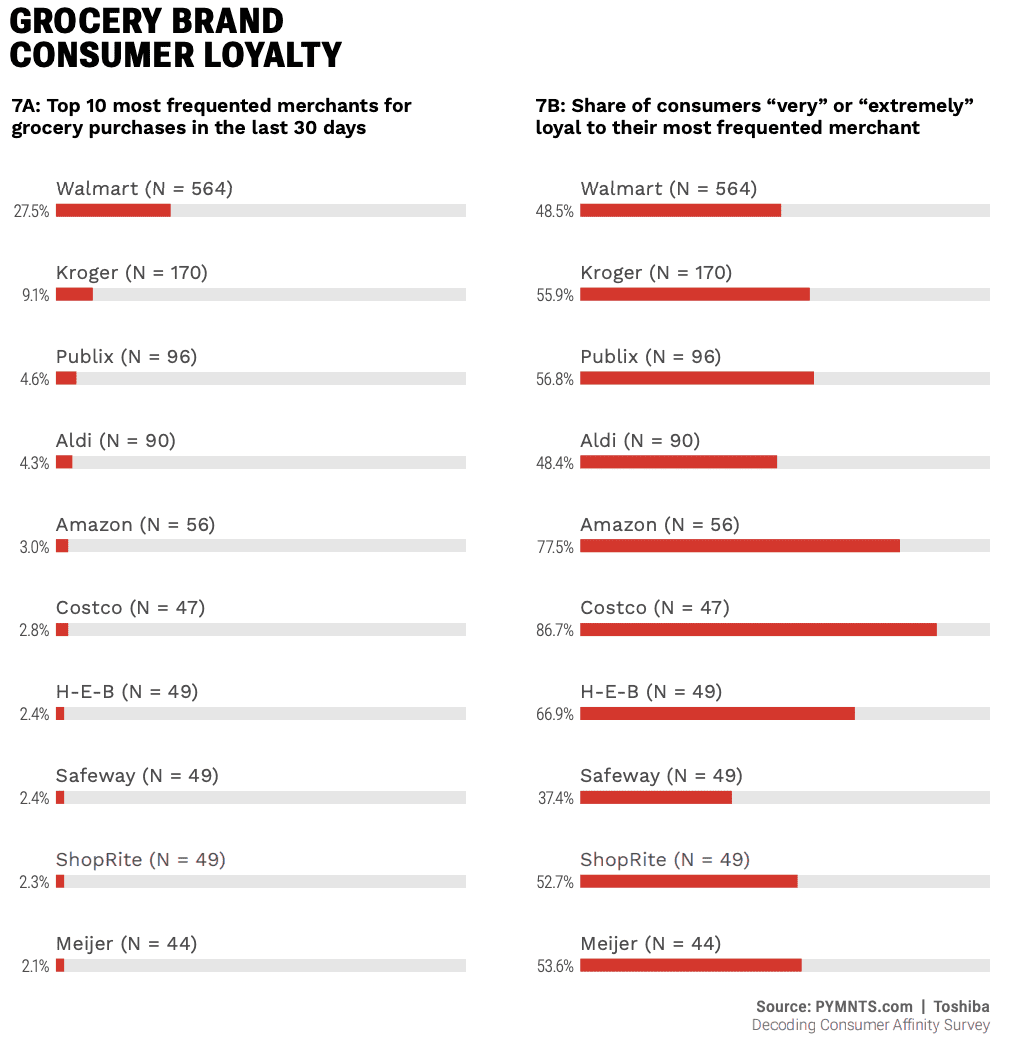

Indeed, research from the Decoding Consumer Affinity Study finds that consumers purchase their groceries at Walmart more than three times as much as runner-up Kroger. The study found that the superstore chain was the most-frequented grocery merchant for 28% of consumers in the prior 30 days, while Kroger was the most-frequented merchant for 9%. Still, Kroger’s position was about twice as strong as that of bronze medalist Publix.