There’s an old saying — sometimes we move the goalposts a little. And declare victory.

We’re being a bit tongue in cheek here, but for the retailers who still — and for the foreseeable future will — depend on physical retail to move goods, a look back to a recovery stretching out over two years is not all that much to cheer about.

Because the recovery is only a slight retracement of what’s been a multi-year inexorable slide of physical retail, which still accounts for the bulk of their fortunes.

Right now, the slew of retail earnings — no matter where you might look — are sounding some alarms about shoppers, noting the mixed pressures of rising interest rates and rising inflation.

Depending on where you look, some firms are maintaining guidance, others are cutting their outlook.

Among the latest examples of the latter can be found with Macy’s, which said on Tuesday morning (Aug. 23) that discretionary spending was under pressure and that it would have to take markdowns in order to get consumers to keep opening their wallets (and of course to move goods off of physical and virtual shelves).

Drill down a bit, and we can see from earnings supplementals that comparable sales were up 4.3% on an owned basis, and 4.4% on an owned plus licensed basis vs. the same quarter of 2019.

Similarly, Walmart, which lowered its profit guidance during its own results presentation recently, said that U.S. comp sales grew 11.7% on a two year stack.

You get the picture. None of this is to say that retailers have not made progress in climbing back from the depths of the pandemic.

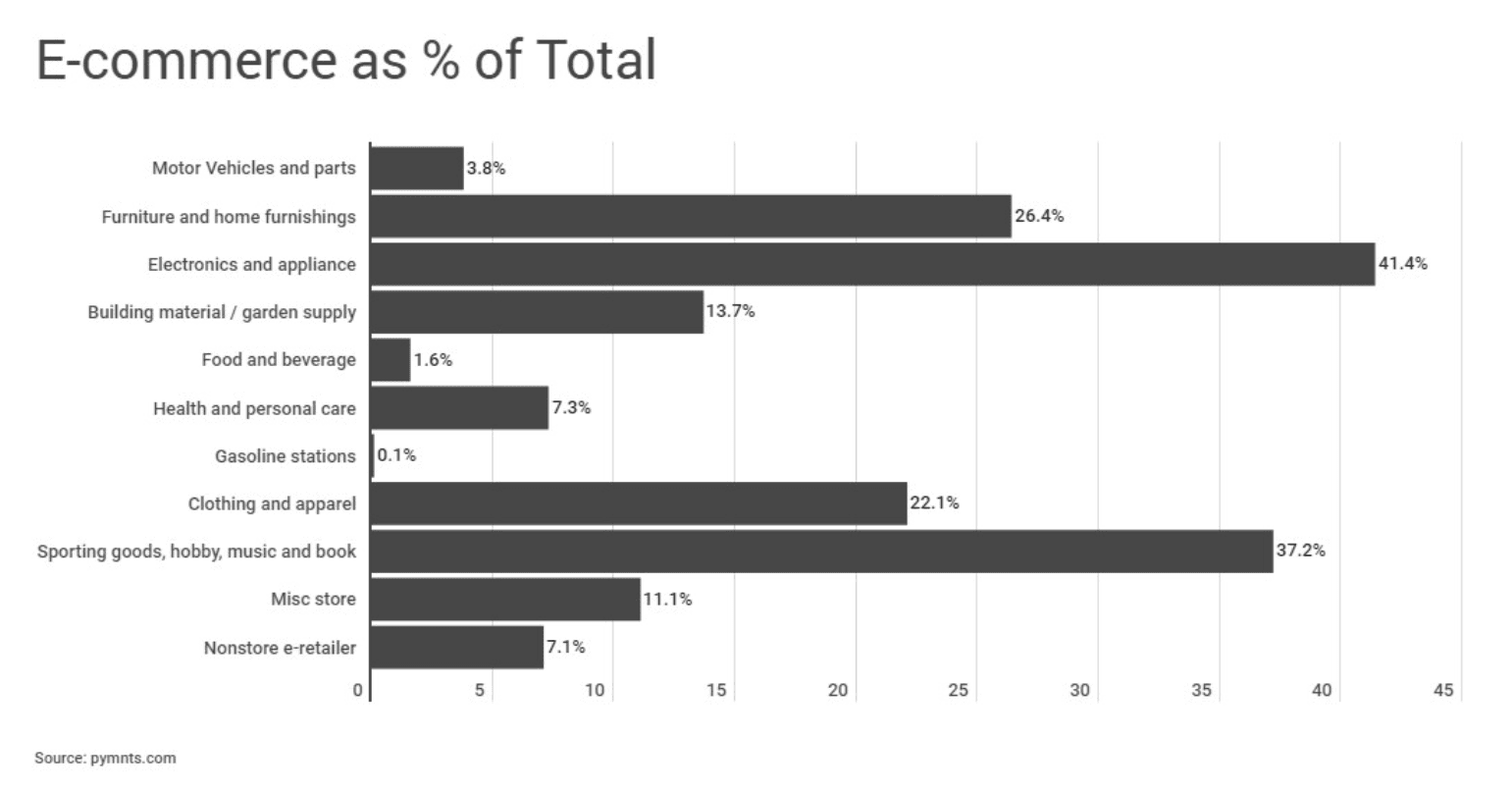

But as to that long and winding downtrend for physical retail: Even before the pandemic, Karen Webster noted back in 2019 that “the traditional physical store model, which is how most everyone today defines physical retail and measures its sales, pretty much is — and has been for the last several years — on life support.” Back then we noted that eCommerce had risen from a standing start to capture a not insignificant slice of several verticals (such as furniture and clothing) that commonly and traditionally would be bought off the literal rack.

Fast forward to today, and, per data released by the U.S. Census Bureau earlier this month, eCommerce as a percentage of total U.S. retail sales stood at 14.5% in the second quarter of 2022. That’s up from mid-single digits back in 2013.

The merchants themselves are still striving to find the right balance of channel mix. Macy’s has just guided to flat to up 1% growth in its comp owned plus licensed sales, and in an environment where that channel is still (roughly) two-thirds of the top line, we can get a sense of the headwinds here, and that bedevil the retailers who rely on foot traffic to get the inventory moving. And in the meantime, 2019 seems ever further away, a pre-pandemic yardstick that will matter less and less as the great digital shift continues.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.