The big bite and impact that inflation is having on consumers is unavoidable right now, with shoppers sending a loud and clear message to retailers everywhere.

“Our customers have made it clear that value is more important than ever this season,” Kohl’s CMO Christie Raymond said in a statement Monday (Oct. 24) announcing the department store’s launch of a month’s worth of holiday savings and deals.

It’s a move that follows in the wake of similar expanded promotions by the likes of Amazon, Walmart and Target, as well as countless other smaller players all striving to make a connection – and a sale – with an increasingly budget-minded and cautious consumer at a fevered pace.

Retailers are rushing to capture early holiday dollars with discounts, with Amazon double-dipping on sales events and Walmart among others following suit, bracing for a spending chill at the winter holidays as consumer belt-tightening goes to the next notch and recession bears down.

For PYMNTS’ new report into shopper thinking entering the fourth quarter, “Consumer Inflation Sentiment: Consumers Buckle Down On Belt-Tightening,” we surveyed over 2,600 U.S. consumers, and found that for “70 million consumers across the United States, the belief is that the recession has already begun — and 89 million more have already begun tightening their belts to prepare for a recession they believe is now unavoidable.”

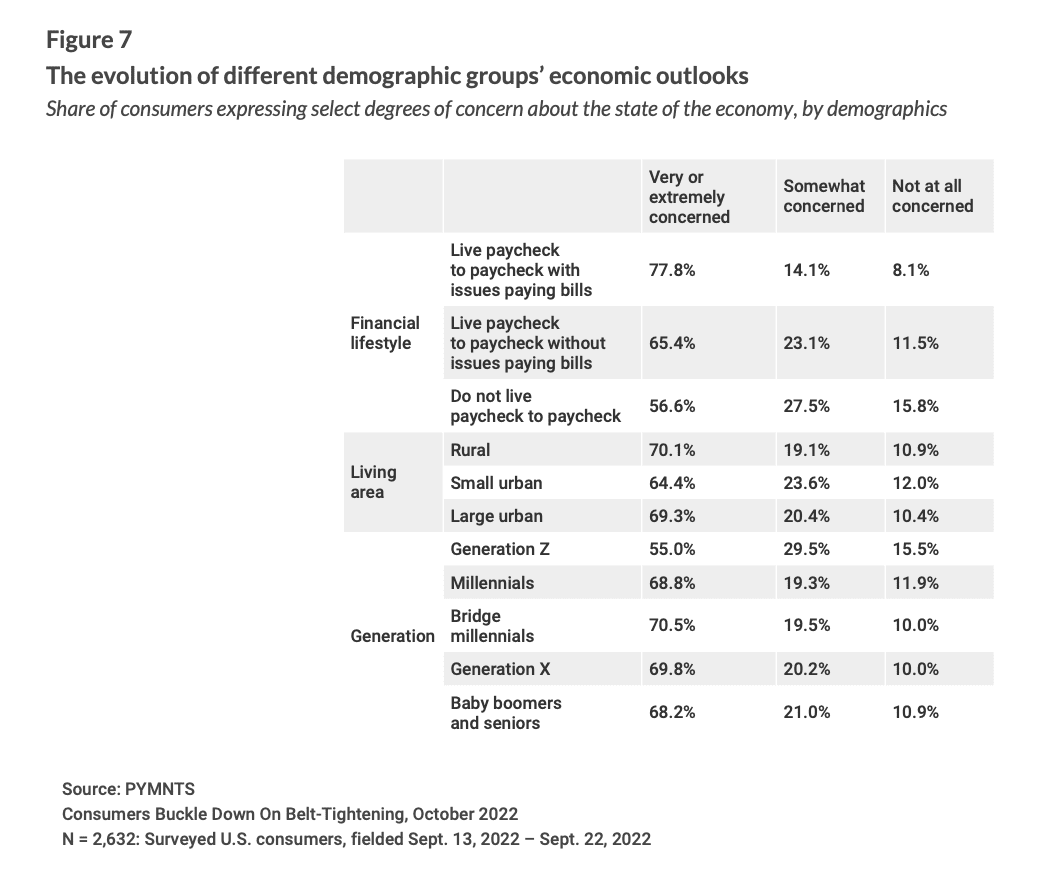

Among those most concerned about runaway inflation leading to recession, the study states, “Consumers living in rural areas, those living paycheck to paycheck and bridge millennials are even more pessimistic. Seventy percent of rural consumers, 78% of those living paycheck to paycheck with issues paying bills and 71% of bridge millennials are very or extremely concerned about the economy in the short term.”

See also: Core Inflation Hits 40-Year High as Consumers Weigh Spending Priorities

Anticipating the consumer pullback in spending during the most moneymaking quarter of the year for many merchants, mainstream retailers across sectors are pivoting to an ‘everything on sale all the time’ posture, in addition to marquee sales events that have dominated headlines.

Get the study: Consumer Inflation Sentiment: Consumers Buckle Down On Belt-Tightening

Readying for a Rough Ride

CNBC reported on Oct. 20 that reported that “Retailers, desperate to coax inflation-fatigued consumers to spend, are expected to beef up promotions as they struggle to get rid of already marked-down excess inventory, adding that Marshal Cohen, chief industry advisor for market research firm NPD Group said, “This will be the year of the perpetual deal for Christmas.”

