For all the triumphs and records that fill the pages of sports history, those pages are also dotted with more than a few legendary upsets, errors and outright fails. Every fan has their own example, but these athletic unravelings are so culturally important that even the Smithsonian magazine compiled a Top 10 list of them to immortalize their place in history.

Since its renaming in 1971, Nike has towered over rivals in the athletic footwear and apparel space, building a brand and global business of legendary proportions, that is, until about eight months ago.

After hitting an intraday and all-time high of $179 last Nov. 5, the Beaverton, Oregon category leader has suffered an unprecedented reversal of fortune that has taken its stock down by over 40% — a slump previously unseen by Nike whether looking back five, 10 or even 25 years.

Clearly, the owner of the iconic “swoosh” is in the midst of troubling times and is doing everything in its power to offset a swirl of global supply chain and raw material challenges that are only worsening its fight against the building storm of macroeconomic headwinds.

As much as the sports-casual, “athleisure” and “sneakerhead” trends are still style segment leaders and showing no signs of slowing down, so far nothing Nike has tried to do has been able to jolt investors from their bearish beliefs and take a fresh look and return the 50-year old champ to its glory days.

On Your Mark …

Advertisement: Scroll to Continue

To be sure, Nike is not alone in this current storm, as rivals such as Adidas have fallen over 50% during the same eight-month span and are being clobbered by the same basket of economic, geopolitical and pandemic-related blows.

For its part, since reporting fiscal Q4 and full year 2022 results three weeks ago, in which shipping and freights costs took on outsized importance, Nike has been digging in and pushing through the pain — like a good long distance runner would — and has rolled out a steady stream of products and processes aimed at countering the down trend.

Last week, for example, the company unveiled its new “Nike Style” omnichannel store format in Seoul, Korea, calling it a blur between physical and digital retailing that expands the definition of sport.

In addition to “gender agnostic lifestyle product zones for fleece, tops, sport lifestyle footwear and accessories,” the company’s announcement said the newest Nike outpost also includes more digital interactive features as well as a SNKRS lounge for members.

A second Nike Style retail location is set to open in Shanghai this fall, with additional unspecified plans to expand the concept regionally and internationally.

Also last week, multiple media reports said that Nike and Fanatics were expanding their apparel and hat partnership to include cross promotion of several major collegiate teams in the NCAA.

While neither company issued official updates on the transaction, Fanatics did post links to two different articles in its newsroom.

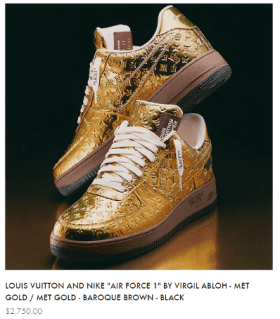

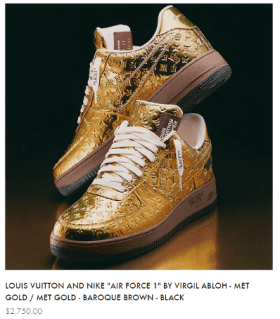

At the same time, Hong Kong-listed sneaker culture site Hypebeast said the Nike x Louis Vuitton collaboration started three years ago by recently deceased designer Virgil Abloh will reportedly have its latest product drop in late July.

While the limited-edition designer shoes are likely to generate some buzz and will presumably sell out quickly, the $2,750 price tag suggests they are not targeted at a mainstream audience, or likely to meaningfully move the needle for either company’s top line.

There’s also the fact that the pricey sneakers do not reflect the current spate of consumer belt-tightening and discretionary spending restraint that is impacting retailers everywhere.