In some ways, the current inflation-recession prediction cycle is reminiscent of the guessing game of 2020, in which consumers and businesses spent loads of mental energy speculating on how long the pandemic would last, with their outsized fears ultimately proving to be correct.

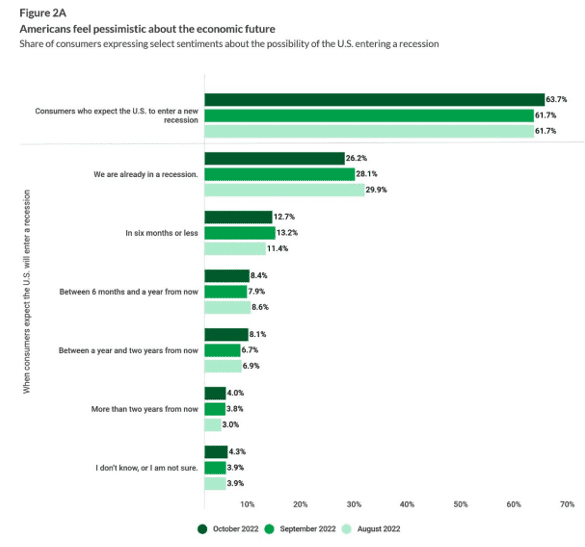

Today, consumers are once again placing bets, only this time it is on the length and depth of a recession that hasn’t even officially been declared yet, with new PYMNTS data showing that 65% of Americans saying they believe one is imminent, and 26% saying they believe it is already here.

Exactly how this burgeoning pessimism will impact the retail sector, which has already been damaged by nearly a year of inflationary belt-tightening and product trade-downs, is arguably already being reflected in the sector’s sales results and forecasts. Whether it’s the slump of growth at online marketplaces like Amazon, or the anecdotal warnings of individual brands and shops, cautionary tales have dominated the narrative within the retail patch for weeks.

The Consumer’s View

According to the new PYMNTS study, “Consumer Inflation Sentiment: Inflation’s Long Consumer Spending Shadow,” which surveyed over 2,400 United States consumers across different incomes and lifestyles, several key demographics and regional differences have been observed in terms of how consumers are personally experiencing the downturn and how that affects their increasingly gloomy outlooks.

Advertisement: Scroll to Continue

Despite a slight drop in inflation levels over the past three months from the June peak of 9.1%, consumer trepidation is mounting. The study stated that “the average American has grown pessimistic and believes inflation won’t return to normal until around May 20, 2024 — later than they expected in previous months. They also have strong concerns about America’s overall economic future.”

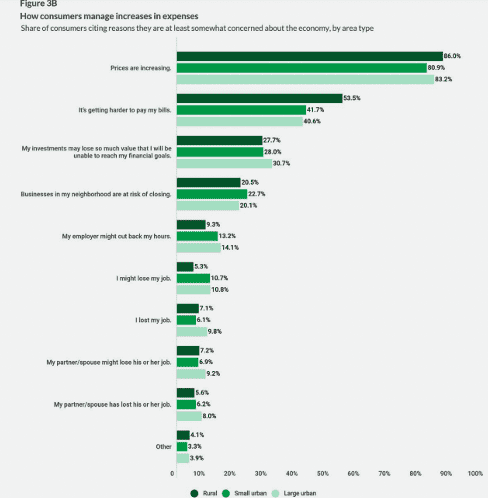

Retail and services receipts tell the tale for most, as three-quarters of consumers (64.9%) are “very or extremely concerned” about rising prices from retail goods to gas and utilities.

Demographic soundings of how an impending recession is perceived show the mixed views of Americans in different stages of life and financial security. Per the study, “baby boomers and seniors are the most likely to believe we are already in a recession, with 55% agreeing we are. Generation Z is the least likely to agree, at 23%. The average baby boomer puts the projected date of returning to normalcy at July 22, 2024.”

Generation X consumers born between 1965 and 1980 are the least upbeat of all groups measured, with 68% thinking the U.S. is headed into a recession. This group’s recovery date is a marginal but meaningful 10 days later than the average, putting the all-clear at May 30, 2024.

Retail Implications

Price increases continue to weigh heavily on perceptions, with rural consumers reporting the greatest concerns (86%), followed by those in large urban areas (83.2%). Those living in smaller urban areas are the least worried but their percentage is still high (80.9%).

Consumer pullbacks continue showing up in retail earnings. PYMNTS reported Nov. 1 that “shares of Amazon are down nearly 20% since the Seattle-based retail and the cloud-service company reported disappointing Q3 earnings a week ago. This at a time when Walmart’s stock is flat, leaving it with a $380 billion market cap that is roughly 2.5x smaller than the $930 billion valuation of Amazon.” Walmart will report sales for the third quarter of fiscal year 2023 Nov. 15.

See also: Amazon and Walmart Look to Soothe Customers, Vendors, Employees, Investors

It’s much the same story even in categories that have shown resilience during the inflationary pinch of 2022, like apparel.

During Allbirds’ Q3 earnings call Tuesday (Nov. 8) Co-founder and Co-CEO Joey Zwillinger told analysts that “we expect Q4 to be negatively impacted by persistent inflation and high levels of promotional activity which will impact our U.S. business.” He added that “we are preparing for a scenario in which consumer headwinds worsen in the coming months as the full impact of myriad market dynamics are fully digested by consumers.”

Home furnishings, which saw stellar growth in the first two years of the pandemic, are sagging as well. For example, Wayfair reported a Q3 net revenue decline of 9% year over year.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.