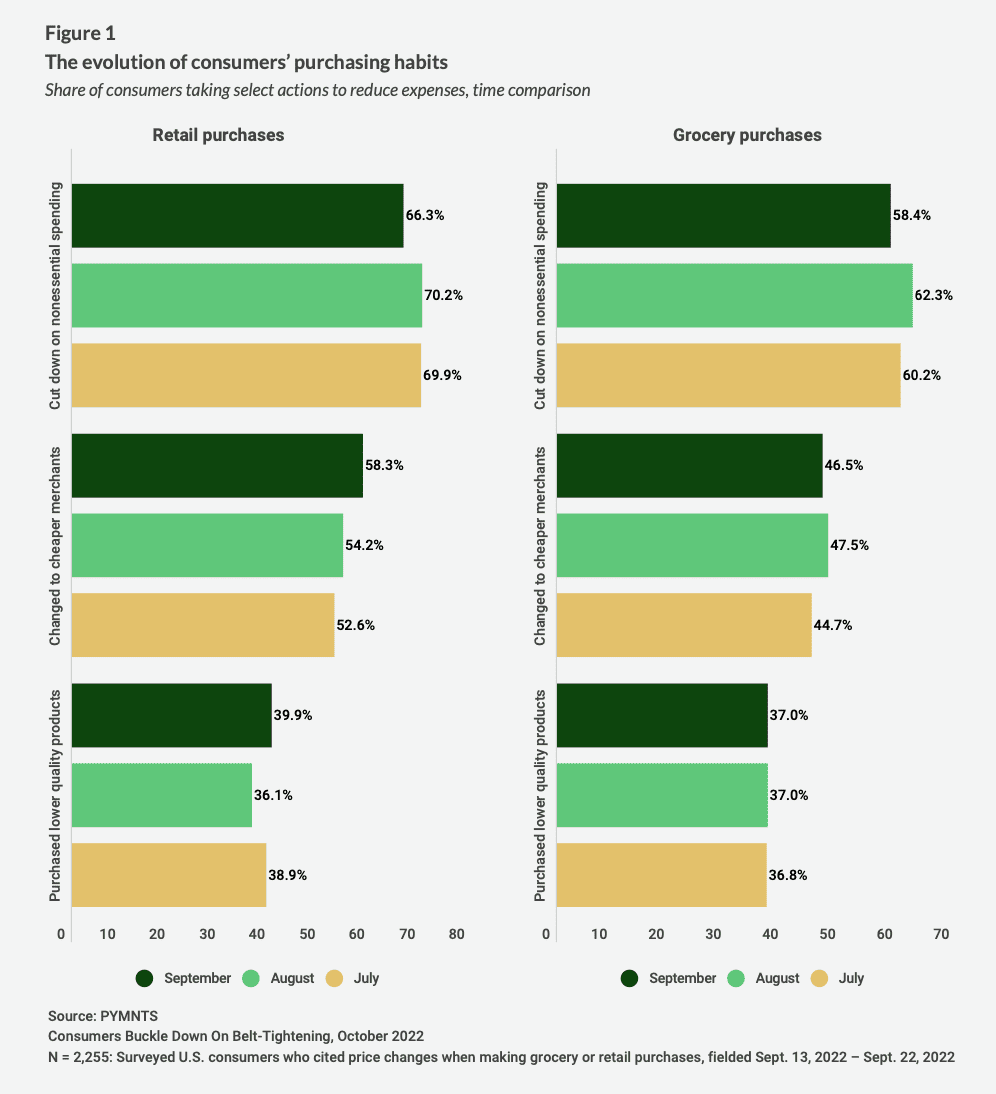

In stark contrast to the end of last year when shelves were empty in retail stores and out-of-stocks common on ecommerce sites, those supply chain issues have eased and there’s plenty of inventory. But consumers continue cutting nonessentials and trading down.

This is a boon for deep discounters like Dollar Tree in the U.S., which held a nationwide hiring event on Oct. 19 seeking “thousands of associates” to staff its 16,231 stores in 48 states and five Canadian provinces ahead of what it sees as a strong season for foot traffic.

See also: Stubborn Inflation Continues Devouring Retail Sales as Consumers Grow Cautious

It’s much the same story in the U.K. The Wall Street Journal reported on Monday (Oct. 24) that “Consumer confidence across Europe is at an all-time low, according to Eurostat, the European Commission’s statistics agency, which started measuring consumer confidence in 1985. Retail sales in the eurozone declined 2% year-over-year in August, the most recent data available, and could slow further if the region slides into recession in the coming months, as some economists expect.”

In that story, Mat Ankers, interim chief financial officer of European discount chain Pepco Group NV, which currently operates 4,000 locations, said “We’ll be accelerating our store openings,” adding that “Price and value have always been important to customers, but now it is more important than ever.”

The PYMNTS study Consumer Inflation Sentiment: Consumers Buckle Down On Belt-Tightening notes that “Two-thirds of retail shoppers say they are spending less on ‘nice-to-have’ products than they did a year ago, and 58% of grocery shoppers say the same. Although consumers are cutting back on nonessential retail and grocery spend, this belt-tightening is hitting retailers much harder than grocers.”

The fear of entering full-blown recession will benefit some, like the deep discounters, as well as lower-priced restaurant chains as consumer retain some spending rituals — like dining out — but do so at less pricey places. And less expensive eateries will be contending with more competition from eating at home to save money.

In an interview, Paytronix CEO Andrew Robbins told PYMNTS’ Karen Webster, “If you’re in the low- to mid-end of restaurant expense, you’re going to see some trade down where higher-end people are going to come to you, but you’re going to lose some to grocery. So, you’re going to be fine, net-net, but you’ll see some shifting of people in the trade-down process.”

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.